Get the free combined life insurance company of new york instructions for ...

Show details

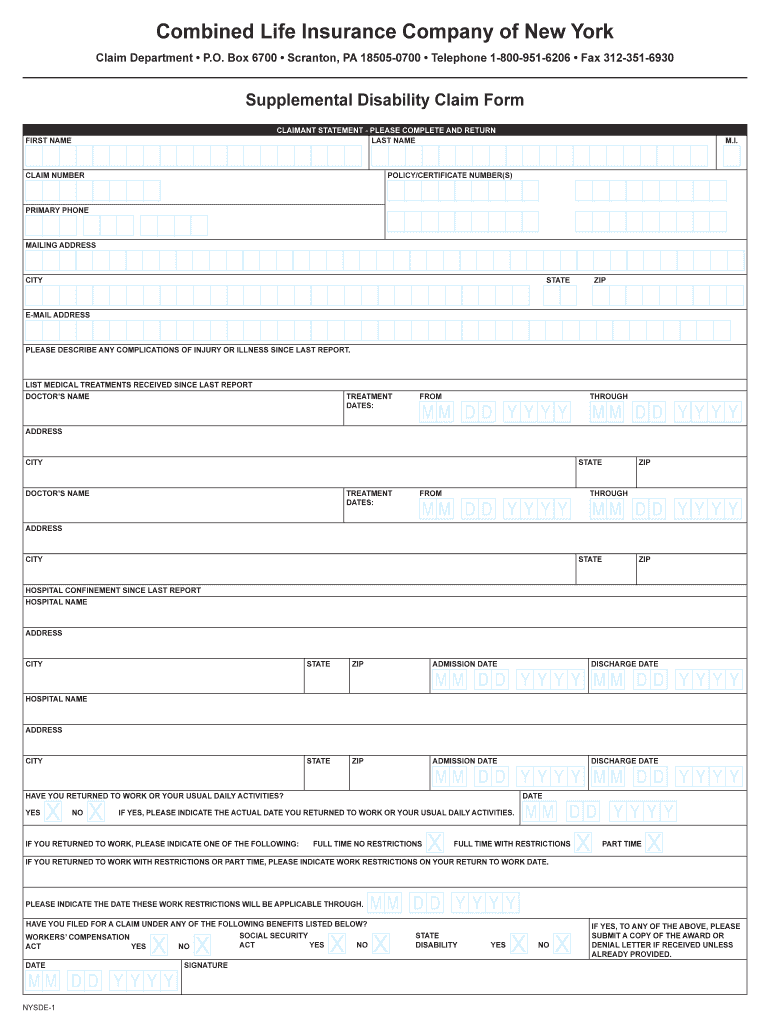

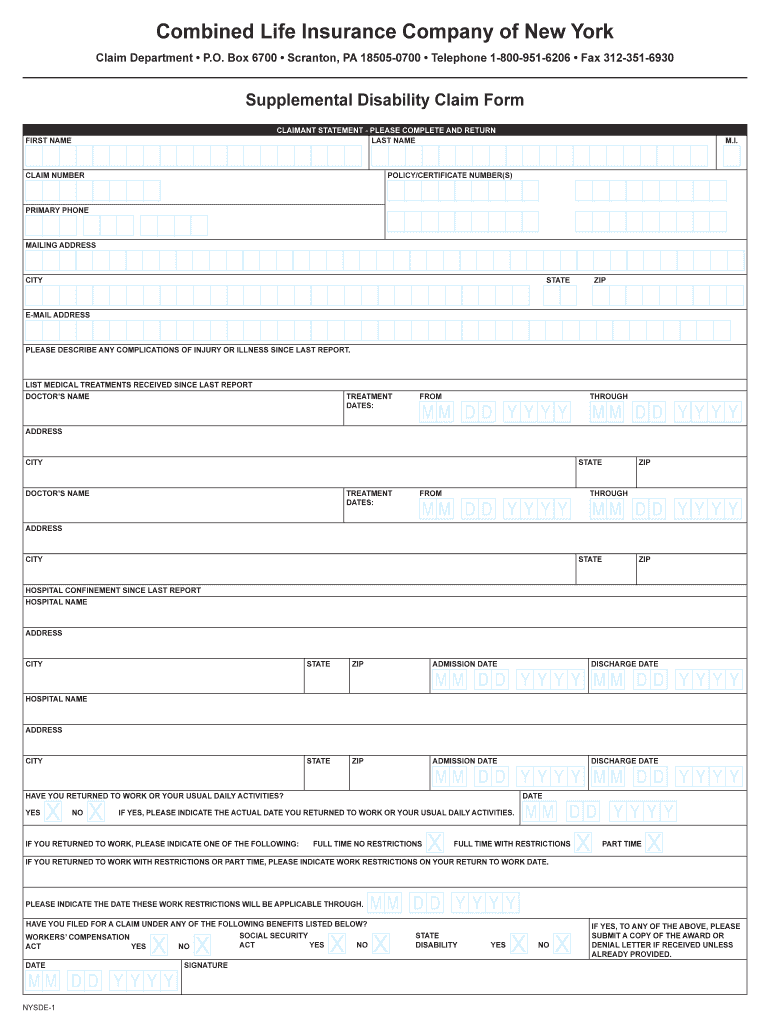

Combined Life Insurance Company of New York Claim Department P.O. Box 6700 Scranton, PA 185050700 Telephone 18009516206 Fax 3123516930Supplemental Disability Claim Form CLAIMANT STATEMENT PLEASE COMPLETE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign combined life insurance company

Edit your combined life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your combined life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit combined life insurance company online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit combined life insurance company. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out combined life insurance company

How to fill out combined life insurance company

01

To fill out a combined life insurance company form, follow these steps:

02

Gather relevant information: You will need personal details of the insured person, such as name, age, gender, and contact information.

03

Determine coverage needs: Decide the amount of coverage you require and the duration of the policy.

04

Research and compare insurance companies: Look for reputable insurance providers that offer combined life insurance policies.

05

Request quotes: Contact the chosen insurance companies and request quotes based on your coverage needs.

06

Review the quotes: Carefully analyze the quotes, considering factors such as premiums, coverage terms, and any additional benefits or riders.

07

Complete the application form: Once you have selected an insurance company, fill out their combined life insurance application form. Provide accurate and truthful information.

08

Submit supporting documents: Attach any required documents, such as identification proof, medical records, or income verification, as stated by the insurance company.

09

Pay premiums: Pay the specified premiums by the due date to activate your combined life insurance policy.

10

Review and sign the policy: Carefully review the terms and conditions of the policy. If satisfied, sign the policy document.

11

Keep a copy: Make sure to keep a copy of the filled-out application form and the signed policy document for your records.

Who needs combined life insurance company?

01

Combined life insurance can benefit various individuals, including:

02

- Breadwinners: Individuals who provide financial support to their families and want to ensure their loved ones are financially secure in the event of their death.

03

