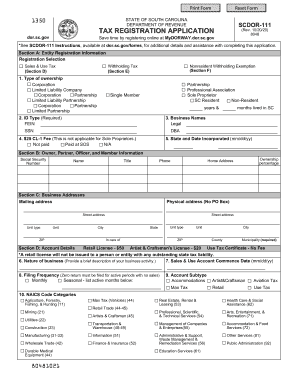

Who needs a form SCDOR-111?

Form SCDOR-111 stands for the tax registration application. It is issued by the Department of Revenue for taxpayers in the State of South Carolina. Business entities and individuals can register for a license using this application.

What is form SCDOR-111 for?

Business owners use this application to obtain a retail sales license, an artist & craftsman license, nonresident withholding exemption, or to register for use tax and withholding tax.

Is it accompanied by other forms?

A business entity must have a Federal Employer Identification Number before sending this application to the Department of Revenue. In some cases there are license fees to be paid. License fee for a retail sales license is $50, for example. The receipt for paying this fee should accompany the application.

When is form SCDOR-111 due?

Companies should file this form before they start their business activity in the state. They have to obtain tax registration before they make their first sale.

How do I fill it out?

In Section A: give information about your business entity and its physical location. Provide VEIN and SSN, check in the box the type of ownership.

In Section B: specify details about your nature of business. Provide an anticipated date of the first retail sales. Check if you sell motor oil, tires, lead acid batteries, large appliances, aviation gasoline, jet fuel, prepaid wireless cards, or service to cellular and personal communications tax.

In Section C: furnish the table for proper tax withholding from the employee’s wages and other payments made by an employer. Include the anticipated date of the first payroll.

In Section D check in the box to apply for nonresident withholding exemption.

In Section E: Make the list of all the members of the business owners, general partners, officers and members of your entity who have company share.

Where do I send a form SCDOR-111?

Send the completed copy to the following address:

SC Department of Revenue

Registration Unit

Columbia, South Carolina 29214-0140