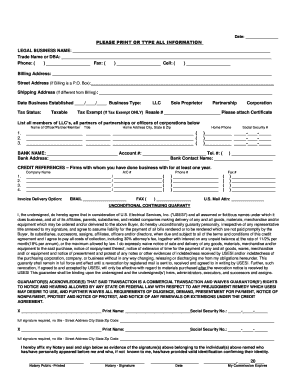

A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Get the free New York Itemized Statement by Corporation

Show details

A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new york itemized statement

Edit your new york itemized statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york itemized statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new york itemized statement

How to fill out New York itemized statement:

01

Gather all relevant financial documents, such as receipts, invoices, and bank statements.

02

Organize your expenses into categories, such as rent/mortgage, utilities, transportation, and meals.

03

Enter each expense under the appropriate category on the itemized statement.

04

Make sure to include accurate and detailed information for each expense, such as the date, description, and amount.

05

Double-check your calculations to ensure accuracy.

06

Sign and date the completed itemized statement.

Who needs a New York itemized statement:

01

Individuals or businesses who are required to report their expenses in detail for tax or legal purposes.

02

Landlords or property owners who need to provide detailed expense reports to tenants or authorities.

03

Individuals or businesses who need to track their expenses for personal or financial management purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new york itemized statement?

The New York itemized statement is a document that details the individual expenses incurred by a person or business in the state of New York.

Who is required to file new york itemized statement?

Individuals and businesses that have incurred expenses in the state of New York are required to file the itemized statement.

How to fill out new york itemized statement?

The New York itemized statement can be filled out by listing all the individual expenses incurred in the state, along with their respective amounts and categories.

What is the purpose of new york itemized statement?

The purpose of the New York itemized statement is to provide a detailed breakdown of the expenses incurred in the state for tax or reporting purposes.

What information must be reported on new york itemized statement?

The New York itemized statement should include information such as the date, description, amount, and category of each expense incurred in the state.

Fill out your new york itemized statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York Itemized Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.