Get the free Digital Tax Map History - New York City Department of Finance

Show details

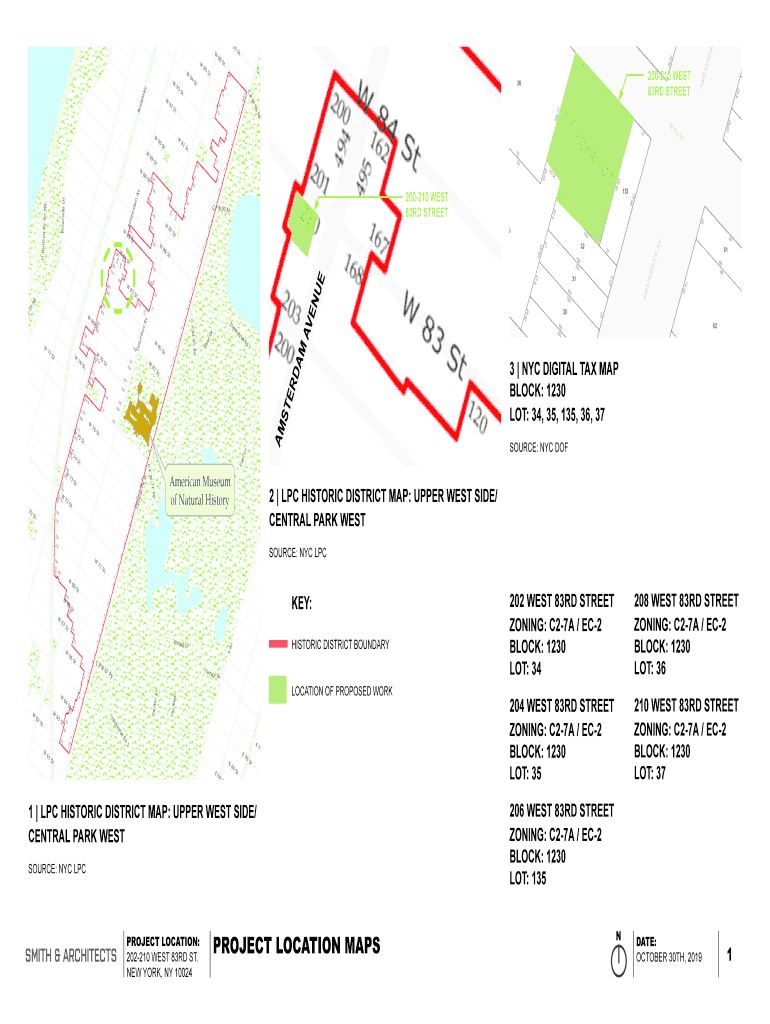

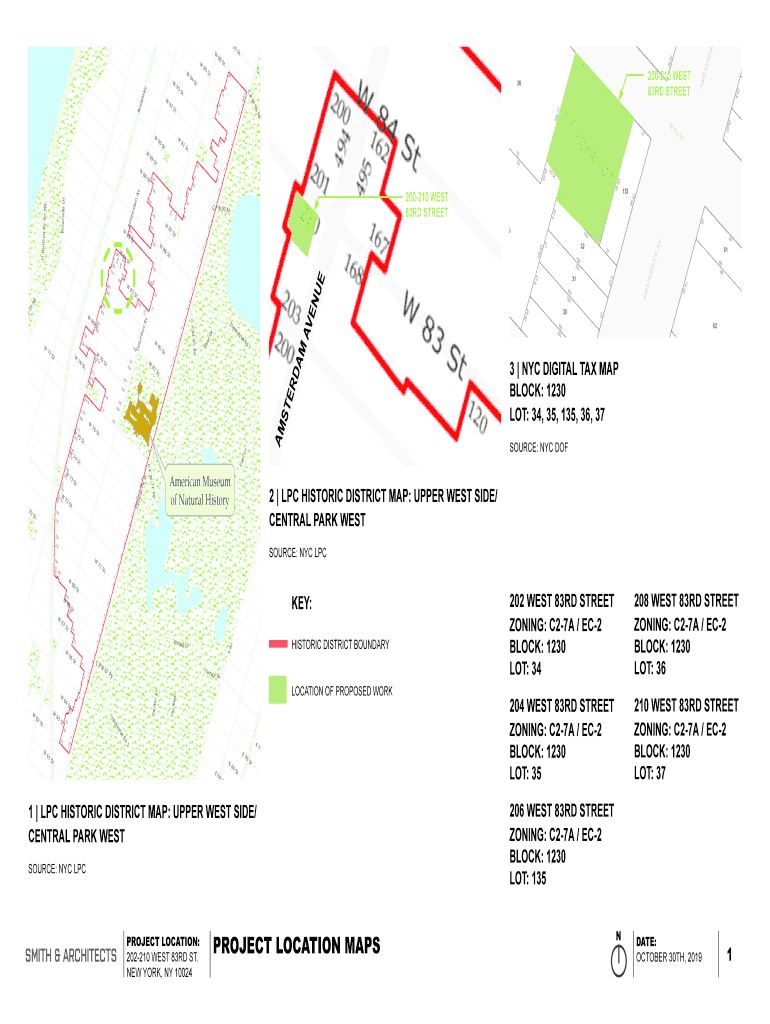

200210 WEST 83RD STREETAMSTERDAMAV EN UE200210 WEST 83RD STREET3 NYC DIGITAL TAX MAP BLOCK: 1230 LOT: 34, 35, 135, 36, 37 Sources: NYC DOF2 LPC HISTORIC DISTRICT MAP: UPPER WEST SIDE/ CENTRAL PARK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign digital tax map history

Edit your digital tax map history form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your digital tax map history form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing digital tax map history online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit digital tax map history. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out digital tax map history

How to fill out digital tax map history

01

To fill out a digital tax map history, follow these steps:

02

Start by gathering all the relevant tax information such as property details, previous tax records, and any changes made since the last tax filing.

03

Access the digital tax map system or software provided by your local tax authority.

04

Enter the required property details such as address, owner information, and parcel identification number.

05

Input the tax assessment values for the property, including any changes or updates.

06

Verify and cross-reference the information entered to ensure accuracy.

07

Submit the completed digital tax map history form through the designated online portal or by any prescribed means.

08

Keep a copy of the submitted form for future reference.

09

If required, follow up with the tax authority to confirm receipt and resolve any discrepancies or issues.

10

Regularly update the digital tax map history as and when necessary to reflect any changes in property ownership or tax assessments.

Who needs digital tax map history?

01

Digital tax map history is needed by various parties, including:

02

- Property owners who need to maintain accurate tax records and submit them to the tax authority.

03

- Real estate agents and brokers who require the tax map history to assist their clients in making informed decisions about property transactions.

04

- Appraisers and assessors who evaluate the value of properties and rely on the tax map history for reference.

05

- Tax authorities who use the digital tax map history to assess property taxes and monitor changes in ownership and assessments.

06

- Government agencies responsible for urban planning, land management, and infrastructure development that rely on tax map data.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete digital tax map history online?

pdfFiller has made it easy to fill out and sign digital tax map history. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the digital tax map history in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out digital tax map history using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign digital tax map history and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is digital tax map history?

Digital tax map history is a record of tax maps and related information that have been digitized for easier access and analysis.

Who is required to file digital tax map history?

Property owners, real estate agents, and tax authorities are typically required to file digital tax map history.

How to fill out digital tax map history?

Digital tax map history can be filled out electronically using software provided by the relevant tax authority.

What is the purpose of digital tax map history?

The purpose of digital tax map history is to make it easier to access and analyze information related to property taxes and land ownership.

What information must be reported on digital tax map history?

Information such as property boundaries, ownership details, and tax assessments must be reported on digital tax map history.

Fill out your digital tax map history online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Digital Tax Map History is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.