IRS 8960 2022 free printable template

Show details

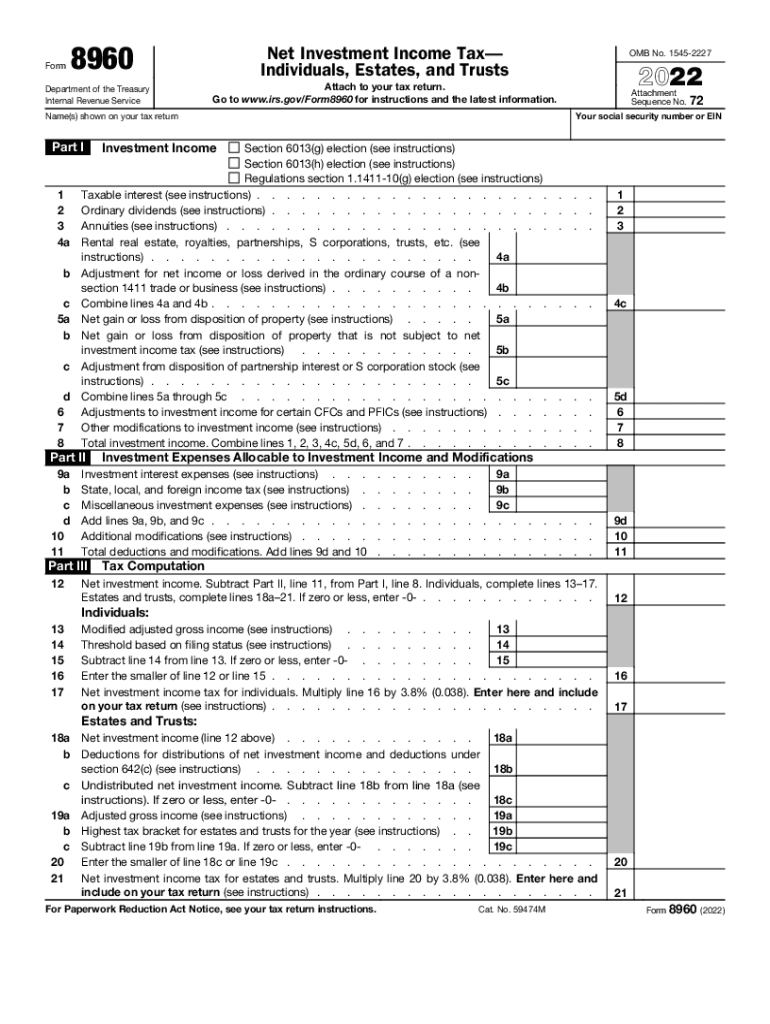

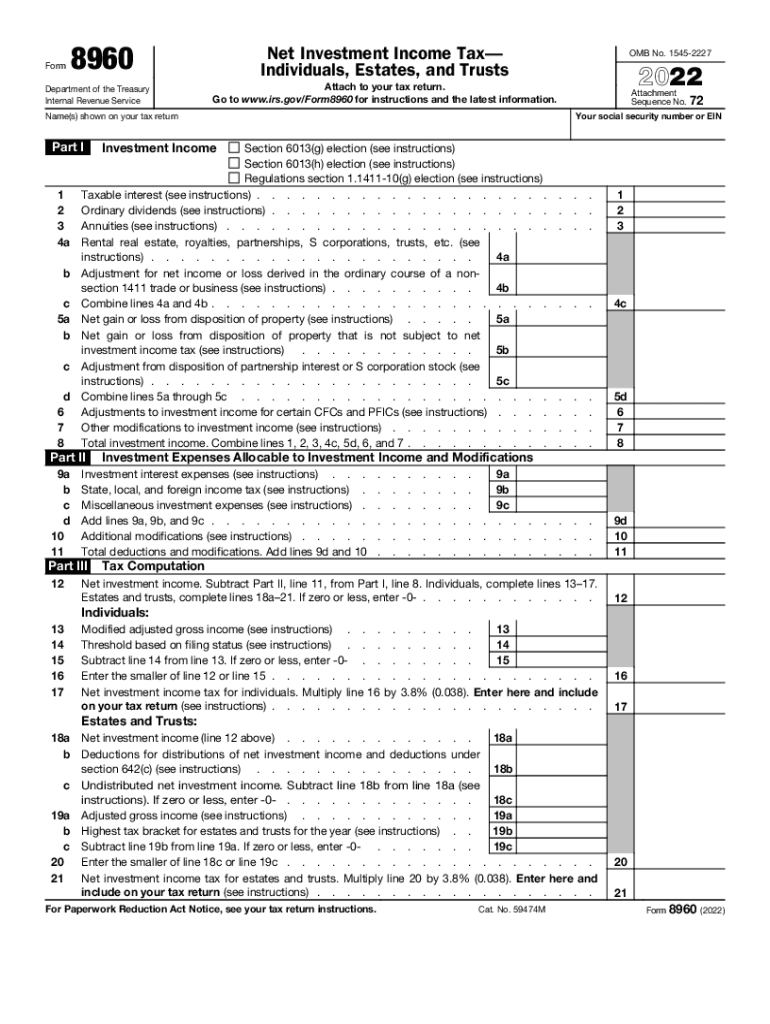

Form8960Department of the Treasury Internal Revenue Servicemen Investment Income Tax Individuals, Estates, and Trusts OMB No. 154522272022Attach to your tax return. Go to www.irs.gov/Form8960 for

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8960

Edit your IRS 8960 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8960 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8960 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8960. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8960 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8960

How to fill out IRS 8960

01

Obtain IRS Form 8960 from the IRS website or your tax software.

