Get the free California's Taxation of Timber and Timberland - GGU Law ...

Show details

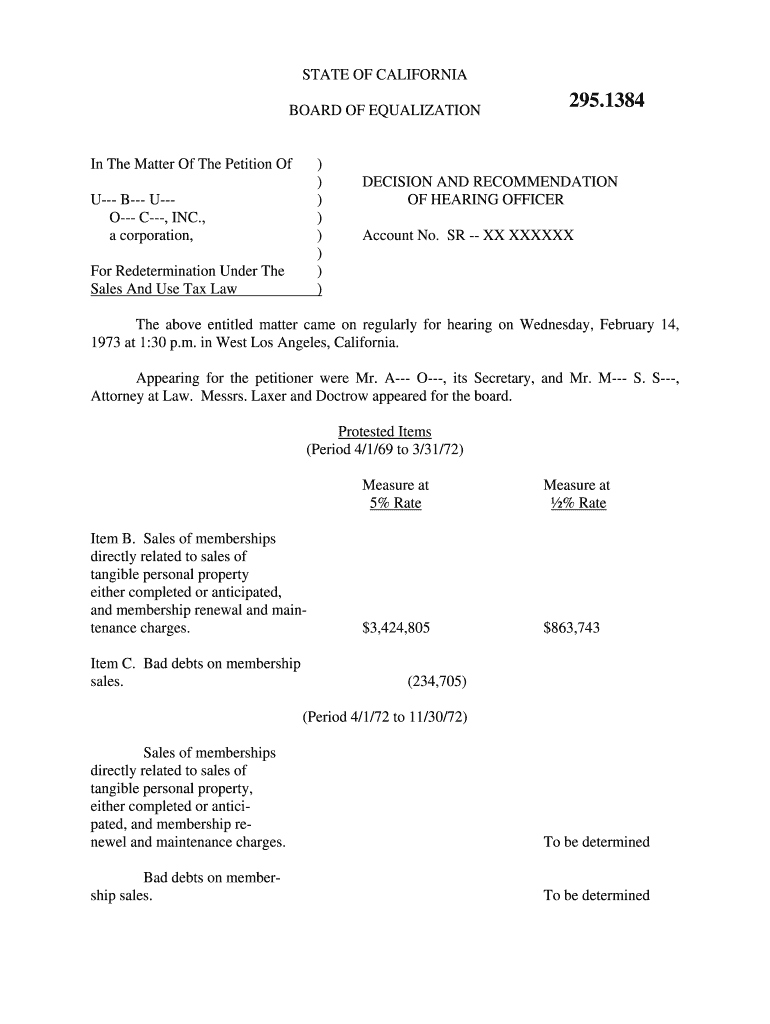

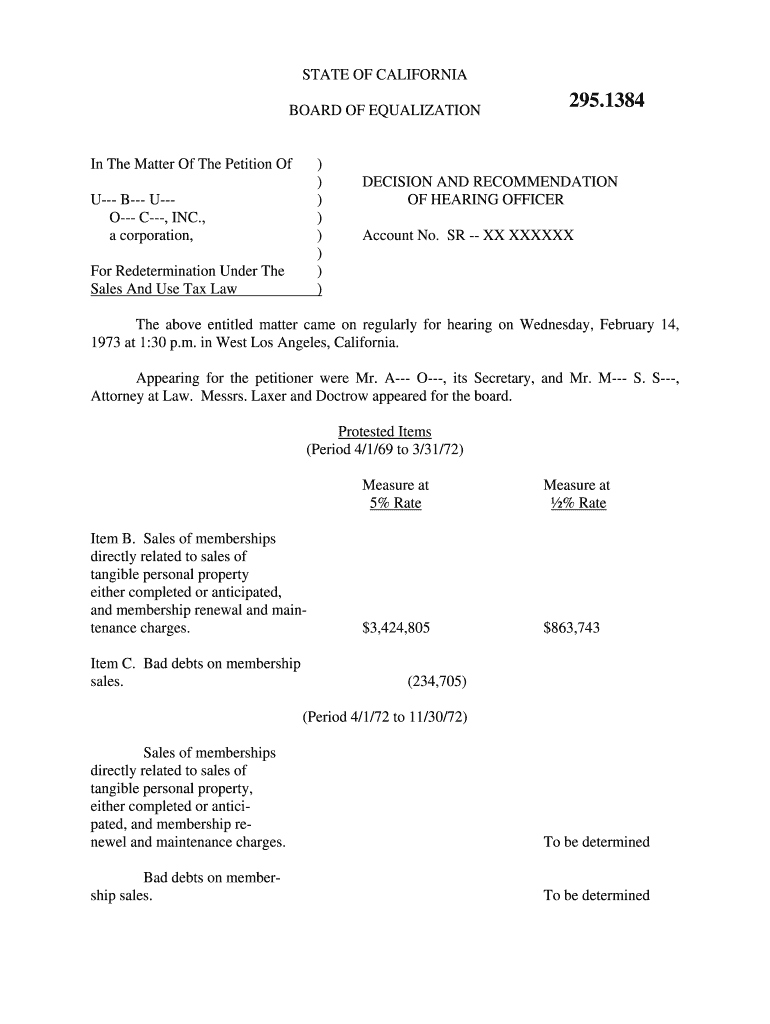

STATE OF CALIFORNIA BOARD OF EQUALIZATION In The Matter Of The Petition Of))))))))U B UO C, INC., a corporation, For Redetermination Under The Sales And Use Tax Law295.1384DECISION AND RECOMMENDATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign californias taxation of timber

Edit your californias taxation of timber form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your californias taxation of timber form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing californias taxation of timber online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit californias taxation of timber. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out californias taxation of timber

How to fill out californias taxation of timber

01

To fill out California's taxation of timber, follow these steps:

02

Gather all necessary information and forms: Obtain copies of the California Timber Tax Return form (FTB Form 577), the Schedule A - Timber Account forms (FTB Form 578), and any other supporting documents required.

03

Understand the information requirements: Read the instructions provided with the tax forms to understand what information needs to be reported. Pay attention to details such as the tax year, reporting period, and any specific instructions for calculations or deductions.

04

Calculate your timber yield: Determine the total volume of timber harvested from each parcel of land during the reporting period. This may involve measuring or estimating the volume of timber using accepted methods.

05

Determine the applicable timber tax rate: Refer to the current California Timber Tax Rate Schedule to determine the tax rate applicable to your timber harvest.

06

Complete the Timber Account forms: Fill out the Schedule A - Timber Account forms (FTB Form 578). Provide detailed information about each parcel of land where timber was harvested, including the size, location, and volume of timber harvested.

07

Calculate the timber tax liability: Use the information provided in the Timber Account forms and the applicable tax rate to calculate the total timber tax liability for each parcel of land.

08

Complete the Timber Tax Return form: Transfer the calculated tax liability from the Timber Account forms to the California Timber Tax Return form (FTB Form 577). Fill out the rest of the form, providing any additional requested information.

09

Submit the forms and payment: Make copies of all completed forms for your records and submit the originals to the California Franchise Tax Board along with the required payment. Ensure that the forms are submitted by the specified deadline.

10

