Get the free sherwin williams credit application

Show details

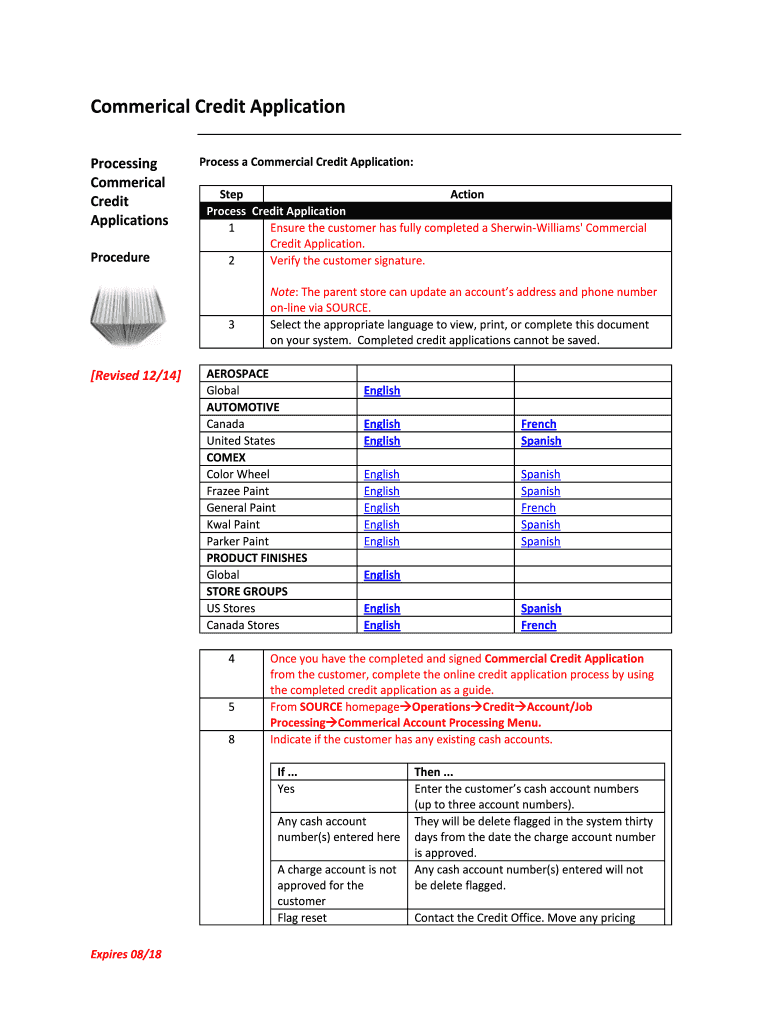

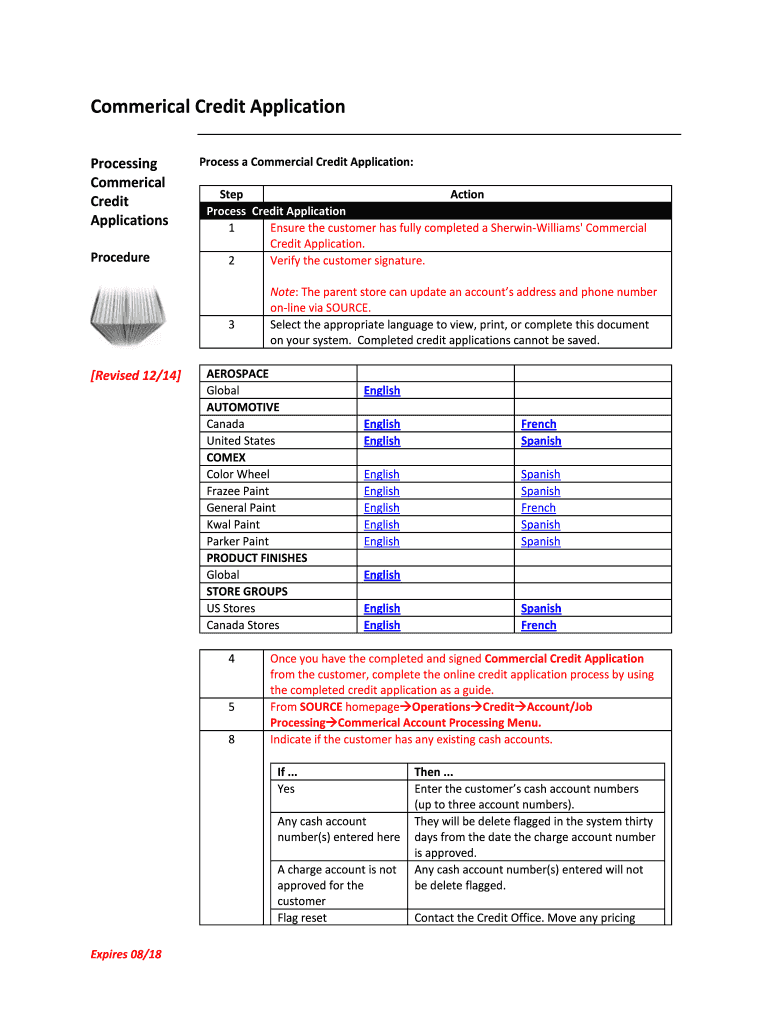

This document outlines the procedures to process a Commercial Credit Application for customers at Sherwin-Williams, including steps for verification and submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sherwin williams commercial credit application steps form

