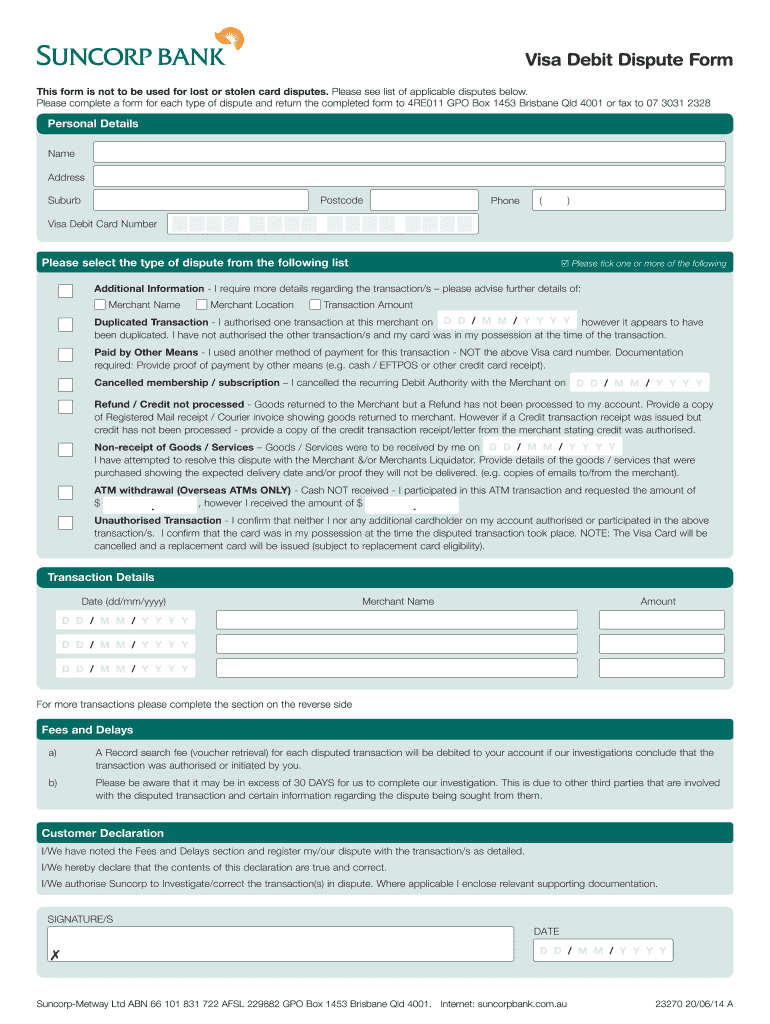

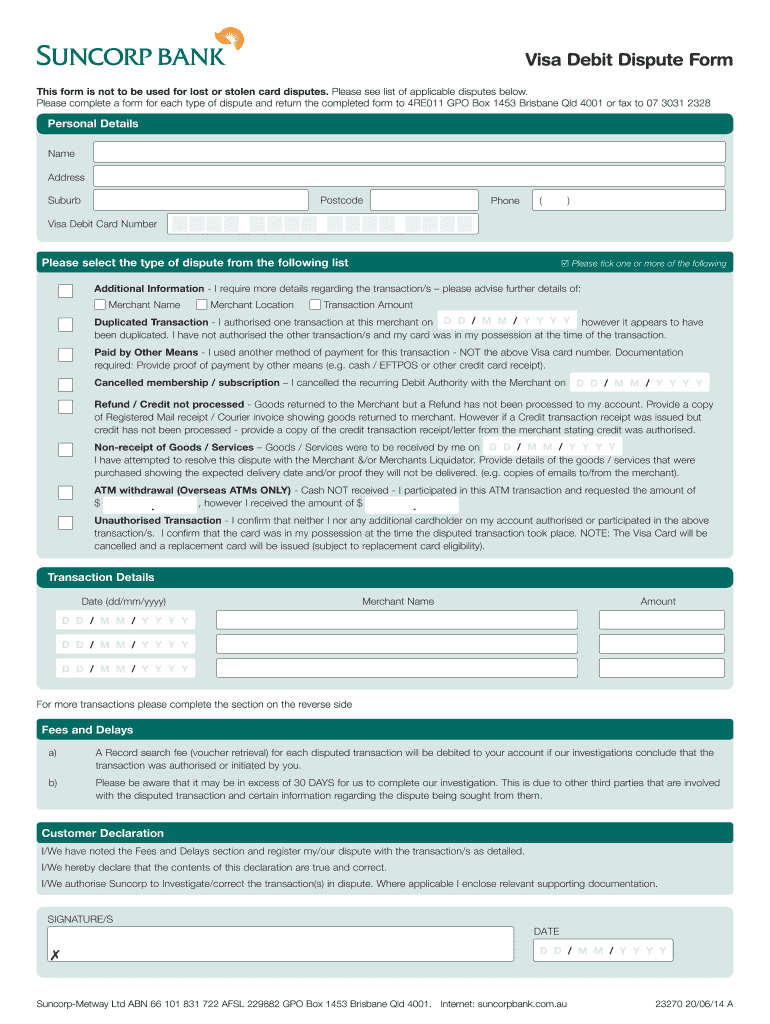

AU Suncorp Bank 23270 2014-2025 free printable template

Get, Create, Make and Sign australia suncorp bank dispute form

Editing suncorp visa debit online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out suncorp debit dispute form

How to fill out AU Suncorp Bank 23270

Who needs AU Suncorp Bank 23270?

Video instructions and help with filling out and completing australia bank 23270 dispute form

Instructions and Help about suncorp 23270 debit

Music hello David here at merchant accounts dot CA today I'm going to talk a little about visas new claims resolution process it's going to replace that old charge back process that's been in place for many years with the new streamline process that should make it faster for disputes to be resolved which is a benefit for cardholders and merchants but really importantly it's supposed to cut down on the number of charge bats charge backs that actually occur, so we'll get into that, and I'll explain but let's start we'll start by telling you this there is no more such a thing as a charge back going forward in as of April 15th Visa referred to these as disputes which makes more sense and in the past when you put all your paperwork together and sent it off to fight the charge back it was called to represent mint, and it's no longer called that and how it's called the dispute response again more sensible life is getting easier in terms of the actual process itself what's changing is that in the past chargebacks would occur this is a common complaint I'd hear from merchants with lots of different things and processors that they would get a charge back for example for an order they had refunded a week ago it's like how can I be getting a charge back, and now I'm getting a charge back fee it's very unfair, and it was unfair and what was happening is the issuers we're not always ensuring that the charge back was fair in other words if a credit had been issued the charge back is not supposed to go through Visa has addressed this and this new process is going to prevent that from happening what's