02

Enter your name and Social Security number at the top of the form.

03

Calculate your Adjusted Gross Income (AGI) and enter it in Part I.

04

Deduct any applicable exclusions, which may include income beyond the net investment income threshold.

05

Complete Part II by calculating your net investment income (NII), including dividends, interest, and capital gains.

06

Fill out Part III, which requires you to calculate the amount of your tax based on your NII and the applicable thresholds.

07

Review the form for accuracy and completeness before submitting it with your tax return.

Who needs IRS 8960?

01

Individuals with net investment income who also have a modified adjusted gross income over the applicable threshold (typically $200,000 for single filers and $250,000 for married couples filing jointly).

02

Estates and trusts with undistributed net investment income.

Fill

form

: Try Risk Free

People Also Ask about

Can I deduct state income taxes on form 8960?

The total of the state, local, and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960. Enter only the tax amount that is attributed to the net investment income. Do not include sales tax or any foreign income taxes paid for which you took a credit.

What is 8960 for?

Taxpayers use this form to figure the amount of their net investment income tax (NIIT).

How is Form 8960 calculated?

If your net investment income is $1 or more, Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment income—whichever is the smaller figure—by 3.8 percent.

Can you deduct brokerage fees on Form 8960?

For instance, brokerage fees that are not properly allocable will not be allowed as a deduction. The instructions to Form 8960 provides examples of deductions that are not deductible for NII purposes. For example, deductions for contributions to IRAs or other qualified plans.

Do I need a 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

Does 3.8% net investment income tax apply?

If you have investment income and go over the MAGI threshold, the 3.8% tax will apply to your net investment income or the portion of your MAGI that goes over the threshold—whichever is less.

How do you avoid net investment income tax?

If we can increase investment expenses to lower our net income, that is another way to avoid the Net Investment Income Tax. Examples of expenses are rental property expenses, investment trade fees, and state and local taxes.

What is tax form 8960 used for?

Attach Form 8960 to your return if your modified adjusted gross income (MAGI) is greater than the applicable threshold amount. Use Form 8960 to figure the amount of your Net Investment Income Tax (NIIT).

Who needs to file form 8960?

If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe. You won't know for sure until you fill out Form 8960 to calculate your total net investment income.

Who pays 3.8 net investment tax?

The net investment income tax is a 3.8% tax on investment income that typically applies only to high-income taxpayers. 1 It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect. Net investment income can be capital gains, interest, or dividends.

Who is subject to NIIT?

A 3.8 percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

What is excluded from net investment income tax?

Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income. Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes.

Who pays 3.8 net investment tax?

Your net investment income is less than your MAGI overage. Let's say you have $30,000 in net investment income and your MAGI goes over the threshold by $50,000. You'll owe the 3.8% tax.

Who fills out 8960?

IRS Form 8960 Applies If The Following Are True… You have investment income. Your Modified Adjusted Gross Income (MAGI) is above the threshold outlined below.

Who is subject to net investment income?

3. What individuals are subject to the Net Investment Income Tax? Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separately$125,000Single$200,000Head of household (with qualifying person)$200,0001 more row

Do I have to pay net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount. As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT).

What is the 3.8% tax called?

Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Who must pay net investment income tax?

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount.

What income is subject to NIIT?

Not everyone will need to pay the NIIT, and only those who fall above certain income thresholds will be subject to it. The IRS statutory income thresholds are as follows: Married filing jointly — $250,000. Married filing separately — $125,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 8960 in Chrome?

IRS 8960 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the IRS 8960 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IRS 8960 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit IRS 8960 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRS 8960, you need to install and log in to the app.

What is IRS 8960?

IRS Form 8960 is used to calculate and report the Net Investment Income Tax (NIIT), which is a 3.8% tax on certain investment income of individuals, estates, and trusts.

Who is required to file IRS 8960?

Individuals, estates, and trusts that have net investment income and whose modified adjusted gross income exceeds certain thresholds are required to file IRS Form 8960.

How to fill out IRS 8960?

To fill out IRS Form 8960, you need to gather information about your net investment income and your modified adjusted gross income, then complete the form according to the instructions provided by the IRS, detailing your income sources and calculating the tax.

What is the purpose of IRS 8960?

The purpose of IRS Form 8960 is to determine the amount of Net Investment Income Tax owed by taxpayers, which is applied to certain types of income such as dividends, interest, and capital gains.

What information must be reported on IRS 8960?

IRS Form 8960 requires reporting of net investment income, which includes interest, dividends, capital gains, rental and royalty income, and certain estate or trust income, along with the taxpayer's modified adjusted gross income.

Fill out your IRS 8960 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8960 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.