Edit your sherwin williams commercial credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sherwin williams credit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sherwin williams business account application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sherwin williams credit application online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sherwin williams credit form

How to fill out Sherwin Williams business credit:

01

Gather all necessary documents and information: Before starting the application process, make sure you have all the required documents and information handy. This may include your business tax identification number, financial statements, proof of address, contact information, and any other relevant documentation.

02

Visit the Sherwin Williams business credit application page: Go to the Sherwin Williams website and navigate to their business credit application page. You may need to create an account or log in if you already have one.

03

Complete the application form: Fill out the application form with accurate and up-to-date information. Provide all the necessary details about your business, including its name, address, contact information, revenue, years in operation, and other requested information.

04

Provide financial information: You may be required to provide financial information about your business, such as your annual revenue and any outstanding debts or liabilities. Be sure to accurately disclose this information.

05

Provide trade references: Sherwin Williams may request trade references from your business. These are typically other companies or suppliers that you have worked with or have a financial relationship with. Provide accurate and valid trade references that can vouch for your business's creditworthiness.

06

Submit the application: Once you have completed all the necessary sections of the application form, review your entries for accuracy, and submit the application. Make sure you carefully read and understand any terms and conditions associated with the credit application.

Who needs Sherwin Williams business credit:

01

Business owners: Sherwin Williams business credit is primarily designed for business owners who may need credit for purchasing paints, coatings, and other related products for their operations or projects.

02

Contractors and professionals: Contractors, painters, builders, and other professionals in the construction and remodeling industries may find Sherwin Williams business credit beneficial for managing their supply and material needs.

03

Commercial and institutional clients: Businesses, institutions, and organizations that regularly require paint and coatings for maintenance and renovation purposes may benefit from having Sherwin Williams business credit to streamline their procurement processes.

Note: It's important to note that the eligibility criteria, terms, and conditions for Sherwin Williams business credit may vary, so it's best to consult with Sherwin Williams directly or review their official documentation for the most accurate and up-to-date information.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a business credit application?

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

Does Sherwin-Williams take Amex?

We accept Visa, MasterCard, or American Express. When you are checking out, you will be prompted to enter your credit card number for payment. Is it safe to use my credit card? We guarantee that every transaction you make at SherwinWilliams will be 100 percent safe and secure.

Does Sherwin-Williams offer a credit card?

“With 0% interest, Sherwin-Williams PRO+ provides an invaluable financial foundation — with credit provided by Sherwin-Williams, not a bank or a credit card company — that helps you take advantage of the opportunities all around you.”

Does Sherwin-Williams have a credit card?

“With 0% interest, Sherwin-Williams PRO+ provides an invaluable financial foundation — with credit provided by Sherwin-Williams, not a bank or a credit card company — that helps you take advantage of the opportunities all around you.”

What is business credit application?

The business credit application is your opportunity to prove that your business is an appropriate credit risk.

What are the benefits of commercial credit Sherwin?

there are no interest fees. no matter how long a paint job might take, interest will not be added on. single point of contact regardless of what store supplies the paint. field and job site support.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sherwin williams credit application directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your sherwin williams credit application and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit sherwin williams credit application on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign sherwin williams credit application. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit sherwin williams credit application on an Android device?

The pdfFiller app for Android allows you to edit PDF files like sherwin williams credit application. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is Sherwin Williams business credit?

Sherwin Williams business credit refers to the credit account offered by Sherwin Williams, allowing businesses to purchase paint and related products on account, thus enabling deferred payment.

Who is required to file Sherwin Williams business credit?

Businesses that wish to establish a credit account with Sherwin Williams or those looking to manage their spending and maintain credit lines for purchasing products are required to file for Sherwin Williams business credit.

How to fill out Sherwin Williams business credit?

To fill out Sherwin Williams business credit, one must complete a credit application form provided by Sherwin Williams, supplying necessary business information, financial statements, and credit references.

What is the purpose of Sherwin Williams business credit?

The purpose of Sherwin Williams business credit is to facilitate easier purchasing for businesses, manage cash flow, and build a credit history with the company.

What information must be reported on Sherwin Williams business credit?

Information that must be reported includes business name, address, tax identification number, financial statements, trade references, and ownership details.

Fill out your sherwin williams credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sherwin Williams Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.