CA SFMTA Low-Income Discount Eligibility Form 2019 free printable template

Show details

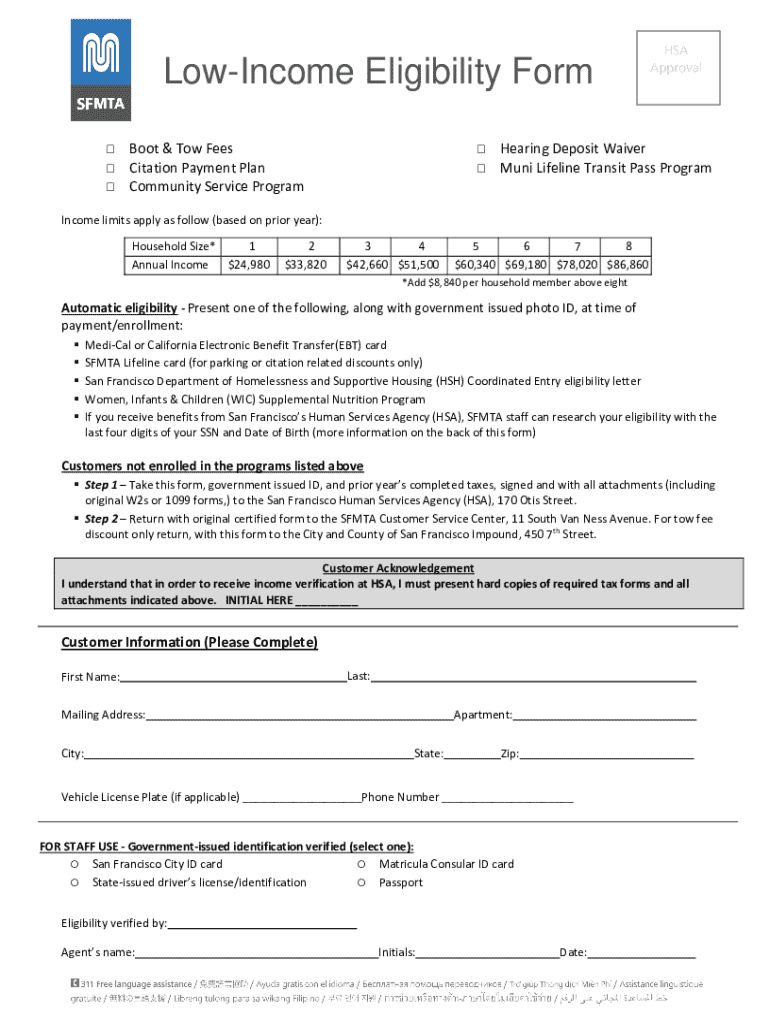

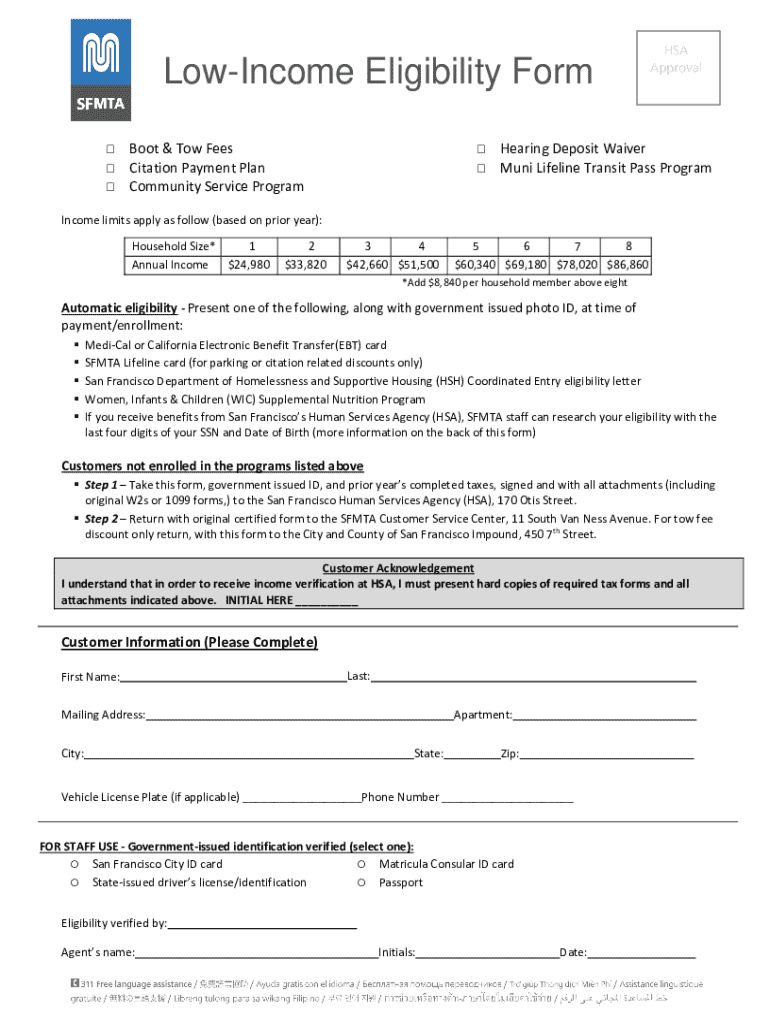

Income Eligibility Form

Boot & Tow Fees

Citation Payment Plan

Community Service ProgramHearing Deposit Waiver

Mini Lifeline Transit Pass ProgramIncome limits apply as follows (based on prior year):

Household

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit . Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA SFMTA Low-Income Discount Eligibility Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out

How to fill out CA SFMTA Low-Income Discount Eligibility Form

01

Obtain the CA SFMTA Low-Income Discount Eligibility Form from the SFMTA website or an authorized location.

02

Review the eligibility requirements to ensure you qualify for the low-income discount.

03

Complete the personal information section, including your name, address, and contact details.

04

Provide details about your household income, including all sources of income for every member of your household.

05

Attach necessary documentation to verify your income, such as tax returns, pay stubs, or benefit statements.

06

Sign and date the form to certify that the information you provided is accurate and complete.

07

Submit the completed form and supporting documents to the designated SFMTA office or online portal.

Who needs CA SFMTA Low-Income Discount Eligibility Form?

01

Individuals or families with low income who rely on public transportation in San Francisco.

02

Those who qualify based on specific income guidelines set by the SFMTA.

Fill

form

: Try Risk Free

People Also Ask about

What is a VA 760 form?

2022 Virginia Resident Form 760 Individual Income Tax Return.

What is the IRS fee waiver form?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is a 763 form in Virginia?

What is a 763 form? File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Nonresidents File Form 763. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

What is Form 8508?

Form 8508. (January 2023) Department of the Treasury - Internal Revenue Service. Application for a Waiver from. Electronic Filing of Information Returns.

