Get the free Fiduciary (Trust and Estate) - Department of Taxation - Hawaii ...

Show details

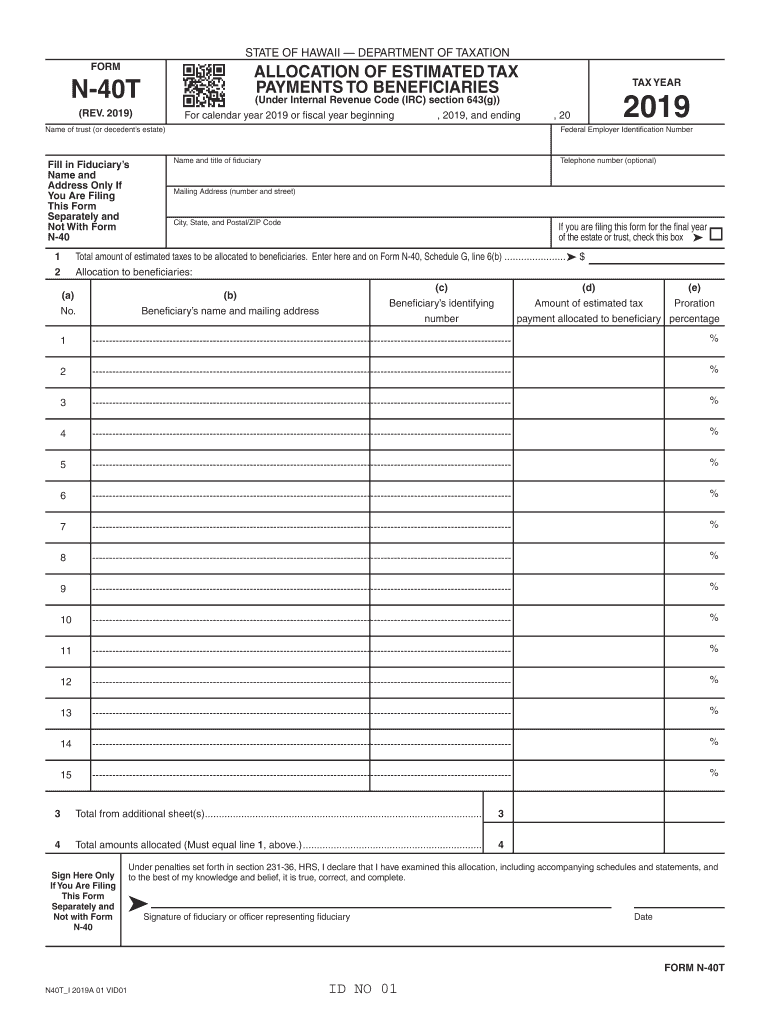

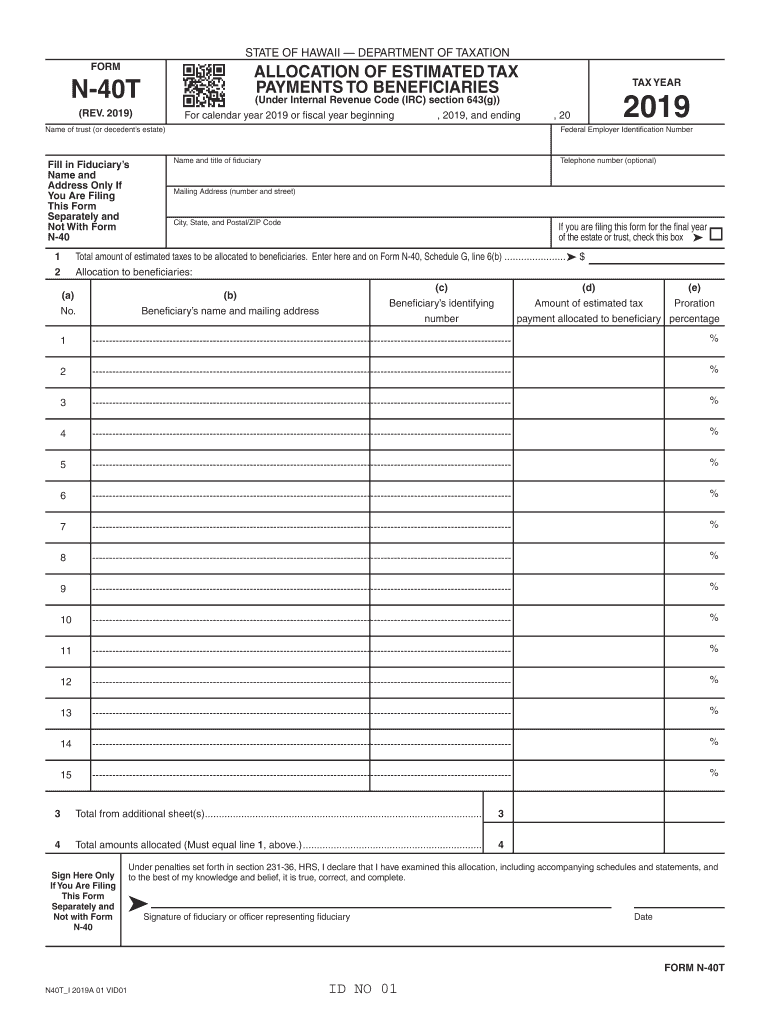

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATIONFORMN40T (REV. 2019) ALLOCATION OF ESTIMATED Name of trust (or decedents estate)Fill in Fiduciaries Name and Address Only If You Are Filing This Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary trust and estate

Edit your fiduciary trust and estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary trust and estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiduciary trust and estate online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiduciary trust and estate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiduciary trust and estate

How to fill out fiduciary trust and estate

01

To fill out a fiduciary trust and estate, follow these steps:

02

Gather all necessary documents: This includes any wills, trusts, financial statements, property deeds, and other relevant paperwork.

03

Understand the requirements: Familiarize yourself with the specific requirements and guidelines for filling out a fiduciary trust and estate. This may vary depending on your jurisdiction or the nature of the estate.

04

Identify the fiduciary: Determine who will be acting as the fiduciary, responsible for managing the estate and trust assets. This could be an individual or a corporate trustee.

05

Provide personal information: Fill out the necessary forms with personal information about the decedent, beneficiaries, and fiduciary. This includes names, addresses, dates of birth, and Social Security numbers.

06

Outline the estate assets and liabilities: Provide a detailed inventory of all estate assets and liabilities. This may include bank accounts, real estate properties, investments, debts, and more.

07

Distribute the estate: Determine how the estate will be distributed among the beneficiaries. This could be specified in the will or trust documents or may be subject to court approval.

08

Complete necessary tax forms: Depending on the size and complexity of the estate, you may need to file various tax forms, such as estate tax returns or income tax returns for the estate.

09

File the fiduciary trust and estate documents: Once all necessary forms are completed, file them with the appropriate court or government agency.

10

Comply with any ongoing obligations: After filling out the fiduciary trust and estate, you may have ongoing responsibilities, such as managing investments, distributing assets, and providing regular reports to beneficiaries or the court.

11

Seek professional advice if needed: If you are unsure about any aspect of filling out a fiduciary trust and estate, consider consulting with an attorney or other qualified professional for guidance.

Who needs fiduciary trust and estate?

01

Fiduciary trust and estate can be needed by various individuals or entities, including:

02

