FL DR-309638 2014-2025 free printable template

Show details

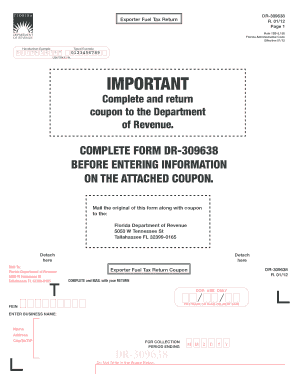

DR309638

R. 01/14-Page 1

Exporter Fuel Tax Returner Calendar Year:Rule 12B5.150

Florida Administrative Code

Effective 01/14

Handwritten Example0 123 456 7 8 9Typed Example0123456789Use black ink.IMPORTANTComplete

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-309638

Edit your FL DR-309638 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-309638 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DR-309638 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DR-309638. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-309638 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-309638

How to fill out FL DR-309638

01

Begin by downloading the FL DR-309638 form from the official website.

02

Fill in your personal details at the top of the form, including your name, address, and contact information.

03

Specify the type of request or purpose for using the form in the designated section.

04

Provide any required supporting documentation as indicated on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the form as instructed, either online or via mail, to the appropriate authority.

Who needs FL DR-309638?

01

Individuals or businesses seeking to fulfill a specific administrative requirement in Florida.

02

People applying for certain licenses or permits that require this form.

03

Anyone needing to update or correct information recorded in public records.

Fill

form

: Try Risk Free

People Also Ask about

What is the fuel tax rate in Florida 2023?

Florida Tax Changes Effective January 1, 2023. Florida's excise tax on gas and diesel fuel will increase by 1.2 cents per gallon as part of an automatic inflation adjustment written into state law, bringing the tax from 19 to 20.2 cpg for both gasoline and diesel.

What is the new gas tax in Florida?

The state's gas tax will up in 2023 from 19 cents per gallon to 20.2 cents per gallon, the Florida Department of Revenue reports. A spokesperson from the Department of Revenue says state law requires annual adjustments to the fuel tax based on national Consumer Price Index.

How much is the gas tax in us?

Federal taxes include excises taxes of 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel, and a Leaking Underground Storage Tank fee of 0.1 cents per gallon on both fuels.

What is the gas tax in the US?

The federal gas tax has been set at 18.4 cents per gallon of gasoline since 1993. In real terms, the gas tax has lost almost half its value since its last adjustment in 1993 because it is not indexed for inflation.

Which USA has the highest gas tax?

As of 2023, Alaska has the lowest gas tax in the nation, with a rate of $0.09 per gallon. The state benefits from its abundant oil reserves and relies heavily on revenue generated from oil production rather than gas taxes. On the other end of the spectrum, Pennsylvania has the highest gas tax rate at $0.61 per gallon.

How much federal tax is in a gallon of gasoline?

The federal government levies taxes on gasoline (18.4 cents a gallon) and diesel (24.4 cents a gallon). These tax rates have been unchanged since 1993.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find FL DR-309638?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the FL DR-309638 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the FL DR-309638 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit FL DR-309638 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing FL DR-309638, you need to install and log in to the app.

What is FL DR-309638?

FL DR-309638 is a form used in Florida for reporting information regarding the sales and use tax collected from buyers.

Who is required to file FL DR-309638?

Businesses and sellers in Florida that collect sales and use tax from their customers are required to file FL DR-309638.

How to fill out FL DR-309638?

To fill out FL DR-309638, one must provide details about the total sales, the amount of sales tax collected, and any exemptions or deductions applicable, following the instructions provided with the form.

What is the purpose of FL DR-309638?

The purpose of FL DR-309638 is to report sales and use taxes collected by businesses to ensure compliance with Florida state tax laws.

What information must be reported on FL DR-309638?

Information that must be reported on FL DR-309638 includes total sales, taxable sales, sales tax collected, any exemptions claimed, and the business's identification details.

Fill out your FL DR-309638 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-309638 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.