Get the free Credit Card and Client Portal Info.docx

Show details

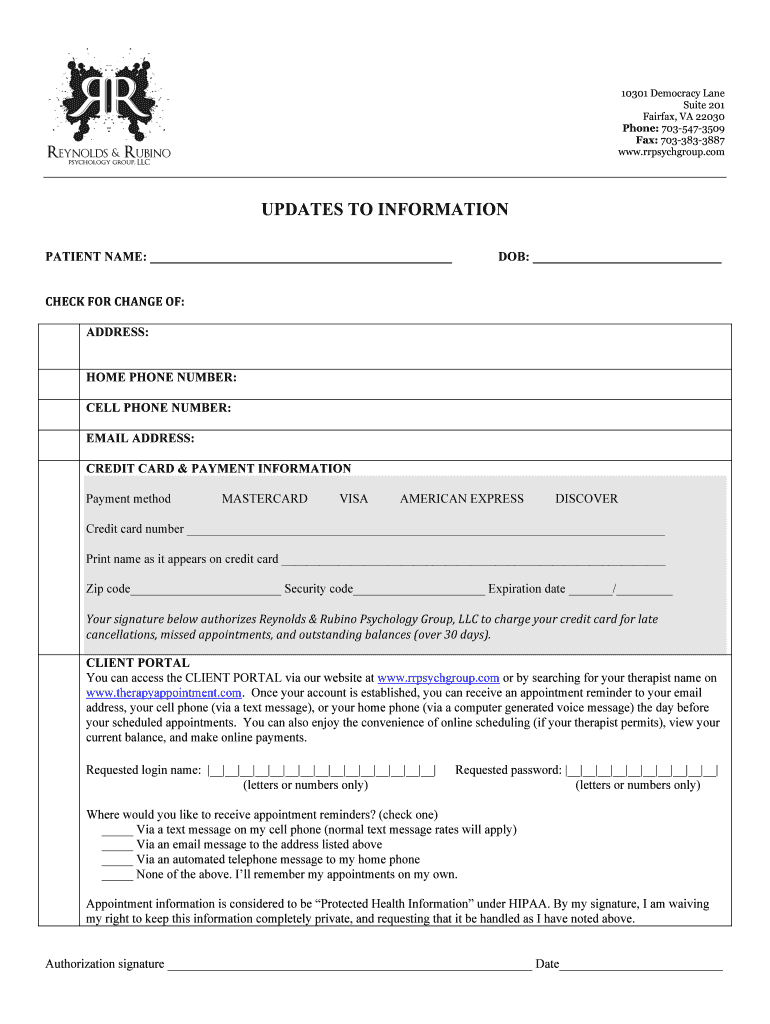

10301 Democracy Lane Suite 201 Fairfax, VA 22030 Phone: 7035473509 Fax: 7033833887 www.rrpsychgroup.comUPDATES TO INFORMATION PATIENT NAME: DOB: CHECK FOR CHANGE OF:ADDRESS: HOME PHONE NUMBER: CELL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card and client

Edit your credit card and client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card and client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card and client online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit card and client. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card and client

How to fill out credit card and client

01

To fill out a credit card application, follow these steps:

02

Start by providing your personal information, including your name, contact details, and social security number.

03

Enter your employment details, such as your current job title, employer's name, and monthly income.

04

Provide your financial information, including your existing debts, monthly expenses, and assets.

05

Indicate the type of credit card you are interested in (e.g., rewards, low-interest, secured).

06

Read and understand the terms and conditions of the credit card agreement. If you agree, proceed to the next step.

07

Submit the application and wait for approval. Be sure to provide accurate and complete information to improve your chances of getting approved for the credit card.

08

To fill out a client application, follow these steps:

09

Start by gathering the necessary information about the client, such as their name, contact details, and identification documents.

10

Determine the purpose of the client application (e.g., opening a bank account, applying for a service).

11

Ask the client to provide any specific information required for the application (e.g., income details, previous address, references).

12

Fill out the application form on behalf of the client, ensuring all information is accurate and complete.

13

Review the application with the client to ensure its accuracy and make any necessary corrections.

14

Submit the application to the relevant department or organization for processing.

15

Follow up with the client or organization to track the status of the application.

Who needs credit card and client?

01

Credit cards are useful for individuals who:

02

- Want to make secure and convenient payments without carrying cash.

03

- Need to build or improve their credit history.

04

- Wish to earn rewards, cash back, or travel points on their purchases.

05

- Want to have a financial backup for emergencies.

06

- Plan to make large purchases and pay them off over time.

07

- Travel frequently and need a widely accepted payment method.

08

Clients are needed by various organizations and service providers, including:

09

- Financial institutions that offer banking services.

10

- Insurance companies that provide coverage to individuals or businesses.

11

- Professional service providers, such as law firms or consulting agencies.

12

- Healthcare providers, including hospitals and clinics.

13

- E-commerce platforms or online retailers that need customer information for transactions and deliveries.

14

- Government agencies and departments that require citizen information for various purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card and client?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the credit card and client in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete credit card and client on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your credit card and client, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit credit card and client on an Android device?

You can make any changes to PDF files, such as credit card and client, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is credit card and client?

Credit card and client refers to the financial transactions made using a credit card by a customer.

Who is required to file credit card and client?

Credit card companies and financial institutions are required to report credit card and client information to regulatory authorities.

How to fill out credit card and client?

Credit card and client information can be filled out electronically through designated platforms provided by regulatory authorities.

What is the purpose of credit card and client?

The purpose of monitoring credit card and client transactions is to prevent fraud, money laundering, and other financial crimes.

What information must be reported on credit card and client?

Information such as transaction amount, date, merchant details, and client's personal information must be reported.

Fill out your credit card and client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card And Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.