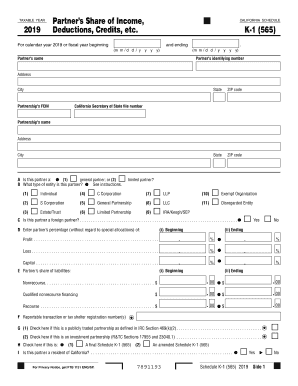

KPC partners share of income credits and modifications 2019-2025 free printable template

Show details

*197311×2019 PC, Partners Share of Income, Credits

and ModificationsPartnership: Complete and provide Schedule PC to each corporate or partnership partner. For individual, estate and trust partners,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1040a instructions form

Edit your form 1040a instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form pdf forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing partner pdf online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1040x return. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate pdf form

How to fill out KPC partners share of income credits and modifications

01

Gather all necessary financial documents related to the KPC partners.

02

Identify the total income earned by each partner during the fiscal year.

03

Determine the specific income credits applicable to the partners based on their share.

04

Document any modifications that need to be made to these credits, such as adjustments for losses or distributions.

05

Complete the KPC income credit forms by entering the calculated credits and any modifications.

06

Review the completed forms for accuracy before submission.

07

Submit the forms to the appropriate tax authority or financial institution as required.

Who needs KPC partners share of income credits and modifications?

01

Individuals or entities who are partners in a KPC (Korean Partnership Corporation).

02

Tax professionals preparing returns that include KPC income components.

03

Accountants managing the financials of a KPC.

04

Financial advisors advising partners on their income credits and tax implications.

Fill

form 1040 1040a

: Try Risk Free

People Also Ask about using filing return

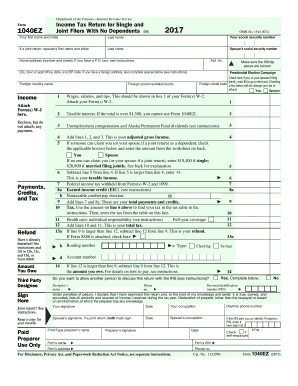

What is the 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What tax return forms do I need to file?

Common IRS tax forms you should know about (and where to get them) Form 1040 and Form 1040-SR. Schedule A: For itemizing. Schedule B: Reporting interest and dividends. Schedule C: For freelancers or small business. Schedule D: Capital gains. The W-2: Income from a job. Form 1098: Mortgage or student loan interest you paid.

Do I file a 1040 if I have a W-2?

To get started filling out Form 1040, you'll first need to gather all of your tax documents, including W-2s, 1099s, and other records of your income and deductions.

Is W-2 same as 1040?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

Can I do tax return myself Canada?

You can file your taxes online or by paper, or find other options such as having someone else complete them for you. Options include: NETFILE-certified tax software (electronic filing)

How do I file a tax return report?

There are three main ways to file taxes: fill out IRS Form 1040 or Form 1040-SR by hand and mail it (not recommended), file taxes online using tax software, or hire a human tax preparer to do the work of tax filing.

How can I fill my own income tax return?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

Can I file my first tax return online Canada?

The NETFILE and ReFILE services are now open for the electronic filing of your T1 personal income tax and benefit return. The NETFILE and ReFILE services for tax years 2017 (ReFILE excluded), 2018 (ReFILE excluded), 2019, 2020, 2021, and 2022 will be open until Friday, January 26, 2024.

How do I file my first tax return in Canada?

How to file your tax return EFILE. If you had an accountant or tax preparer prepare your tax return, they'll likely file your return electronically using EFILE. NETFILE. Certain brands of tax software allow you to file your return electronically using NETFILE. Mail. You can mail a paper return to the CRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 1040 1040ez to be eSigned by others?

Once you are ready to share your 1040x 1024, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete 1040x filing online?

With pdfFiller, you may easily complete and sign partnerships annually transfers online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit partnership tax check straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing partnership tax.

What is KPC partners share of income credits and modifications?

KPC partners' share of income credits and modifications refers to the allocation of income, credits, and certain adjustments that are distributed among partners in a partnership based on the partnership agreement.

Who is required to file KPC partners share of income credits and modifications?

Partners in the KPC (Kuwait Petroleum Corporation) structure who need to report their allocated income, credits, and modifications as part of their tax filings are required to file this information.

How to fill out KPC partners share of income credits and modifications?

To fill out the KPC partners share of income credits and modifications, partners should follow the guidelines provided by the KPC, which typically includes detailing each partner's share of income, specifying applicable credits, and making necessary modifications as outlined in the partnership agreement.

What is the purpose of KPC partners share of income credits and modifications?

The purpose is to ensure accurate allocation of income and tax credits to each partner, to maintain compliance with tax regulations, and to provide a clear understanding of each partner's financial position within the partnership.

What information must be reported on KPC partners share of income credits and modifications?

The information that must be reported includes the partner's name, their allocated share of income, applicable tax credits, deductions, and any modifications to the income or credits that could affect their tax liability.

Fill out your pdf 1040a 1040ez form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1040 Schedule Schedules is not the form you're looking for?Search for another form here.

Keywords relevant to filing partnership tax

Related to 1040x filing partnership

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.