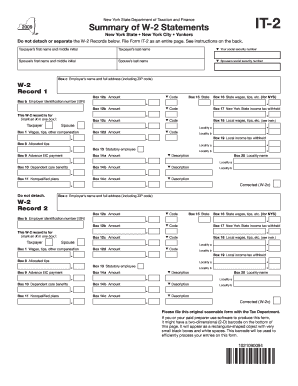

NY DTF IT-2 2019 free printable template

Get, Create, Make and Sign NY DTF IT-2

Editing NY DTF IT-2 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF IT-2 Form Versions

How to fill out NY DTF IT-2

How to fill out NY DTF IT-2

Who needs NY DTF IT-2?

Instructions and Help about NY DTF IT-2

Music when you get an actor like Bill sparser who clearly revels in it, and he's made for this kind of thing that's when it comes together, and you have a character that is beyond either just the actor or just the makeup I think our interest in practical effects started when we were kids like most people the original Planet of the Apes came out when we were kids, so a lot of that stuff just goes into your brain reading comic books when I realized that somebody makes all the cool things that I was seeing in movies and on TV that was a huge moment for me personally creating characters is a great way to tell a story it's the book for us in any great movie we were approached by production and I think the first batch of material we got from them included pencil sketches, and it was already inherent in his art that he wanted Penny wise to have a larger head with a makeup character what we start with is we start with a head cast of the actor what's really the best way to do it is to jump into clay sand as possible and start blocking in clay shapes and seeing what works and what doesn't work, and then we go from the sculpture to the mold, and we create our rubber pieces that believe seamlessly onto the actor on average when you're covering this much of the face it becomes a two and a half to three-hour job there's this like childlike quality to it right the proportions of the head, and then we had a version of teeth that had these little kind of extended in sizes, so it looked like kind of cute they called them bunny teeth it was just such a cute look but such a creepy look and then the other thing which I thought was a genius touch was having the eyes be slightly wall-eyed which really played off as if there is a real creepy aspect it's not a complex makeup but its visually striking, and it's fresh in that it is a decrepit weird evil child version of the clown my favorite part of this job is being able to design and create something that didn't exist before and then be able to take it to this very final step where it goes on to film as a living breathing creature we didn't create this craft right we stand upon the shoulders of people that we recognize some people that we knew some people that we had access to, and we don't ever want that to disappear when we finally get to go to the movie theater, and you can see the work on the screen a lot of times its very special if I go early enough when the film comes out you're seeing with an audience of people that really love and appreciate that stuff I think it kind of feeds my drive to continue to keep doing really, really cool crazy character work would you say you know how to like contour yes I understand contouring I can do it, but my hands start shaking, and I get like what am I wasting my god-given ability to make an already beautiful woman even more beautiful plus it's a skill she has to learn herself

People Also Ask about

Where can I get NYS tax forms?

What is at 2 tax form?

What is an IT 2 form New York?

Does the W-2 form include both federal and state tax information?

Do I need to attach w2 to New York tax return?

What is a 1040?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF IT-2 in Gmail?

Can I sign the NY DTF IT-2 electronically in Chrome?

Can I create an electronic signature for signing my NY DTF IT-2 in Gmail?

What is NY DTF IT-2?

Who is required to file NY DTF IT-2?

How to fill out NY DTF IT-2?

What is the purpose of NY DTF IT-2?

What information must be reported on NY DTF IT-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.