- Parents: Parents who want to secure their child's future and cover expenses such as education, marriage, or any debts they may inherit.

04

- Business owners: Business owners who want to protect their business from financial loss in case of the death of a key employee or co-owner.

05

- Homeowners: Homeowners with mortgage loans who want to ensure their loved ones can continue to make mortgage payments and maintain a stable living situation.

06

- Individuals with dependents: Individuals with dependents, such as aging parents or disabled family members, who want to provide financial stability and support even after their death.

07

- Anyone looking for financial protection: Anyone concerned about leaving a financial burden on their loved ones may opt for combined life insurance to provide financial security in difficult times.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify combined life insurance company without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your combined life insurance company into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in combined life insurance company?

With pdfFiller, it's easy to make changes. Open your combined life insurance company in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the combined life insurance company in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your combined life insurance company in seconds.

What is combined life insurance company?

A combined life insurance company is a company that offers both life insurance and health insurance policies.

Who is required to file combined life insurance company?

Any insurance company that offers both life and health insurance policies is required to file combined life insurance company.

How to fill out combined life insurance company?

To fill out combined life insurance company, the insurance company must provide details of both their life and health insurance policies, including premium amounts and coverage information.

What is the purpose of combined life insurance company?

The purpose of combined life insurance company is to streamline the filing process for insurance companies that offer both life and health insurance policies.

What information must be reported on combined life insurance company?

The combined life insurance company must report details of both their life and health insurance policies, including policy numbers, coverage amounts, premium amounts, and any claims made.

Fill out your combined life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Combined Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.