Get the free Consolidated Revenue and Refunding Bonds, Series 2008

Show details

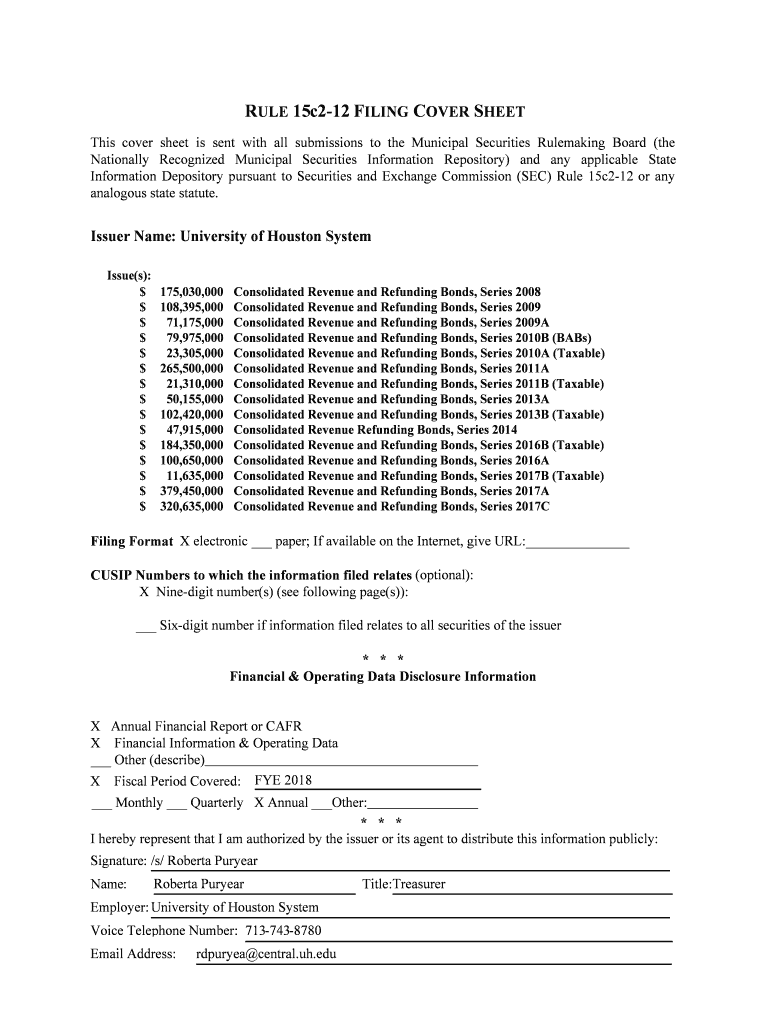

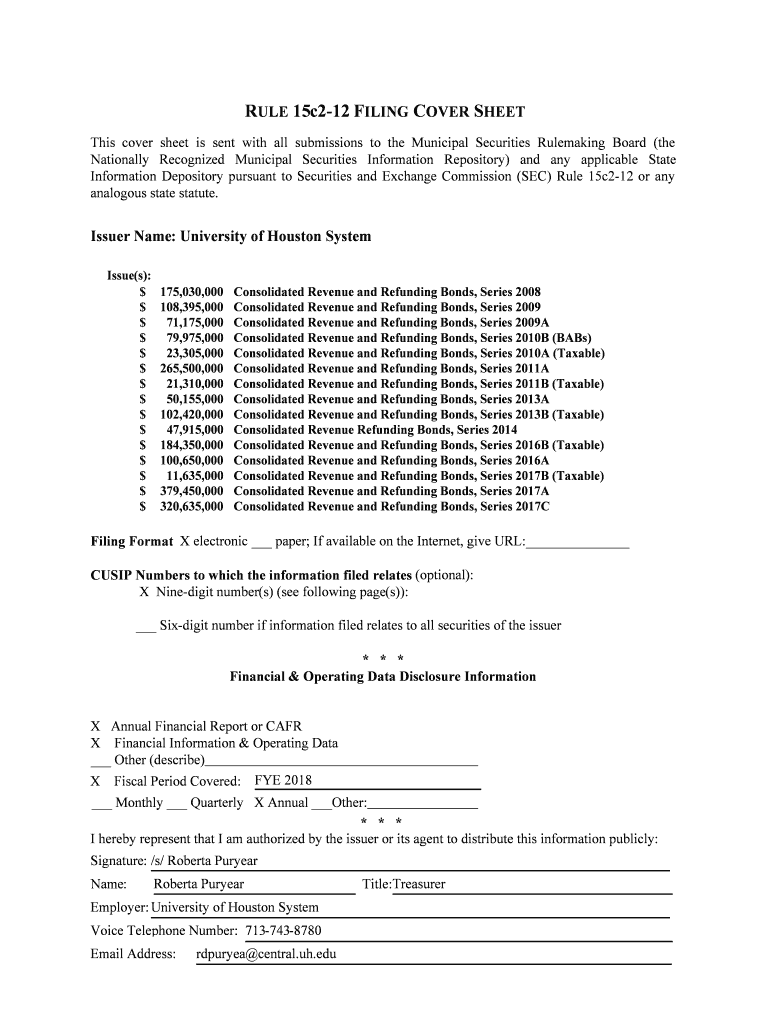

RULE 15c212 FILING COVER SHEET

This cover sheet is sent with all submissions to the Municipal Securities Rule making Board (the

Nationally Recognized Municipal Securities Information Repository) and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated revenue and refunding

Edit your consolidated revenue and refunding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated revenue and refunding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consolidated revenue and refunding online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit consolidated revenue and refunding. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated revenue and refunding

How to fill out consolidated revenue and refunding

01

To fill out consolidated revenue and refunding, follow these steps:

02

Gather all relevant financial information and documents needed for the consolidation process.

03

Determine the reporting period for which you are preparing the consolidated revenue and refunding statement.

04

Calculate the total revenue of each subsidiary or entity that needs to be included in the consolidation.

05

Adjust the revenue figures for any intercompany transactions or eliminations necessary.

06

Sum up the adjusted revenue figures to obtain the consolidated revenue.

07

Review the refunding activities of each subsidiary or entity and consolidate the refunding figures.

08

Analyze any differences or discrepancies between the consolidated revenue and refunding statement and the individual subsidiary statements.

09

Ensure proper disclosure and documentation of the consolidation process.

10

Seek professional assistance or consult accounting standards if needed.

11

Reconcile and verify the consolidated revenue and refunding statement for accuracy before finalizing and submitting it.

Who needs consolidated revenue and refunding?

01

Consolidated revenue and refunding is needed by organizations or companies that have multiple subsidiaries or entities under their control or ownership.

02

It is particularly important for publicly-traded companies, conglomerates, parent companies, or holding companies that need to present a comprehensive financial picture of their entire group.

