Get the free Records Retention and Disposition Schedule CO-2, for use by ...

Show details

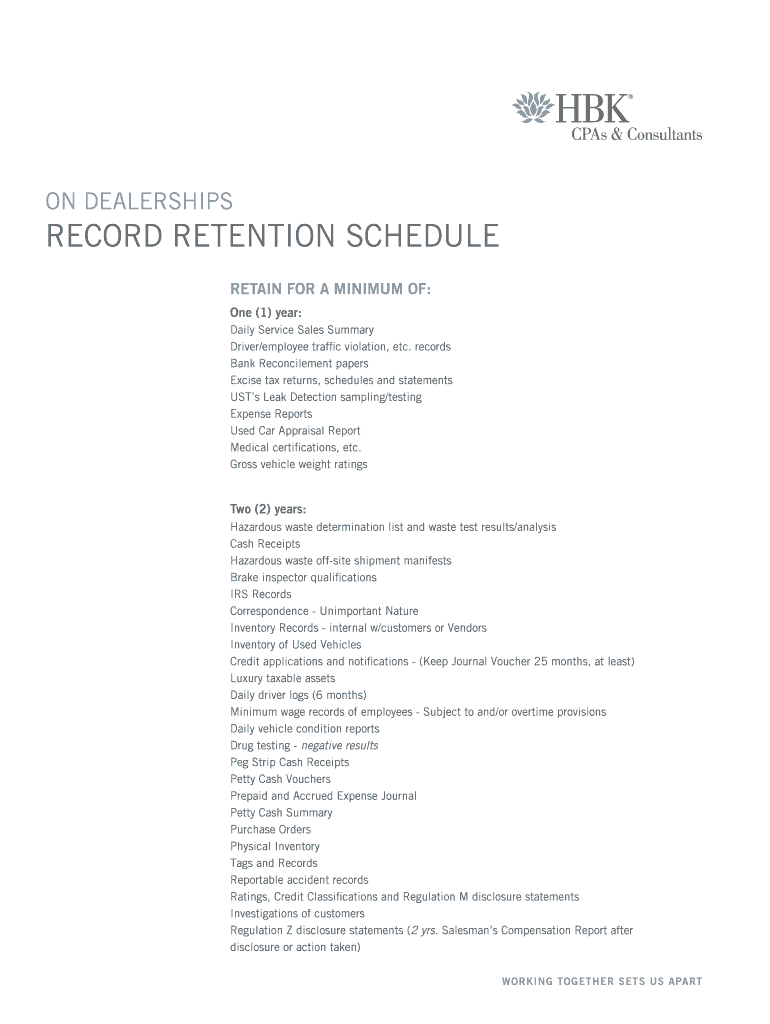

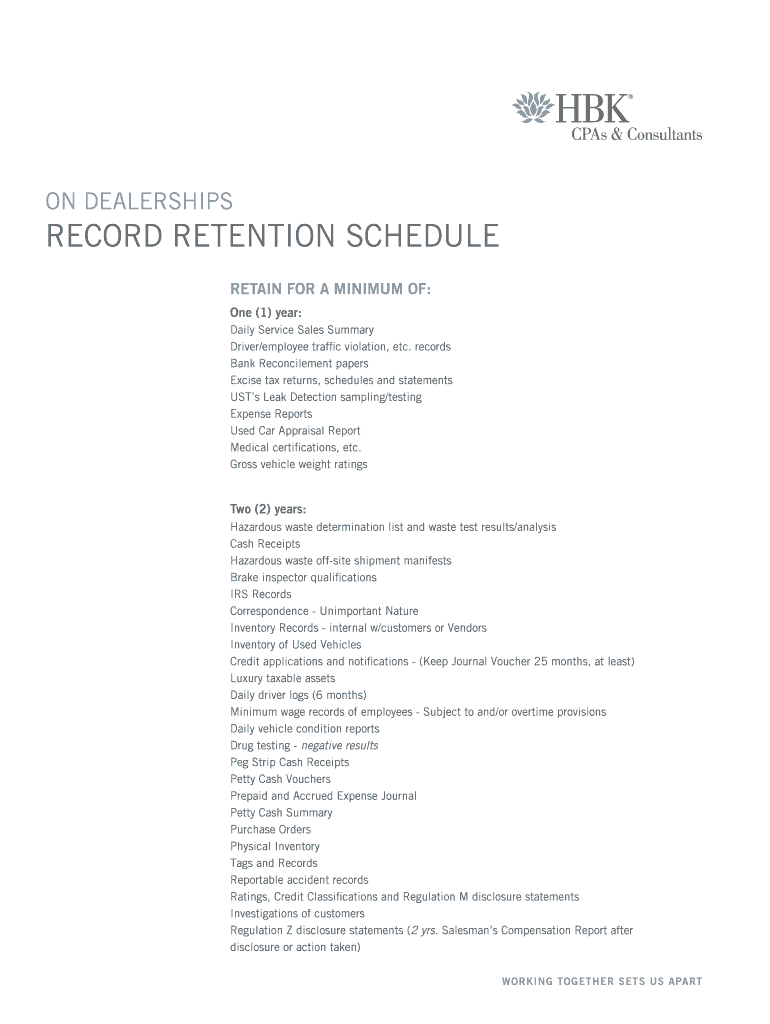

ON DEALERSHIPSRECORD RETENTION SCHEDULE

RETAIN FOR A MINIMUM OF:

One (1) year:

Daily Service Sales Summary

Driver/employee traffic violation, etc. records

Bank Reconsignment papers

Excise tax returns,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign records retention and disposition

Edit your records retention and disposition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your records retention and disposition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing records retention and disposition online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit records retention and disposition. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out records retention and disposition

How to fill out records retention and disposition

01

To fill out records retention and disposition, follow these steps:

02

Start by reviewing your organization's records retention and disposition policy. This policy will provide guidelines on how long certain types of records should be retained and when they can be disposed of.

03

Gather all the relevant records that need to be processed. This may include physical documents, electronic files, and any other forms of record keeping.

04

Identify and categorize the records based on their type and their retention period. This will help you determine how long each record should be kept before it can be disposed of.

05

Create a comprehensive inventory of all the records along with their retention periods. This will serve as a reference for future record management and disposal activities.

06

Implement appropriate record storage systems to ensure that the records are secure and easily retrievable during their retention period.

07

Monitor the retention period for each record and ensure that they are disposed of according to the policy guidelines. This may involve shredding physical documents or securely deleting electronic files.

08

Maintain proper documentation of the disposal process, including the date and method of disposal, in case of future audits or legal requirements.

09

Regularly review and update the records retention and disposition policy to reflect any changes in regulations or organizational needs.

Who needs records retention and disposition?

01

