NYC DoF NYC-5UB 2020 free printable template

Show details

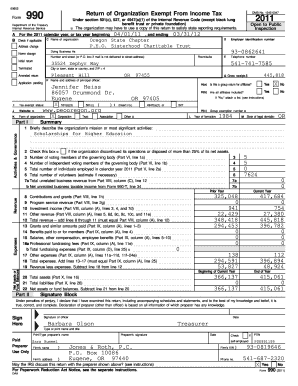

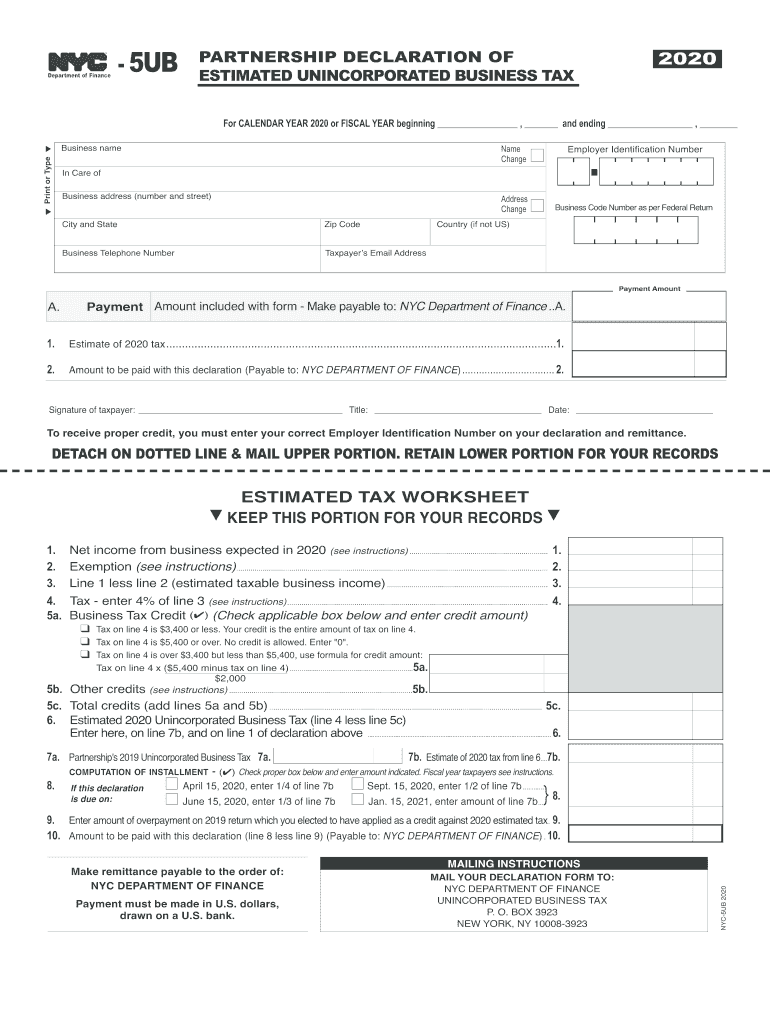

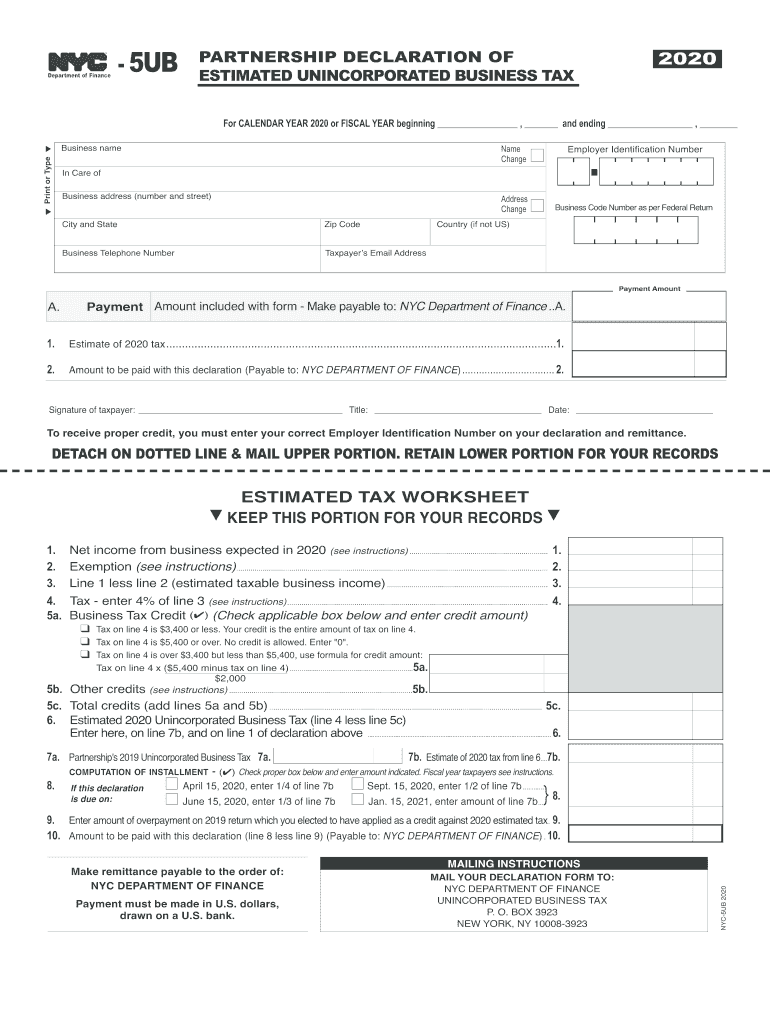

5UBPARTNERSHIP DECLARATION OF ESTIMATED UNINCORPORATED BUSINESS TAX2020t Print or Type for CALENDAR YEAR 2020 or FISCAL YEAR beginning, and ending, Business namesake ChangenAddress ChangenEmployer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-5UB

Edit your NYC DoF NYC-5UB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-5UB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-5UB online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NYC DoF NYC-5UB. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-5UB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-5UB

How to fill out NYC DoF NYC-5UB

01

Obtain the NYC DoF NYC-5UB form from the New York City Department of Finance website or local office.

02

Fill in your name and contact information at the top of the form.

03

Provide the property information including address and block and lot numbers.

04

Indicate the reason for filing the NYC-5UB form in the designated section.

05

Attach any required supporting documents that validate your claim as directed.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the NYC Department of Finance by mail or in person.

Who needs NYC DoF NYC-5UB?

01

Property owners or representatives who wish to claim an exemption or adjustment related to their property taxes in New York City.

Fill

form

: Try Risk Free

People Also Ask about

Is a non resident required to file income tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Do I have to file New York non resident tax return?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

Who must file a NYC UBT return?

a full-year or part-year New York City resident and. the owner of a business, a beneficiary of an estate or trust, or a partner in a partnership whose business, estate or trust, or partnership is subject to the New York City unincorporated business tax (UBT).

Who is exempt from NYC UBT tax?

Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account. Entities engaged primarily with qualifying investment activities are partially exempt from UBT on the income.

