Get the free an insurance company evaluates many numerical variables

Show details

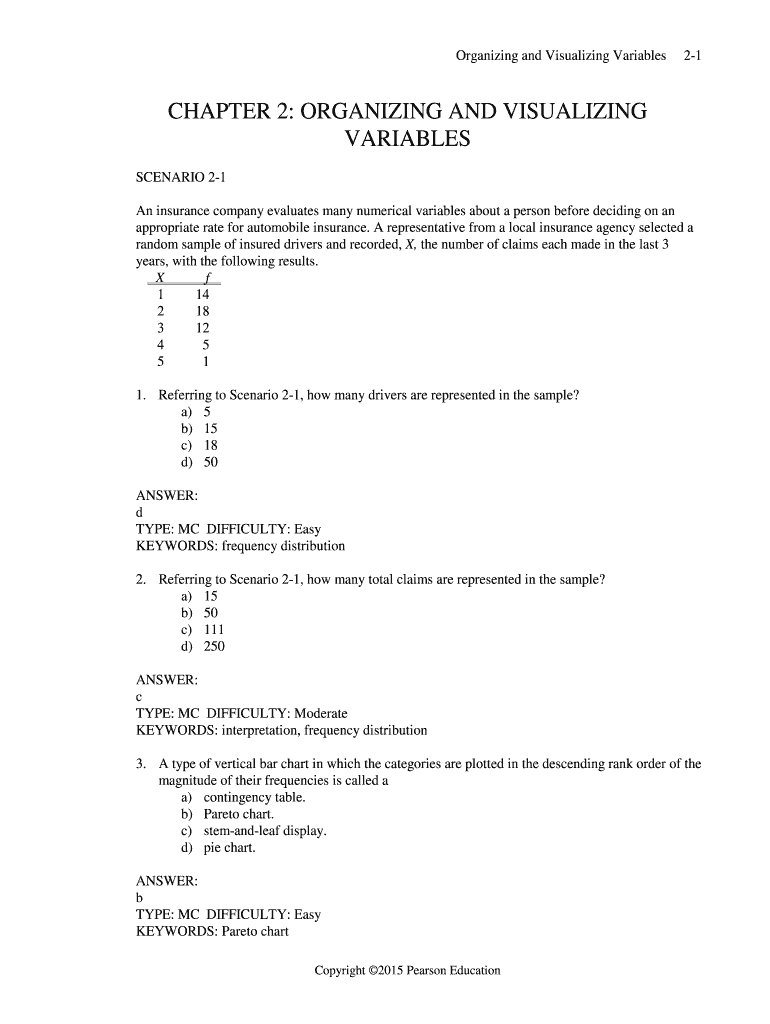

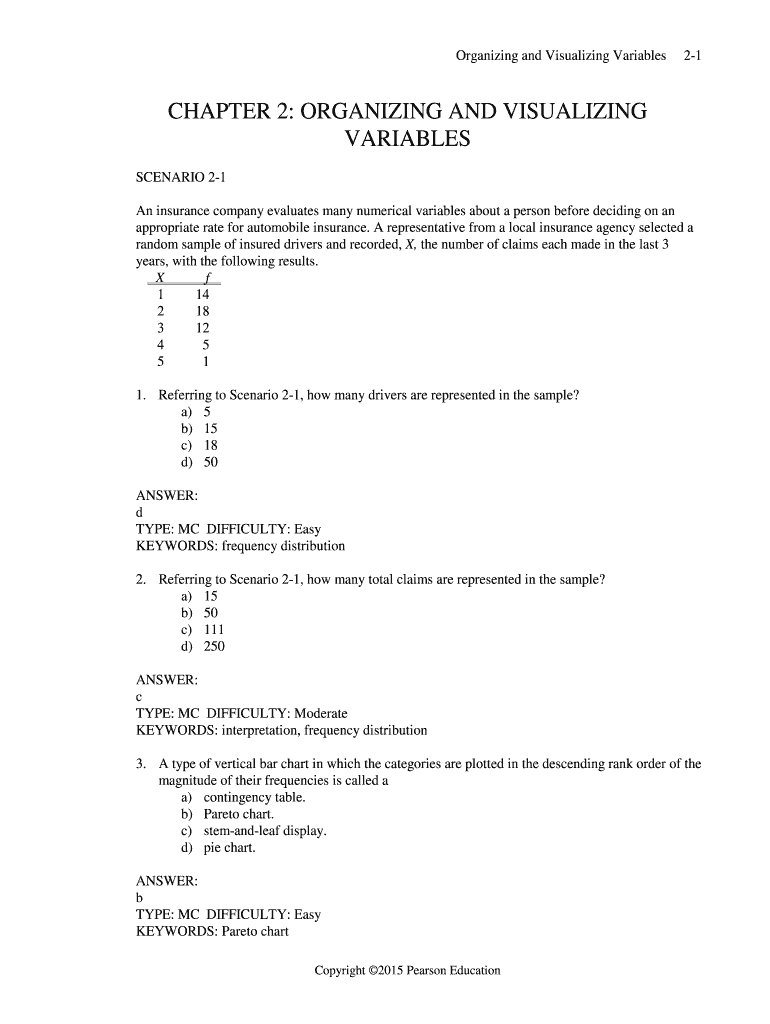

Organizing and Visualizing Variables21CHAPTER 2: ORGANIZING AND VISUALIZING

VARIABLES

SCENARIO 21

An insurance company evaluates many numerical variables about a person before deciding on an

appropriate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an insurance company evaluates

Edit your an insurance company evaluates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an insurance company evaluates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing an insurance company evaluates online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit an insurance company evaluates. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an insurance company evaluates

How to fill out an insurance company evaluates

01

Start by gathering all the necessary information about the insurance policies you want to evaluate. This includes policy documents, details of coverage, premium rates, and any other relevant information.

02

Assess the financial stability of the insurance company by reviewing their financial statements, credit ratings, and market reputation. This will give you an idea of their ability to honor claims and provide timely reimbursements.

03

Analyze the coverage options offered by the insurance company and compare them with your specific needs and requirements. Consider factors such as deductibles, limits, exclusions, and additional benefits.

04

Evaluate the customer service and claims handling process of the insurance company. Look for reviews and feedback from existing policyholders to determine their satisfaction levels and the company's responsiveness to customer inquiries and complaints.

05

Consider the pricing and affordability of the insurance policies. Compare premium rates with other similar companies to ensure you are getting the best value for your money.

06

Take note of any special features or riders offered by the insurance company that may enhance or customize your coverage. This can include options for add-ons, such as riders for critical illness, accidental coverage, or additional property protection.

07

Finally, make an informed decision based on your evaluation of the insurance company's financial stability, coverage options, customer service, pricing, and any additional features that align with your specific insurance needs.

Who needs an insurance company evaluates?

01