- Executors or personal representatives: These individuals are responsible for managing the estate of a deceased person and ensuring the proper distribution of assets according to the will or applicable laws.

03

- Trustees: Trustees are appointed to manage assets held in a trust and administer distributions to beneficiaries as outlined in the trust agreement.

04

- Guardians or conservators: In cases where individuals are unable to manage their own affairs due to incapacity, a guardian or conservator may be appointed to act in their best interests and oversee their financial matters.

05

- Beneficiaries: Beneficiaries of a trust or estate may need to understand the fiduciary trust and estate process to ensure their rights are protected and assets are distributed correctly.

06

- Legal professionals: Attorneys specializing in estate planning, probate, or trust law often deal with fiduciary trust and estate matters on behalf of their clients.

07

- Financial institutions: Banks and other financial institutions may require fiduciary trust and estate documentation to administer accounts or release funds to beneficiaries.

08

It's important to consult with legal and financial professionals to determine if the creation and filling out of a fiduciary trust and estate is necessary in a specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fiduciary trust and estate directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your fiduciary trust and estate and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute fiduciary trust and estate online?

pdfFiller has made filling out and eSigning fiduciary trust and estate easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the fiduciary trust and estate electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fiduciary trust and estate in minutes.

What is fiduciary trust and estate?

Fiduciary trust and estate is a legal relationship in which one party holds property for the benefit of another, managing the assets according to the wishes of the grantor or settlor.

Who is required to file fiduciary trust and estate?

Trustees, executors, administrators, or anyone else responsible for managing a trust or estate may be required to file fiduciary trust and estate.

How to fill out fiduciary trust and estate?

Fiduciary trust and estate forms can be filled out by providing detailed information about the assets, income, expenses, distributions, and beneficiaries of the trust or estate.

What is the purpose of fiduciary trust and estate?

The purpose of fiduciary trust and estate is to ensure that the assets held in trust are managed and distributed in accordance with the terms of the trust document or will.

What information must be reported on fiduciary trust and estate?

Information such as assets, income, expenses, distributions, and beneficiaries must be reported on fiduciary trust and estate forms.

Fill out your fiduciary trust and estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Trust And Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.