IRS SS-4 2019 free printable template

Show details

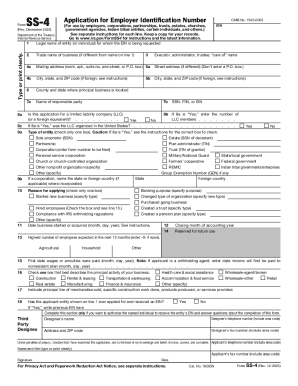

Cat. No. 16055N SS-4 Rev. 12-2017 Page 2 Form SS-4 Rev. 12-2017 Do I Need an EIN File Form SS-4 if the applicant entity does not already have an EIN but is required to show an EIN on any return statement or other document. See Disregarded entities on page 4 of the instructions for details on completing Form SS-4 for an LLC. 1 See also the separate instructions for each line on Form SS-4. IF the applicant. AND. Does not currently have nor expect to have employees THEN.. SS-4 Application for...Employer Identification Number OMB No. 1545-0003 For use by employers corporations partnerships trusts estates churches government agencies Indian tribal entities certain individuals and others. Go to www.irs.gov/FormSS4 for instructions and the latest information. Department of the Treasury See separate instructions for each line. Keep a copy for your records. Internal Revenue Service Legal name of entity or individual for whom the EIN is being requested Type or print clearly. Complete lines 1...2 4a 8a 8b c if applicable 9a 9b if applicable and 10 14 and 16 18. Hired or will hire employees including household employees Does not already have an EIN Opened a bank account Needs an EIN for banking purposes only Either the legal character of the organization or its ownership changed for example you incorporate a The trust is other than a grantor trust or an IRA trust4 Is a foreign person needing an EIN to comply with IRS withholding regulations Needs an EIN to complete a Form W-8 other than...Form W-8ECI avoid withholding on portfolio assets or claim tax treaty benefits6 8a 8b c if applicable 9a 9b if applicable 10 and 18. Sole proprietor SSN Partnership Corporation enter form number to be filed No. SSN ITIN or EIN. Other specify If a corporation name the state or foreign country if applicable where incorporated Reason for applying check only one box Started new business specify type Estate SSN of decedent Plan administrator TIN Trust TIN of grantor Personal service corporation...Church or church-controlled organization Other nonprofit organization specify 9b Military/National Guard Farmers cooperative REMIC State State/local government Federal government Indian tribal governments/enterprises Group Exemption Number GEN if any Foreign country Banking purpose specify purpose Changed type of organization specify new type Purchased going business Hired employees Check the box and see line 13. Created a trust specify type Compliance with IRS withholding regulations Created a...pension plan specify type Closing month of accounting year Date business started or acquired month day year. Go to www*irs*gov/FormSS4 for instructions and the latest information* Department of the Treasury See separate instructions for each line. Keep a copy for your records. Internal Revenue Service Legal name of entity or individual for whom the EIN is being requested Type or print clearly. Form Rev* December 2017 8a EIN Trade name of business if different from name on line 1 4a Mailing...address room apt.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

Instructions and Help about IRS SS-4

How to edit IRS SS-4

To edit the IRS SS-4 form, you can use tools that allow PDF editing and form filling. With pdfFiller, you can easily update the necessary information directly within the form fields. After editing, ensure that all information is accurate and complete before submitting. Utilizing pdfFiller also allows you to save the edited form for future reference or to resend if necessary.

How to fill out IRS SS-4

To fill out the IRS SS-4 form, follow these steps:

01

Download the IRS SS-4 form from the IRS website or access it through pdfFiller.

02

Provide the legal name of the business entity applying for an EIN.

03

Include the trade name, if applicable.

04

Detail the principal address and the responsible party's name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

05

Select the type of entity applying for the EIN and provide information regarding the nature of business.

Completing the form accurately is crucial, as mistakes may lead to processing delays or issues with your EIN.

About IRS SS-4 2019 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS SS-4 2019 previous version

What is IRS SS-4?

IRS SS-4 is the application form used to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned to business entities for tax purposes. This form is essential for various business activities, including hiring employees and opening a business bank account.

What is the purpose of this form?

The purpose of the IRS SS-4 form is to apply for an Employer Identification Number (EIN). An EIN is used for identifying a business entity in the tax system and is necessary for reporting payroll taxes, filing business tax returns, and other official business transactions. Obtaining an EIN helps streamline business operations and ensures compliance with federal tax laws.

Who needs the form?

Any business entity that falls under the category of a partnership, corporation, LLC, or sole proprietorship may require an EIN. Additionally, non-profit organizations, trusts, estates, and other entities that undergo tax reporting may also need to complete the IRS SS-4. Individuals or businesses planning to hire employees or operate a business under a fictitious name must also apply for an EIN using this form.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS SS-4 form if you are operating as a sole proprietor without any employees or if your business is not required to have an EIN for tax purposes. Certain estate and trust conditions, where the entity is managed directly and does not have an EIN requirement or is not subject to self-employment tax, may also qualify for exemption.

Components of the form

The IRS SS-4 form consists of sections requiring specific information about the business entity, such as the legal name, address, responsible party details, and the reason for applying for an EIN. The form also includes a section where you indicate the type of entity and brief details about your business activities. Providing accurate and complete information is essential for the successful processing of the application.

Due date

There is no specific due date for submitting the IRS SS-4 form; however, it is advisable to apply for an EIN before starting any business operations that require it. This ensures that you have the necessary identification number ready for tax filings, employee payroll registrations, and other business dealings. Early submission helps avoid potential delays in your business setup.

What are the penalties for not issuing the form?

Failure to submit the IRS SS-4 form when required may lead to penalties, including fines and difficulty in conducting business legally. Not having an EIN can hinder various business operations, such as hiring employees, opening bank accounts, and filing necessary tax documentation. It is crucial to apply for an EIN to maintain compliance with federal tax laws and avoid complications.

What information do you need when you file the form?

When filing the IRS SS-4 form, you will need to provide fundamental information, such as the legal name of the business, trade name (if applicable), principal address, and details about the responsible party. Additionally, information regarding the type of business entity, reason for applying, and the number of employees expected in the next year, if any, is necessary to complete the form accurately.

Is the form accompanied by other forms?

The IRS SS-4 form typically doesn't need additional forms to be submitted alongside it when applying for an EIN. However, you may need to provide additional documentation to the IRS depending on your business structure, such as Articles of Incorporation or a partnership agreement if applicable. Always check the IRS guidelines to ensure compliance with any specific requirements related to your type of business.

Where do I send the form?

The IRS SS-4 form may be submitted online via the IRS website, by phone, or by mailing a paper form to the appropriate address provided in the IRS instructions. If you are submitting by mail, it is essential to check the latest IRS mailing addresses as they may vary based on the location and whether a payment is included. Ensuring the use of the correct submission method will help avoid processing delays.

See what our users say