Anyone who owns valuable assets, such as a house, car, business, or personal belongings, and wants to protect themselves financially against potential risks and losses should consider an insurance company evaluation.

02

Individuals or families who rely on a steady income and want to secure their financial future in case of unexpected events, such as disability, illness, or death, can benefit from insurance evaluations.

03

Businesses of all sizes should regularly evaluate insurance companies to ensure they have adequate coverage against various risks, such as liability claims, property damage, lawsuits, or employee benefits.

04

Investors and financial institutions who have a stake in insurance companies or deal with insurance products can benefit from evaluating the insurance companies' financial stability, growth potential, and risk management strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send an insurance company evaluates for eSignature?

Once you are ready to share your an insurance company evaluates, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete an insurance company evaluates online?

pdfFiller makes it easy to finish and sign an insurance company evaluates online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete an insurance company evaluates on an Android device?

Use the pdfFiller app for Android to finish your an insurance company evaluates. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is an insurance company evaluates?

An insurance company evaluates risk and determines the appropriate premiums to charge for coverage.

Who is required to file an insurance company evaluates?

Insurance companies are required to file an insurance company evaluates with relevant regulatory authorities.

How to fill out an insurance company evaluates?

An insurance company evaluates is typically filled out by the actuarial department within the insurance company using specific data and calculations.

What is the purpose of an insurance company evaluates?

The purpose of an insurance company evaluates is to accurately assess risk and set appropriate insurance premiums.

What information must be reported on an insurance company evaluates?

An insurance company evaluates typically includes information on the insurance company's financials, underwriting policies, and risk assessment methods.

Fill out your an insurance company evaluates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Insurance Company Evaluates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.