Get the free IRS Offers Help to Students, Families to Get Tax Information ...

Show details

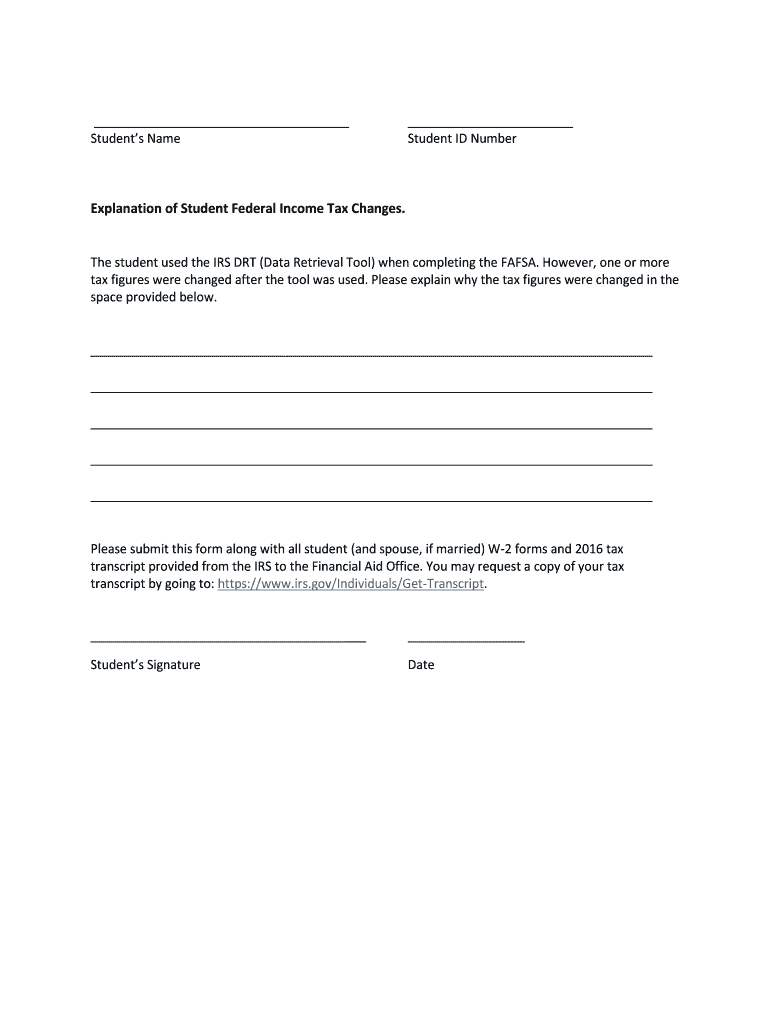

Students Name Student ID NumberExplanation of Student Federal Income Tax Changes. The student used the IRS DRT (Data Retrieval Tool) when completing the FAFSA. However, one or more tax figures were

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs offers help to

Edit your irs offers help to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs offers help to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs offers help to online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs offers help to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs offers help to

How to fill out irs offers help to

01

Gather all required documents and information such as your financial statements, tax returns, income and expense information, and any supporting documents related to your outstanding tax liabilities.

02

Determine if you qualify for an IRS Offer in Compromise based on your financial situation, income, assets, and expenses.

03

Complete the necessary IRS forms, including Form 656, Form 433-A (for individuals) or Form 433-B (for businesses), and any other required forms or schedules.

04

Calculate your proposed offer amount by considering your ability to pay and the total amount of tax debt you owe to the IRS.

05

Submit your completed forms, along with the required documentation and payment for the application fee, to the appropriate IRS address as indicated in the instructions.

06

Await a response from the IRS regarding your offer. This may take several months, as the IRS carefully reviews each offer to ensure its accuracy and compliance.

07

If your offer is accepted, follow the terms and conditions outlined by the IRS, including making timely payments and staying in compliance with your tax obligations.

08

If your offer is rejected, you have the option to appeal the decision or explore other alternatives to resolve your tax debts, such as setting up a payment plan or requesting a partial payment installment agreement.

Who needs irs offers help to?

01

Individuals and businesses who have substantial tax debts and are unable to pay them in full may need IRS offers help.

02

Taxpayers who are facing financial hardship and are unable to meet their basic living expenses while paying off their tax debts may also need IRS offers help.

03

Those who have explored other payment options, such as installment agreements, but still find them unaffordable or unsustainable may benefit from seeking assistance through IRS offers.

04

Taxpayers who have valid reasons to believe that their tax liabilities have been incorrectly assessed or that they qualify for a compromise based on exceptional circumstances may also need IRS offers help.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs offers help to directly from Gmail?

irs offers help to and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit irs offers help to from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irs offers help to, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete irs offers help to on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your irs offers help to. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is irs offers help to?

IRS offers help to taxpayers in need of assistance with tax-related issues.

Who is required to file irs offers help to?

Taxpayers who are facing challenges related to taxes may seek help from the IRS.

How to fill out irs offers help to?

Taxpayers can fill out IRS offers help forms online or by contacting the IRS directly.

What is the purpose of irs offers help to?

The purpose of IRS offers help is to provide support and guidance to taxpayers struggling with tax matters.

What information must be reported on irs offers help to?

Taxpayers must report their tax-related issues and provide relevant documentation when seeking help from the IRS.

Fill out your irs offers help to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Offers Help To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.