Get the free CHAPTER 7 - Bankruptcy Court, District of Arizona

Show details

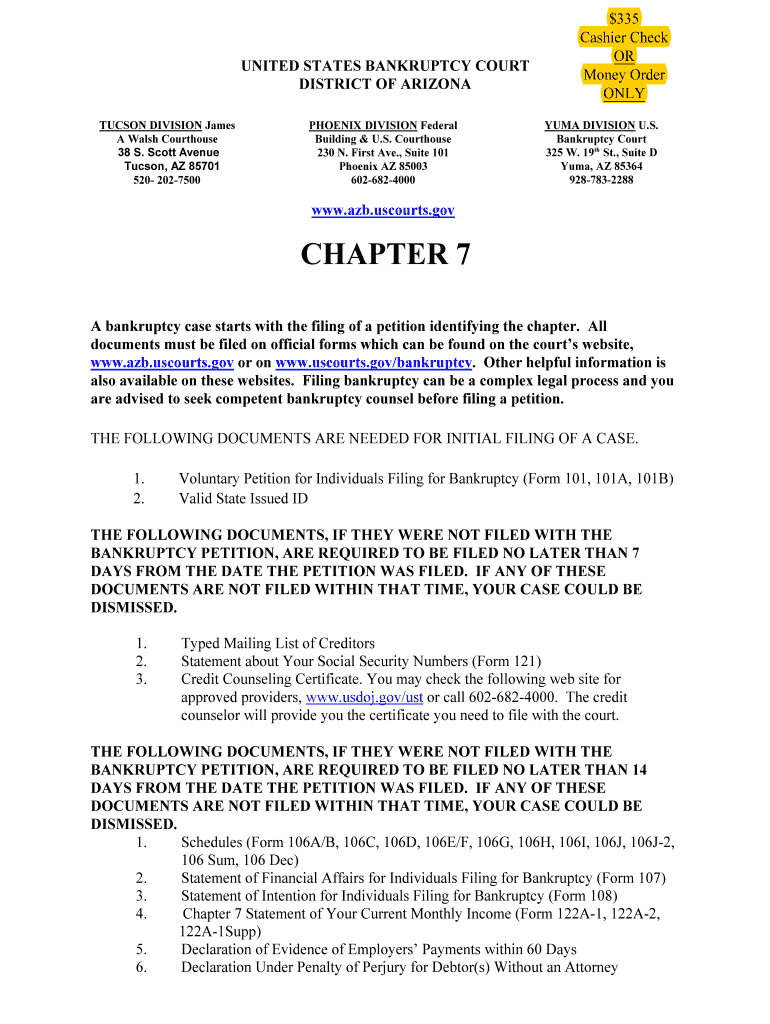

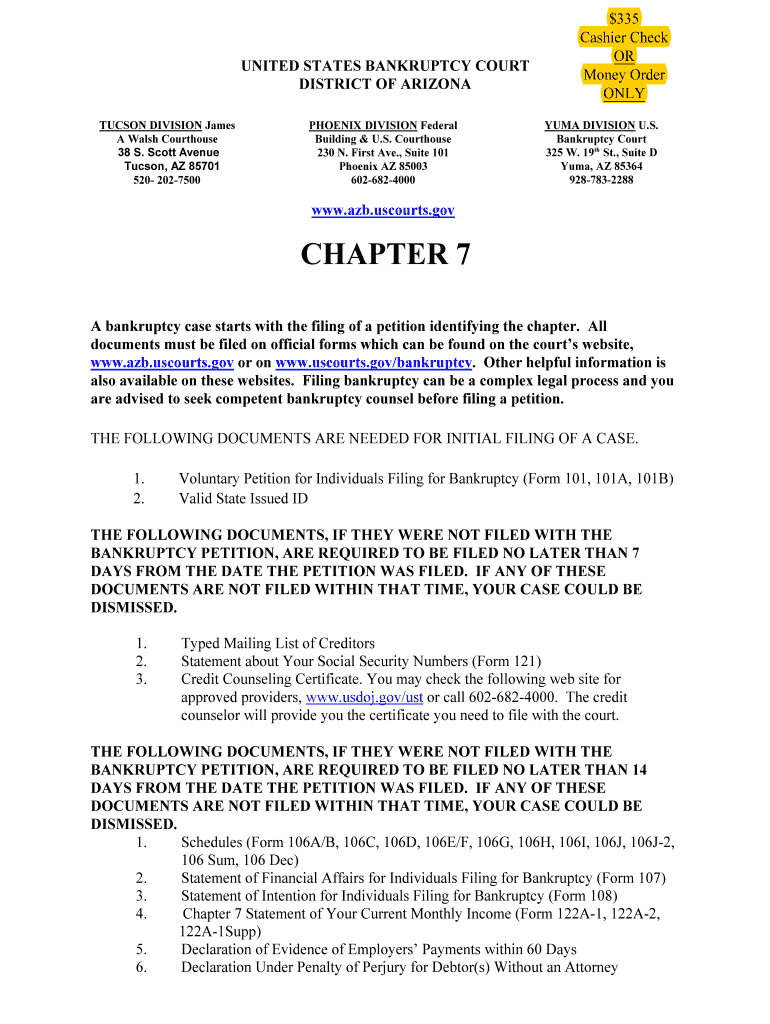

UNITED STATES BANKRUPTCY COURT DISTRICT OF ARIZONA TUCSON DIVISION James A Walsh Courthouse 38 S. Scott Avenue Tucson, AZ 85701 520 2027500PHOENIX DIVISION Federal Building & U.S. Courthouse 230 N.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 7 - bankruptcy

Edit your chapter 7 - bankruptcy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 7 - bankruptcy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 7 - bankruptcy online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapter 7 - bankruptcy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 7 - bankruptcy

How to fill out chapter 7 - bankruptcy

01

To fill out Chapter 7 bankruptcy, follow these steps:

02

Gather all necessary financial documents, such as bank statements, tax returns, and pay stubs.

03

Complete the required bankruptcy forms, including the petition, schedules of assets and liabilities, and a statement of financial affairs.

04

Provide accurate and detailed information about your income, expenses, debts, assets, and any recent financial transactions.

05

Calculate your exemptions and determine which property you can keep through bankruptcy.

06

Attend a credit counseling course before filing for Chapter 7 bankruptcy.

07

File the bankruptcy petition and all supporting documents with the appropriate bankruptcy court.

08

Pay the required filing fee or, if eligible, request a fee waiver.

09

Attend the meeting of creditors, where a trustee will review your bankruptcy forms and ask any questions.

10

Complete a debtor education course after filing for Chapter 7 bankruptcy.

11

Wait for the court's decision on discharging your debts.

12

Follow any post-bankruptcy requirements, such as attending financial management courses or fulfilling any obligations under a reaffirmation agreement.

13

It is highly recommended to consult with a bankruptcy attorney throughout the process to ensure it is done correctly and maximize the benefits of Chapter 7 bankruptcy.

Who needs chapter 7 - bankruptcy?

01

Chapter 7 bankruptcy is primarily designed for individuals or businesses facing overwhelming debt and are unable to repay their creditors.

02

Typically, those who are eligible for Chapter 7 bankruptcy:

03

- Have significant unsecured debts, such as credit card bills, medical bills, or personal loans, that they are unable to pay.

