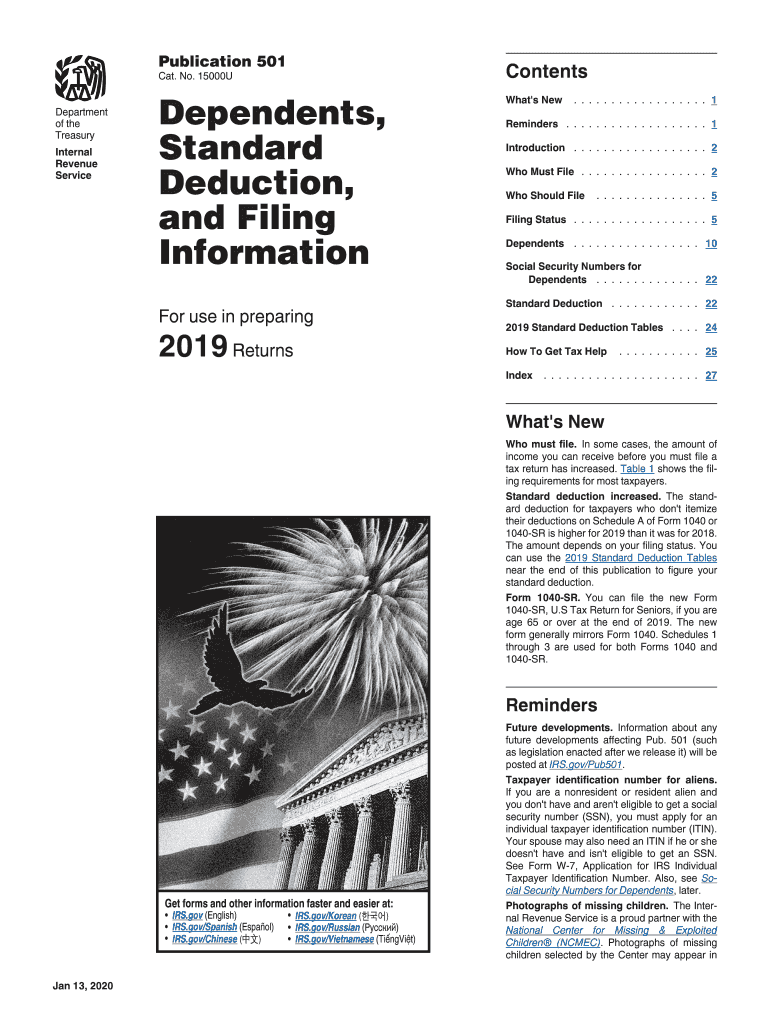

IRS Publication 501 2019 free printable template

Instructions and Help about IRS Publication 501

How to edit IRS Publication 501

How to fill out IRS Publication 501

About IRS Publication previous version

What is IRS Publication 501?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Publication 501

What should I do if I find an error after submitting IRS Publication 501?

If you find an error after submitting IRS Publication 501, you may need to file an amended return. It's crucial to address mistakes as soon as possible to avoid potential penalties or issues. Consider using Form 1040-X to make corrections and clearly state the changes made.

How can I track the status of my IRS Publication 501 submission?

To track the status of your IRS Publication 501 submission, you can use the IRS 'Where's My Refund?' tool if you are expecting a refund. Additionally, if you e-filed, you may receive notifications about your submission's acceptance or rejection, often accompanied by specific error codes for rejections.

Are electronic signatures acceptable when filing IRS Publication 501 online?

Yes, electronic signatures are acceptable when filing IRS Publication 501 online. The IRS allows e-signatures to streamline the filing process, but ensure that you comply with the specific requirements set by the IRS to maintain the validity of your submission.

What should I do if I receive a notice regarding my IRS Publication 501?

If you receive a notice about your IRS Publication 501, carefully read the communication to understand the issue. Gather any required documentation and respond promptly, providing the necessary information or corrections as directed by the IRS to resolve the matter.

See what our users say