03

Regulatory bodies, stakeholders, investors, and creditors may also require consolidated revenue and refunding statements to evaluate the financial health, performance, and potential risks of the organization.

04

These statements provide a consolidated view of the revenue and refunding activities of all the subsidiaries or entities, allowing for better decision-making, analysis, and transparency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consolidated revenue and refunding to be eSigned by others?

Once you are ready to share your consolidated revenue and refunding, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find consolidated revenue and refunding?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific consolidated revenue and refunding and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit consolidated revenue and refunding on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share consolidated revenue and refunding from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is consolidated revenue and refunding?

Consolidated revenue and refunding is a financial process of combining the revenue and refunding activities of a group of companies into a single report.

Who is required to file consolidated revenue and refunding?

Companies that are part of a corporate group or holding company are required to file consolidated revenue and refunding.

How to fill out consolidated revenue and refunding?

Consolidated revenue and refunding is typically filled out by compiling financial information from each member of the group and following the instructions provided by the relevant tax authorities.

What is the purpose of consolidated revenue and refunding?

The purpose of consolidated revenue and refunding is to provide a comprehensive view of the financial activities of the group as a whole, rather than looking at each company separately.

What information must be reported on consolidated revenue and refunding?

Information such as revenue, expenses, taxes, refunds, and other financial data from each member of the group must be reported on consolidated revenue and refunding.

Fill out your consolidated revenue and refunding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Revenue And Refunding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.