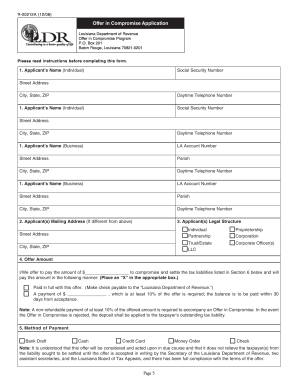

LA R-20212 2019-2025 free printable template

Get, Create, Make and Sign offer in compromise program

Editing offer in compromise program online

Uncompromising security for your PDF editing and eSignature needs

LA R-20212 Form Versions

How to fill out offer in compromise program

How to fill out LA R-20212

Who needs LA R-20212?

Instructions and Help about offer in compromise program

You my name is Jim de metric from Demerit Montaño and associates we're tax specialists who were very specialized we represent people in businesses who are in trouble with the IRS every one of our clients owes the IRS from ten thousand dollars up to two or three million most clients always asked me about the offering compromise, or you've seen it on TV pennies on the dollar it looks like everybody grows taxes gets the pennies on the dollar well that's just not true in 2010 the IRS only accepted 14,000 offers in compromise in all the United States that's only three or four hundred per state so in reality the offering compromise is very difficult to negotiate first it takes six months to a year to get through the IRS system sometimes longer than a year, and it's based on very finite facts number one the IRS looks at your assets do you have equity in those assets can you borrow on the assets or if it's an asset you don't need to can you sell the asset to pay your taxes so the first thing they look at is your equity and assets the next thing they look at is your monthly income and monthly expenses they'll look at your paychecks and pay stubs in your bank statements to determine your average monthly income then they will look at your monthly expenses your rent your utilities your car payment your house payment all of your monthly expenses that are necessary for the health and welfare of your family but in some of those expenses the IRS will only allow certain specific amounts your rent may be 2,000 a month, but they may only allow in a month you may have a car payment that's $650 a month, but they will only allow 496 per month you may have very high medical expenses, and they will allow all of them as long as you can prove all of those expenses, so some expenses have an allowable amount some it's whatever you spend they will compare this to your monthly income to see how much you have left over you may have a hundred a month left over or two or three hundred a month left over but then for an offering to compromise they multiply that monthly amount by 48 so if you have a hundred a month left over that's 48 hundred dollars in an offer and compromise if you have two hundred months left over that's ninety-six hundred that goes with that equity that we talked about that you may have to determine the offering compromise amount so as you can see the offering top might is very difficult and that's why the IRS doesn't grant very many of them each year but if you do qualify we will do the best we can to get your offer and compromise accepted the worst thing to do is procrastinate pick up the phone today call us today, so we can help you today

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get offer in compromise program?

How do I make changes in offer in compromise program?

Can I create an eSignature for the offer in compromise program in Gmail?

What is LA R-20212?

Who is required to file LA R-20212?

How to fill out LA R-20212?

What is the purpose of LA R-20212?

What information must be reported on LA R-20212?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.