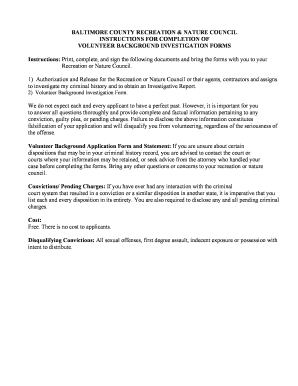

IRS Instructions 6198 2020 free printable template

Show details

SGM Instructions for Form 6198 Draft Ok to Print Init. date 15 41 - 14-OCT-2009 The type and rule above prints on all proofs including departmental reproduction proofs. Then see the begin on page 5 and the instructions for line 18 on page 7 to determine the amounts to enter on those lines. If the activity began on or after one of the effective dates shown below and you did not complete Part III of Form 6198 for this activity for the prior tax year skip lines 11 through 14. Add lines 1 2 4 6...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 6198

Edit your IRS Instructions 6198 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 6198 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instructions 6198 online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 6198. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 6198 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 6198

How to fill out IRS Instructions 6198

01

Obtain IRS Form 6198 from the IRS website or your tax preparer.

02

Review the eligibility criteria to ensure you qualify for the deductions allowed by Form 6198.

03

Gather all necessary documentation related to your business use of the vehicle, including mileage logs, expenses, and receipts.

04

Carefully read through the instructions provided with Form 6198 to understand each section.

05

Fill out the form by entering your information, making sure to accurately report your business use percentage and total vehicle expenses.

06

Double-check all entries for accuracy and completeness before submission.

07

Attach Form 6198 to your main tax return (Form 1040 or other applicable forms) and submit by the tax deadline.

Who needs IRS Instructions 6198?

01

Taxpayers who use their vehicles for business purposes and wish to claim a deduction for those expenses.

02

Self-employed individuals or business owners who need to report vehicle expenses related to their trade or business.

03

Taxpayers who have a qualified vehicle and want to calculate their allowable deductions for vehicle use.

Fill

form

: Try Risk Free

People Also Ask about

Where do I report at risk recapture income?

UltraTax CS will report the at-risk recapture amount on Form 1040, Schedule 1, line 8.

What is the difference between Form 6198 and 8582?

Form 6198 is used to figure at-risk limits. Form 8582 is used to figure passive activity limits.

Do you have to file Form 6198?

You must file Form 6198 if you are engaged in an activity included in (6) under At-Risk Activities (see At-Risk Activities below) and you have borrowed amounts described in (3) under Amounts Not at Risk (see Amounts Not at Risk, later).

What is the purpose of Form 6198?

Use Form 6198 to figure: The profit (loss) from an at-risk activity for the current year. The amount at risk for the current year. The deductible loss for the current year.

How do I fill out Form 6198?

Form 6198 breakdown Determine your losses for the current year. Calculate the amount that was at risk in the business. Compute any at-risk deductions from previous years that you can apply in the current year. Figure the total allowable deduction you can take for the current tax year.

What is IRS Form 6198 at risk limitations?

The at-risk rules place a limit on the amount you can deduct as losses from activities. Generally, any loss from an activity (such as a rental) subject to the at-risk rules is allowed only to the extent of the total amount you have at risk in the activity at the end of the tax year.

What is loss limited by Form 6198?

Form 6198 - At-Risk Limitations is used to determine the profit (loss) from an at-risk activity for the current year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a Schedule C, Schedule E, or Schedule F and some or all of their investment is not at risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Instructions 6198 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS Instructions 6198 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the IRS Instructions 6198 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your IRS Instructions 6198 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit IRS Instructions 6198 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS Instructions 6198 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS Instructions 6198?

IRS Instructions 6198 provides guidance on how to fill out Form 6198, which is used by taxpayers to calculate the allowable deduction for business losses. It outlines the conditions and computations necessary for claiming losses related to business activities.

Who is required to file IRS Instructions 6198?

Taxpayers who have business income or losses that they wish to report and deduct on their tax return are required to file IRS Instructions 6198. This typically includes sole proprietors, partners in a partnership, and shareholders in S corporations.

How to fill out IRS Instructions 6198?

To fill out IRS Instructions 6198, taxpayers should first gather relevant financial information about their business income and expenses. Then, follow the step-by-step instructions provided in the form, entering the necessary figures in the appropriate sections. It's important to refer to the IRS guidelines for specifics on calculations and required documentation.

What is the purpose of IRS Instructions 6198?

The purpose of IRS Instructions 6198 is to guide taxpayers in accurately reporting their business income and losses to ensure they comply with tax laws while claiming appropriate deductions related to their business operations.

What information must be reported on IRS Instructions 6198?

The information that must be reported on IRS Instructions 6198 includes details of business income, allowable deductions, total expenses, and any passive activity losses. Taxpayers must also include any required identification information related to their business activities.

Fill out your IRS Instructions 6198 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 6198 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.