Get the free mortgage loan pre-qualification request for a home purchase

Show details

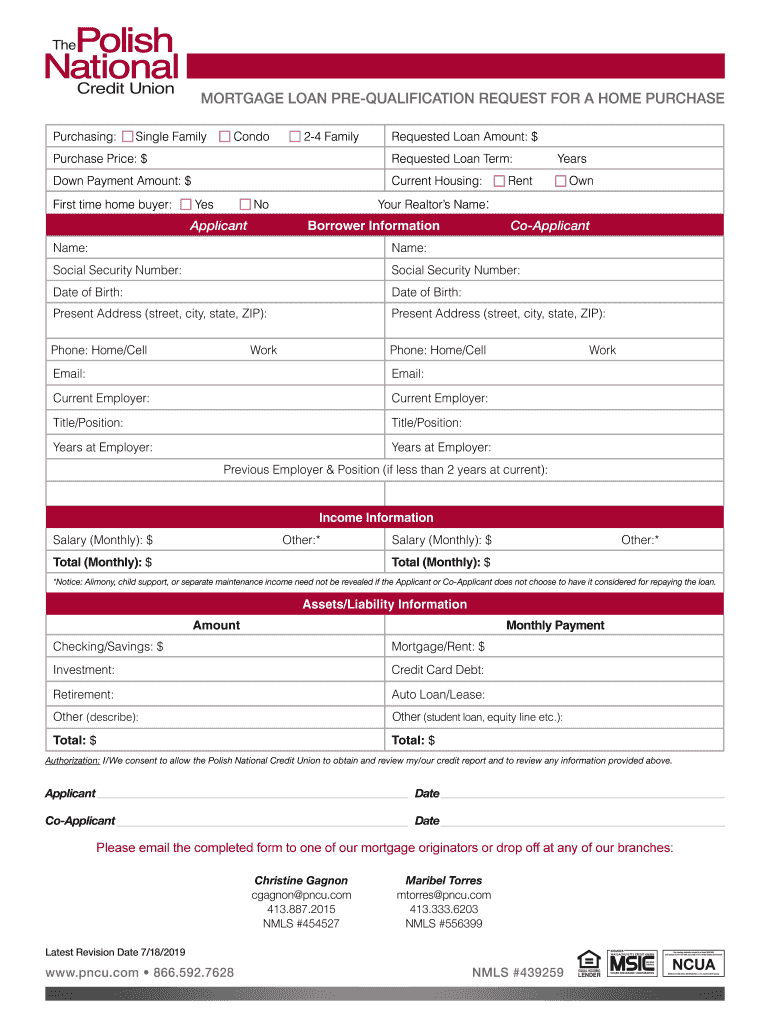

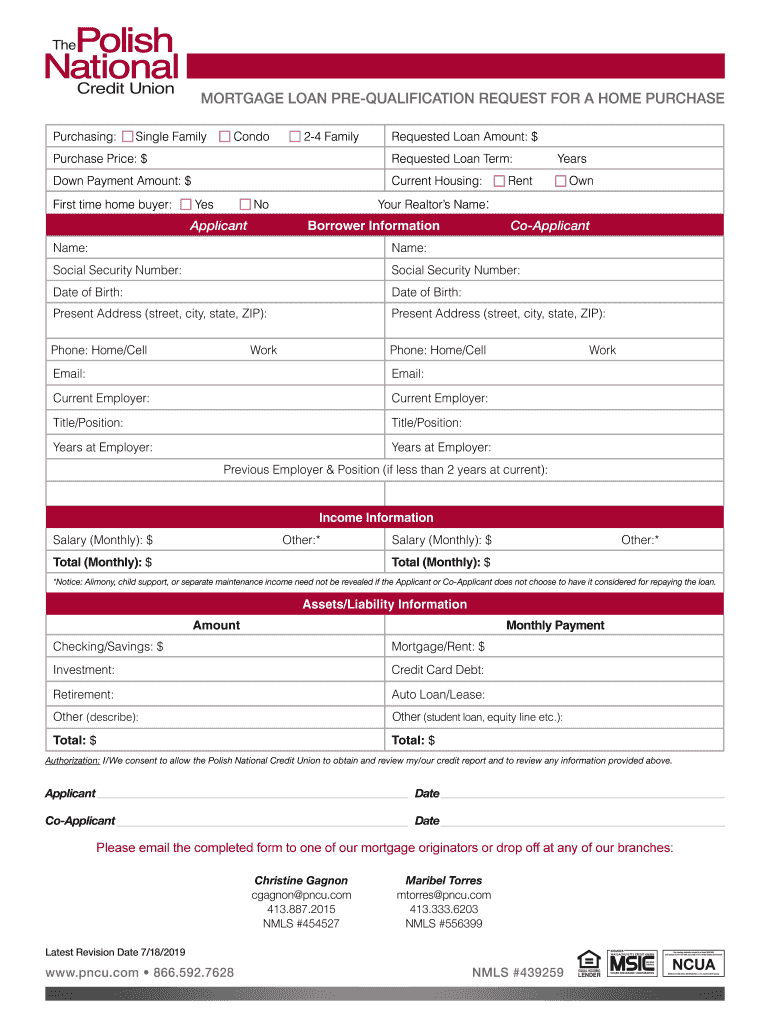

MORTGAGE LOAN PREQUALIFICATION REQUEST FOR A HOME PURCHASE

Purchasing:Single FamilyCondo24 FamilyRequested Loan Amount: purchase Price: requested Loan Term:Down Payment Amount: current Housing:First

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan pre-qualification request

Edit your mortgage loan pre-qualification request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan pre-qualification request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loan pre-qualification request online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage loan pre-qualification request. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan pre-qualification request

How to fill out mortgage loan pre-qualification request

01

Step 1: Gather all necessary documents. This includes proof of income, employment verification, tax returns, and bank statements.

02

Step 2: Research different lenders and compare their pre-qualification processes. Choose a lender that suits your needs and preferences.

03

Step 3: Visit the lender's website or contact them directly to access their mortgage loan pre-qualification request form.

04

Step 4: Fill out the form accurately and completely. Provide all required personal and financial information truthfully.

05

Step 5: Submit the pre-qualification request form to the lender along with any supporting documents they may require.

06

Step 6: Wait for the lender to review your application and determine your pre-qualification status. This may take a few days.

07

Step 7: Receive the pre-qualification decision from the lender. They will inform you about the loan amount you may qualify for, interest rates, and other relevant details.

08

Step 8: Analyze the pre-qualification offer and compare it with your financial goals and capabilities. Decide if it aligns with your plans.

09

Step 9: If you are satisfied with the pre-qualification offer, contact the lender to proceed with the full mortgage loan application process. If not, consider exploring other options.

10

Step 10: Complete the full mortgage loan application process as directed by the lender. Provide any additional documentation and fulfill all requirements.

11

Step 11: Await the final loan approval from the lender. Once approved, you can proceed with the closing process and secure your mortgage loan.

Who needs mortgage loan pre-qualification request?

01

Anyone who is considering buying a home and requires a mortgage loan can benefit from a mortgage loan pre-qualification request. It is particularly useful for first-time home buyers who want to determine their eligibility and potential loan amount before starting the house hunting process. Additionally, individuals who have had credit issues in the past or those with uncertain financial situations can also benefit from a pre-qualification request as it helps them understand what they can afford and what steps they need to take to improve their chances of getting a mortgage loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage loan pre-qualification request in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your mortgage loan pre-qualification request along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit mortgage loan pre-qualification request from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your mortgage loan pre-qualification request into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit mortgage loan pre-qualification request online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mortgage loan pre-qualification request and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Fill out your mortgage loan pre-qualification request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Pre-Qualification Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.