What does a IRS waiver mean?

The IRS considers the taxpayer's overall financial circumstances when considering an OIC in an effort to administratively resolve the amount due. Applicants who meet the definition of a "low-income taxpayer" receive a waiver of their OIC application fee.

Who must file form 8948?

If a taxpayer opts to paper file a tax return, or the return is unable to be e-filed, the preparer must include a Form 8948, Preparer Explanation for Not Filing Electronically, with the paper filed submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like , without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send for eSignature?

When your is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is CA SFMTA Low-Income Discount Eligibility Form?

The CA SFMTA Low-Income Discount Eligibility Form is a document used by eligible residents to apply for reduced fares on public transportation services provided by the San Francisco Municipal Transportation Agency (SFMTA) based on their income level.

Who is required to file CA SFMTA Low-Income Discount Eligibility Form?

Individuals who wish to qualify for the low-income discount on public transportation fares must file the CA SFMTA Low-Income Discount Eligibility Form.

How to fill out CA SFMTA Low-Income Discount Eligibility Form?

To fill out the CA SFMTA Low-Income Discount Eligibility Form, applicants should provide personal information such as their name, address, contact details, income information, and any documentation that supports their claim of low income.

What is the purpose of CA SFMTA Low-Income Discount Eligibility Form?

The purpose of the CA SFMTA Low-Income Discount Eligibility Form is to assess and verify the income level of applicants to determine their eligibility for receiving discounted public transportation fares.

What information must be reported on CA SFMTA Low-Income Discount Eligibility Form?

The information that must be reported on the CA SFMTA Low-Income Discount Eligibility Form includes the applicant's personal identification details, income sources, household size, and any relevant financial documentation to verify low-income status.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.