happening behind the scenes when a chargeback occurs it will now go into visas new platform that platform is going to check automatically you don't have to do anything to see if there was a credit if there are any criteria for example that would cause the charge back to be illegitimate and if so that charge back is blocked you'll never even know what happened and so the number of charge backs that merchants see is going to decrease this is a good thing for merchants one of the things that may be a challenge for merchants is the time frames that you have to respond are getting shorter the time frame when a chargeback comes through your processor depending on their own process has to perceive their process their notification and issue it to the merchant, so it's not possible to say exactly how much time with your particular processor you will have under the new rules, but you got to move more quickly and in 2019 visa is going to shorten the window again they want a faster more streamlined dispute response process, so that's something to be aware of now when you're going to fight that charge back in the past I talked about represent meant a minute ago where you would take your paperwork you'd send it to your processor, and then they'd send it off to the card issuer and defend the charge back on your behalf a lot of merchants didn't really understand what was happening...

People Also Ask about australia suncorp bank visa dispute

What qualifies for debit card dispute?

What are the Visa rules for debit card disputes?

How long do visa debit disputes take?

Can I dispute a Visa debit card transaction?

How do I dispute a debit card claim?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find suncorp visa dispute form?

How do I make changes in suncorp debit form?

Can I create an electronic signature for signing my suncorp dispute form in Gmail?

What is AU Suncorp Bank 23270?

Who is required to file AU Suncorp Bank 23270?

How to fill out AU Suncorp Bank 23270?

What is the purpose of AU Suncorp Bank 23270?

What information must be reported on AU Suncorp Bank 23270?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.