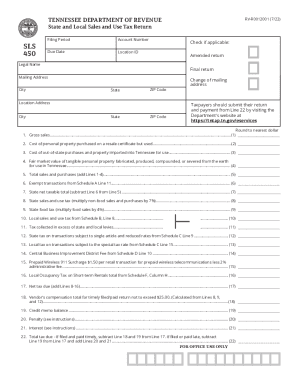

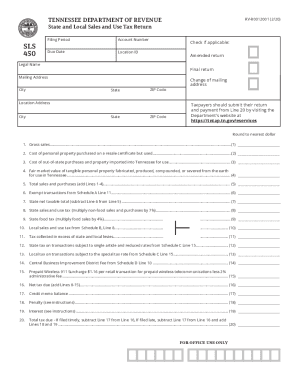

TN DoR SLS 450 2019 free printable template

Get, Create, Make and Sign sales form tennessee

Editing sales form tennessee online

Uncompromising security for your PDF editing and eSignature needs

TN DoR SLS 450 Form Versions

How to fill out sales form tennessee

How to fill out TN DoR SLS 450

Who needs TN DoR SLS 450?

Instructions and Help about sales form tennessee

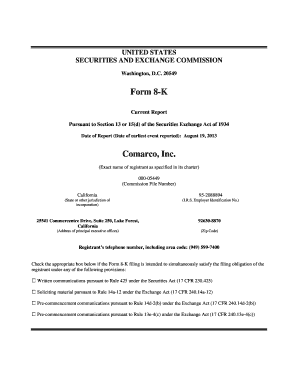

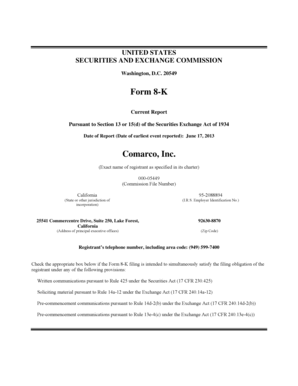

Filing a sales and use return welcome to Tennessee taxpayer access point the data you will see in this course is completely fictitious any resemblance to a real person or business is entirely coincidental to use the playback controls at the bottom of the screen to pause the course to repeat a part or to move forward more quickly in this example we have already logged in and accessed the sales and use account to file or Amanda return you can begin three ways you can select make payments and file returns you can select the filing period, or you can select the file return hyperlink to the right of the corresponding period first you must answer whether you have a file to upload as your sales tax return this example we select now the location step displays each location for which you must provide filing details this bread label is displayed until details for each location are entered additionally each location that still requires details as an exclamation point icon here all three locations require details select the locations ID hyperlink to record details for that location within the sales detail screen you are guided through entering filing information for this location to begin recording filing details for this location select whether you have sales to report you the sales detail window expands to allow you to enter the tax if nor mission for this location all questions must be answered before moving forward based on the answers to the various yes no questions new sections will display you you you ones all information for the location is entered select okay the exclamation point icon for example corporation 1 is no longer displayed this indicates that the information for this location is satisfactory next you will select another location the information being captured now is in regard to example corporation to complete the information for this location you this location does not have any sales to report for this period if you select next while the red text or in exclamation icon is displayed you will encounter a message that indicates you must correct this step before moving on you select the final location select yes to report sales for this location you once all information for the location is entered select ok you the red text is now gone and there are no exclamation point icons select next to proceed the summary page displays the sum of all details provided for each location you also have the ability to enter a credit memo balance or anticipated penalty and interest once all information has been captured, and you are ready to file your sales and use return select submit your password will act as your signature to print a copy of the summary select the print confirmation button to immediately make a payment select a payment source below to return to the account screen select the OK button you the sales and use return for all the locations for 10 type example corporations are now submitted this concludes filing a sales and use return

People Also Ask about

What is the sales tax in the state of Tennessee?

How do I set up sales tax in TN?

What is the tax rate on groceries in Tennessee?

How do I get a sales tax certificate in Tennessee?

What is Tennessee's highest sales tax?

Does Tennessee have state tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sales form tennessee?

How do I edit sales form tennessee in Chrome?

How do I complete sales form tennessee on an Android device?

What is TN DoR SLS 450?

Who is required to file TN DoR SLS 450?

How to fill out TN DoR SLS 450?

What is the purpose of TN DoR SLS 450?

What information must be reported on TN DoR SLS 450?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.