04

- Have little to no disposable income or assets that can be used to repay the debts.

05

- Are willing to have their non-exempt assets liquidated by a trustee, who will then distribute the proceeds to the creditors.

06

- Are seeking a fresh start and want to obtain a discharge of their eligible debts, relieving them of the legal obligation to repay.

07

However, it is important to note that not everyone qualifies for Chapter 7 bankruptcy. Eligibility is determined based on various factors, including income, household size, expenses, and the type of debts owed. Consulting with a bankruptcy attorney can help determine if Chapter 7 bankruptcy is the right option for an individual or business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my chapter 7 - bankruptcy in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your chapter 7 - bankruptcy and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete chapter 7 - bankruptcy on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your chapter 7 - bankruptcy from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete chapter 7 - bankruptcy on an Android device?

Use the pdfFiller Android app to finish your chapter 7 - bankruptcy and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is chapter 7 - bankruptcy?

Chapter 7 bankruptcy is a form of bankruptcy that allows individuals or businesses to discharge or eliminate certain types of debts by liquidating assets.

Who is required to file chapter 7 - bankruptcy?

Individuals or businesses struggling with overwhelming debt and unable to repay their creditors may choose to file for Chapter 7 bankruptcy.

How to fill out chapter 7 - bankruptcy?

To file for Chapter 7 bankruptcy, individuals or businesses must complete a petition and other required forms, provide detailed information about their financial situation, and attend a meeting of creditors.

What is the purpose of chapter 7 - bankruptcy?

The purpose of Chapter 7 bankruptcy is to give debtors a fresh start by discharging certain types of debts and allowing them to move forward without the burden of overwhelming debt.

What information must be reported on chapter 7 - bankruptcy?

Individuals filing for Chapter 7 bankruptcy must report detailed information about their assets, liabilities, income, expenses, and recent financial transactions.

Fill out your chapter 7 - bankruptcy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 7 - Bankruptcy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.