What form do I use for New York City nonresident income tax?

You can get the form online or by mail. Get the NYC-1127 form and learn more about 1127 taxes for nonresident City employees.

Do I have to file NY state tax return for nonresident?

If I'm not domiciled in New York and I'm not a resident, do I owe New York income tax? If you do not meet the requirements to be a resident, you may still owe New York tax as a nonresident if you have income from New York sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NYC DoF NYC-5UB directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your NYC DoF NYC-5UB along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete NYC DoF NYC-5UB online?

Filling out and eSigning NYC DoF NYC-5UB is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the NYC DoF NYC-5UB electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NYC DoF NYC-5UB in seconds.

What is NYC DoF NYC-5UB?

NYC DoF NYC-5UB is a tax form used by the New York City Department of Finance for the reporting of business income and expenses.

Who is required to file NYC DoF NYC-5UB?

Any business entity or individual operating in New York City that generates income and meets certain thresholds is required to file NYC DoF NYC-5UB.

How to fill out NYC DoF NYC-5UB?

To fill out NYC DoF NYC-5UB, you need to provide specific income details, expense information, and complete the designated sections in the form, following the guidelines provided by the NYC Department of Finance.

What is the purpose of NYC DoF NYC-5UB?

The purpose of NYC DoF NYC-5UB is to collect detailed information on business income and expenses to ensure accurate taxation and compliance with city tax regulations.

What information must be reported on NYC DoF NYC-5UB?

Information that must be reported on NYC DoF NYC-5UB includes total income, deductions, expenses related to business operations, and other relevant financial details as specified in the form instructions.

Fill out your NYC DoF NYC-5UB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-5ub is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.