GA F52 2014-2026 free printable template

Show details

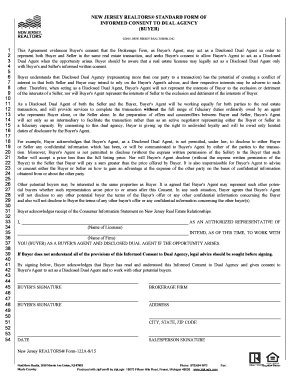

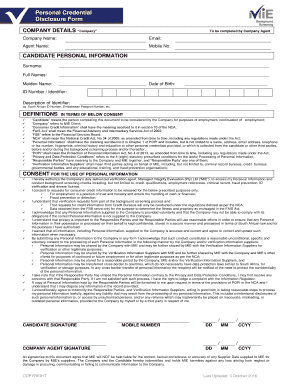

SELLERS PROPERTY DISCLOSURE STATEMENT (CONDOMINIUM) EXHIBIT Georgia REALTORS 2014 Printing This Sellers Property Disclosure Statement (Statement) is an exhibit to the Condominium Purchase and Sale

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA F52

Edit your GA F52 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA F52 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA F52 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit GA F52. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out GA F52

How to fill out GA F52

01

Gather your personal information, including your name, address, and contact details.

02

Obtain the relevant GA F52 form from the official website or local office.

03

Read the instructions provided with the form carefully.

04

Fill in the required fields, such as your identification number and any other pertinent details.

05

Provide any supporting documentation as required, ensuring all documents are complete and legible.

06

Review the filled-out form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form either online or via mail, as per the guidelines provided.

Who needs GA F52?

01

Individuals who are applying for financial assistance or grants through GA programs.

02

Residents who need to report changes in their circumstances related to state benefits.

03

Anyone required to provide documentation for eligibility verification in specific government programs.

Fill

form

: Try Risk Free

People Also Ask about

What type of information must be disclosed to the seller?

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

Is a sellers disclosure required on a condo in Texas?

Is a Seller's Disclosure Required in Texas? Yes. Section 5.008 of the Texas Property Code requires anyone selling a single family home to fill out a seller's disclosure. It even has a script you can use to write your disclosure—so you know you've met all the requirements.

Can you sue previous homeowner for non disclosure in Florida?

Under Florida law, a buyer can sue for damages, and even rescind a transaction, where a seller or real estate agent doesn't reveal a known material problem with the home prior to purchase.

Is a property disclosure required in Florida?

In Florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the Property being sold which are not readily observable by a buyer.

Is a seller's disclosure required for an estate sale in Texas?

This disclosure often provides peace of mind for a buyer, However, ing to the Texas Property Code, while most sellers must complete a Seller's Disclosure Form, not all sellers are required to do so.

Who is exempt from completing a sellers disclosure in Texas?

Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender (Texas Property Code Section 5.008). Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements.

Are sellers disclosures mandatory in Florida?

Florida law requires sellers to disclose any issues they know about that materially affect the value of a home or property. This requirement applies even if the buyer does not ask whether the seller knows about defects.

What happens if seller does not disclose Texas?

A seller has the obligation to disclose certain defects to a buyer before they complete the sale. If a seller fails to disclose those defects, they may be held liable for the cost of repair. In some cases, a court may even rescind the sale of the property.

What is a property disclosure statement BC?

What is a Property Condition Disclosure Statement? If you're selling a home, you are required by law in BC to provide a Property Condition Disclosure Statement and other financial statements to the potential buyer. This document details any existing problems with the property and explains how you can resolve them.

What is the purpose of a disclosure document in real estate?

Also known as a property disclosure statement, a real estate disclosure statement is a document that lists any current defects, repairs, and other significant property details to give buyers a complete picture of the home.

What do sellers have to disclose in Texas?

The seller and the seller's agent are required to disclose known material facts about the property. Because the zoning change could be something a buyer would want to know before deciding to purchase the property, it's a good idea for the seller to disclose what he knows about the potential zoning change.

Is property disclosure statement important?

The PDS is a critical document and should be taken seriously by the seller when filling it out as they could be held liable if a defect was knowingly concealed. The PDS should equally be taken seriously by the buyer, especially if a mortgage is being used for the purchase.

Does Florida require a seller disclosure?

Florida law requires sellers to disclose any issues they know about that materially affect the value of a home or property. This requirement applies even if the buyer does not ask whether the seller knows about defects.

What is a seller disclosure form Florida?

Notice to Seller: Florida law1 requires a Seller of a home to disclose to the Buyer all known facts that materially affect the value of the property being sold and that are not readily observable or known by the Buyer. This disclosure form is designed to help you comply with the law.

What is a sellers disclosure in Florida?

In Florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the Property being sold which are not readily observable by a buyer.

Where can you find the disclosure statement?

The disclosure statement is part of the loan documentation and may be referenced and used as a part of other legal documentation, including the loan agreement, note, security agreements, pledge agreements, and other documents signed when the loan is closed.

What is the most common type of disclosure?

Flooding issues and plumbing leaks are the most common disclosures top real estate agents say they encounter. “The biggest issue is always the plumbing leaks and the roof issues because of the recent hurricane we had last year,” Fonseca said.

Do I have to fill out a seller's disclosure in Florida?

While a seller's property disclosure form is not required under Florida law, Florida law does require seller's and their realtors to disclose any significant property defects that may not be easily visible to the buyer. Buyers still have the responsibility to have the property inspected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute GA F52 online?

pdfFiller has made it simple to fill out and eSign GA F52. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the GA F52 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign GA F52 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out GA F52 on an Android device?

Complete your GA F52 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is GA F52?

GA F52 is a tax form used for reporting certain financial information related to Georgia state taxes.

Who is required to file GA F52?

Businesses and individuals who have specific financial activities or tax obligations in the state of Georgia are required to file GA F52.

How to fill out GA F52?

To fill out GA F52, gather the necessary financial documents, carefully follow the instructions provided with the form, and ensure that all required information is accurately reported.

What is the purpose of GA F52?

The purpose of GA F52 is to collect financial information from taxpayers to ensure compliance with state tax regulations and to assist in the assessment of taxes owed.

What information must be reported on GA F52?

The GA F52 requires reporting of details such as income, deductions, credits, and other relevant financial information pertaining to the taxpayer's financial activities in Georgia.

Fill out your GA F52 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA f52 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.