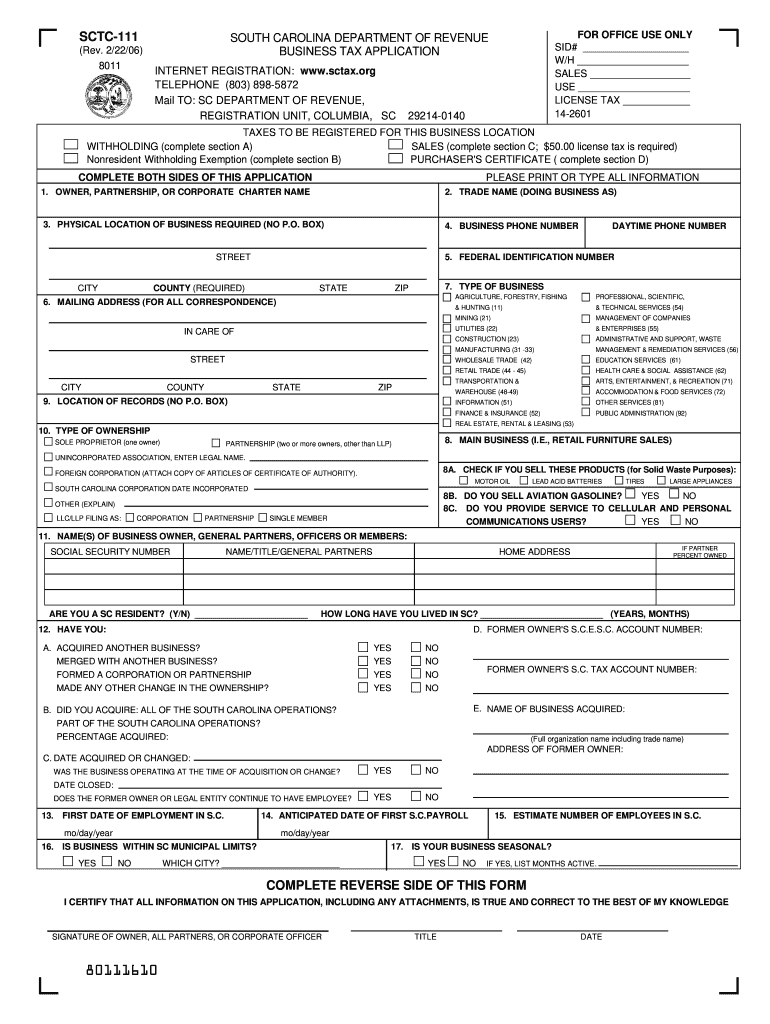

Who needs a SCTC-111 form?

All legal and private identities, who need a sales tax permission in South Carolina State.

What is for SCTC-111 form?

It is a form needed for getting retail license for selling tangible property personal property on the territory of South Carolina State. The following license may be obtained for each business or location, which are in selling tangible property in retail form.

There is a fixed price in 50 USD for getting this license. But also may be required additional payments according business and provided pack of documents.

Usually, registration and obtaining the license takes something like one or two weeks.

Also the service guarantee that retailers don’t have a need in obtaining a separate other tax registrations.

Is SCTC-111 Form accompanied by other forms?

The following form may be accompanied by legal documents about business and tax payment declarations.

When is SCTC-111 Form due?

SCTC-111 doesn’t have specific time of expiration. But it must be filed again, when were serious changes inside the business. It may be changing of ownership, business form or new retailers as a partner.

How do I feel out SCTC-111 Form?

To get the retail license, you must provide in form the following information:

- Owner of business, his partnership and corporate charter name

- Address for mailing

- Physical address (maybe different with legal address)

- Kind of business

- Applicant’s type of ownership

- Information about key personalities inside this business (like officers, owners, key partners, members).

This form may be filed personally or may be sent by e-mail or mail.

Where do I send SCTC-111 Form?

Completed SCTC-111 form must be sent to the SC Department of Revenue Registration Unit. Columbia, SC 29214-0140.