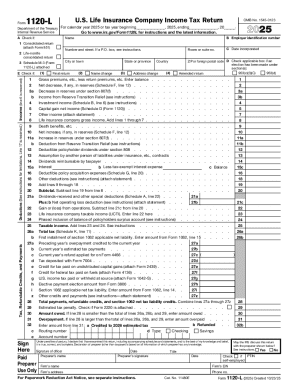

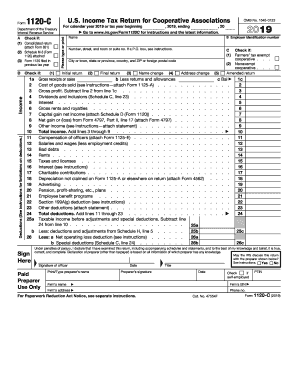

IRS 1120-L 2019 free printable template

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

About IRS 1120-L 2019 previous version

What is IRS 1120-L?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120-L

What should I do if I notice an error on my form 1120 schedule l after submitting?

If you realize there’s an error on your submitted form 1120 schedule l, you need to file an amended return using the same form. Be sure to indicate the changes clearly and submit it following the IRS guidelines for corrections. This ensures that your records are accurate and up-to-date.

How can I verify the status of my submitted form 1120 schedule l?

To check the status of your form 1120 schedule l, you can use the IRS's online tracking system or contact their help desk. It's important to have your details ready, such as your EIN and submission confirmation, to get accurate updates on the processing of your form.

What if my e-filed form 1120 schedule l gets rejected?

In the event your e-filed form 1120 schedule l is rejected, you should receive a notification detailing the reason for rejection. Correct the identified errors promptly and resubmit the corrected form through the same e-filing portal to ensure compliance.

How long should I retain records related to my form 1120 schedule l?

You should maintain records associated with your form 1120 schedule l for at least three years from the date of filing. This includes any documentation that supports the information reported on the form, as it may be required in the event of an audit.

What should I do if I receive a notice from the IRS after filing my form 1120 schedule l?

Receiving a notice from the IRS regarding your form 1120 schedule l requires prompt attention. Read the notice carefully to understand what is being requested, and prepare any necessary documentation or response to clarify or rectify the issue raised.