Records retention and disposition is important for any organization that generates and maintains records. This includes businesses, government agencies, educational institutions, healthcare providers, and non-profit organizations.

02

Having a records retention and disposition policy helps these entities manage their records effectively, ensure compliance with legal and regulatory requirements, and minimize the risk of unauthorized access or data breaches.

03

By implementing a structured approach to managing records, organizations can streamline their operations, save storage space, and facilitate efficient retrieval of information when needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete records retention and disposition online?

pdfFiller has made it simple to fill out and eSign records retention and disposition. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit records retention and disposition online?

With pdfFiller, the editing process is straightforward. Open your records retention and disposition in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the records retention and disposition in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your records retention and disposition and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is records retention and disposition?

Records retention and disposition is the process of determining how long to retain records and how to dispose of them once they are no longer needed.

Who is required to file records retention and disposition?

All organizations and businesses are required to file records retention and disposition.

How to fill out records retention and disposition?

Records retention and disposition forms can be filled out electronically or manually, following the guidelines provided by the governing authority.

What is the purpose of records retention and disposition?

The purpose of records retention and disposition is to ensure that important records are kept for a specified period of time and then disposed of properly.

What information must be reported on records retention and disposition?

The information required on records retention and disposition forms typically includes details about the records being retained, the retention period, and the method of disposition.

Fill out your records retention and disposition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Records Retention And Disposition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.