Keep records: Maintain copies of all forms, supporting documents, and payment receipts for your records. These may be needed for future reference or in case of an audit.

11

Seek professional assistance if needed: If you are unsure about any aspect of the tax filing process or have complex circumstances, consider seeking assistance from a tax professional or consulting the California Franchise Tax Board for guidance.

Who needs californias taxation of timber?

01

Californias taxation of timber is applicable to individuals, partnerships, corporations, trusts, estates, and other entities that own or operate timberland in California and engage in the harvest or sale of timber.

02

Specifically, anyone who owns or operates timberland in California and engages in activities such as timber harvesting, timber sales, or timber processing may need to comply with Californias taxation of timber.

03

It is important to consult the California Franchise Tax Board or a tax professional to determine if you meet the criteria for needing to comply with this tax regulation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify californias taxation of timber without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your californias taxation of timber into a dynamic fillable form that you can manage and eSign from anywhere.

Can I edit californias taxation of timber on an iOS device?

Create, modify, and share californias taxation of timber using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out californias taxation of timber on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your californias taxation of timber. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is californias taxation of timber?

California's taxation of timber is based on the value of timber harvested on private lands within the state.

Who is required to file californias taxation of timber?

Any person or entity that harvests timber on private lands in California is required to file California's taxation of timber report.

How to fill out californias taxation of timber?

To fill out California's taxation of timber report, you need to provide information such as the amount and value of timber harvested, location of the harvest, and other related details.

What is the purpose of californias taxation of timber?

The purpose of California's taxation of timber is to levy a tax on the value of timber harvested on private lands to generate revenue for the state.

What information must be reported on californias taxation of timber?

Information such as the amount and value of timber harvested, location of the harvest, and any exemptions or deductions claimed must be reported on California's taxation of timber report.

Fill out your californias taxation of timber online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Californias Taxation Of Timber is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.