IRS 8960 2019 free printable template

Show details

Form8960Department of the Treasury Internal Revenue Service (99)Net Investment Income Tax Individuals, Estates, and Trusts OMB No. 15452227to your tax return. To www.irs.gov/Form8960 for instructions

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8960

Edit your IRS 8960 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8960 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8960 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8960. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8960 Form Versions

Version

Form Popularity

Fillable & printabley

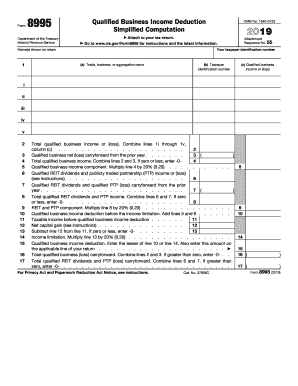

How to fill out IRS 8960

How to fill out IRS 8960

01

Obtain IRS Form 8960 from the IRS website or your tax preparation software.

02

Enter your name and Social Security Number (SSN) at the top of the form.

03

Calculate your net investment income (NII) by adding together your interest, dividends, capital gains, and rental income, and then subtracting any allowable deductions.

04

Determine your modified adjusted gross income (MAGI) by adding back any foreign earned income and tax-exempt interest to your adjusted gross income.

05

Complete Part I of the form by listing your net investment income and any deductions related to it.

06

Complete Part II of the form to determine if you owe the Net Investment Income Tax (NIIT).

07

Transfer your final tax amount to your main tax return (Form 1040).

08

Keep a copy of Form 8960 with your tax records for reference.

Who needs IRS 8960?

01

Individuals whose modified adjusted gross income exceeds specified thresholds (e.g., $200,000 for single filers, $250,000 for married filing jointly).

02

Taxpayers with net investment income, such as interest, dividends, capital gains, rental income, and certain royalties.

03

Individuals subject to the Net Investment Income Tax (NIIT) as part of their tax obligation.

Fill

form

: Try Risk Free

People Also Ask about

What triggers net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount.

Who needs to fill out form 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

What is 8960 for?

Taxpayers use this form to figure the amount of their net investment income tax (NIIT).

What is the purpose of form 8960?

Attach Form 8960 to your return if your modified adjusted gross income (MAGI) is greater than the applicable threshold amount. Use Form 8960 to figure the amount of your Net Investment Income Tax (NIIT).

Who pays 3.8 net investment tax?

Your net investment income is less than your MAGI overage. Let's say you have $30,000 in net investment income and your MAGI goes over the threshold by $50,000. You'll owe the 3.8% tax.

Do I have to pay net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount. As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT).

Who fills out 8960?

IRS Form 8960 Applies If The Following Are True… You have investment income. Your Modified Adjusted Gross Income (MAGI) is above the threshold outlined below.

Who is subject to NIIT?

A 3.8 percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

Who must file 8960?

If your net investment income is $1 or more, Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment income—whichever is the smaller figure—by 3.8 percent.

What is tax form 8960 used for?

Attach Form 8960 to your return if your modified adjusted gross income (MAGI) is greater than the applicable threshold amount. Use Form 8960 to figure the amount of your Net Investment Income Tax (NIIT).

What type of income is subject to NIIT?

The NIIT applies to income from a trade or business that is (1) a passive activity, as determined under § 469, of the taxpayer; or (2) trading in financial instruments or commodities, as determined under § 475(e)(2).

What income is not subject to NIIT?

Not everyone will need to pay the NIIT, and only those who fall above certain income thresholds will be subject to it. The IRS statutory income thresholds are as follows: Married filing jointly — $250,000. Married filing separately — $125,000.

Do I need a 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

How do you avoid net investment income tax?

If we can increase investment expenses to lower our net income, that is another way to avoid the Net Investment Income Tax. Examples of expenses are rental property expenses, investment trade fees, and state and local taxes.

What qualifies for net investment income tax?

In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Who must pay net investment income tax?

The net investment income tax is a 3.8% tax on investment income that typically applies only to high-income taxpayers. 1 It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect. Net investment income can be capital gains, interest, or dividends.

Who is subject to net investment income?

3. What individuals are subject to the Net Investment Income Tax? Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separately$125,000Single$200,000Head of household (with qualifying person)$200,0001 more row

What income is subject to 3.8% net investment tax?

The Net Investment Income Tax is based on the lesser of $70,000 (the amount that Taxpayer's modified adjusted gross income exceeds the $200,000 threshold) or $90,000 (Taxpayer's Net Investment Income). Taxpayer owes NIIT of $2,660 ($70,000 x 3.8%).

What is net investment tax form 8960?

Form 8960 is the IRS form used to calculate your total net investment income (NII) and determine how much of it may be subject to the 3.8% Medicare contribution tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8960 to be eSigned by others?

Once your IRS 8960 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete IRS 8960 online?

pdfFiller has made it simple to fill out and eSign IRS 8960. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out IRS 8960 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 8960 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 8960?

IRS Form 8960 is a tax form used to calculate the Net Investment Income Tax (NIIT) that applies to certain taxpayers with investment income.

Who is required to file IRS 8960?

Taxpayers with modified adjusted gross income (MAGI) above $200,000 for single filers or $250,000 for married couples filing jointly are required to file IRS Form 8960.

How to fill out IRS 8960?

To fill out IRS Form 8960, taxpayers must provide information about their investment income, such as interest, dividends, and capital gains, as well as calculate the applicable taxes based on the provided instructions.

What is the purpose of IRS 8960?

The purpose of IRS Form 8960 is to determine and report the amount of Net Investment Income Tax owed by individuals, estates, and trusts with significant investment income.

What information must be reported on IRS 8960?

IRS Form 8960 requires reporting of net investment income, which includes interest, dividends, capital gains, rental income, and certain other investment-related income.

Fill out your IRS 8960 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8960 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.