Get the free Installment Payment - (only applies if line 6 is $375 or less - see instruction 43)

Show details

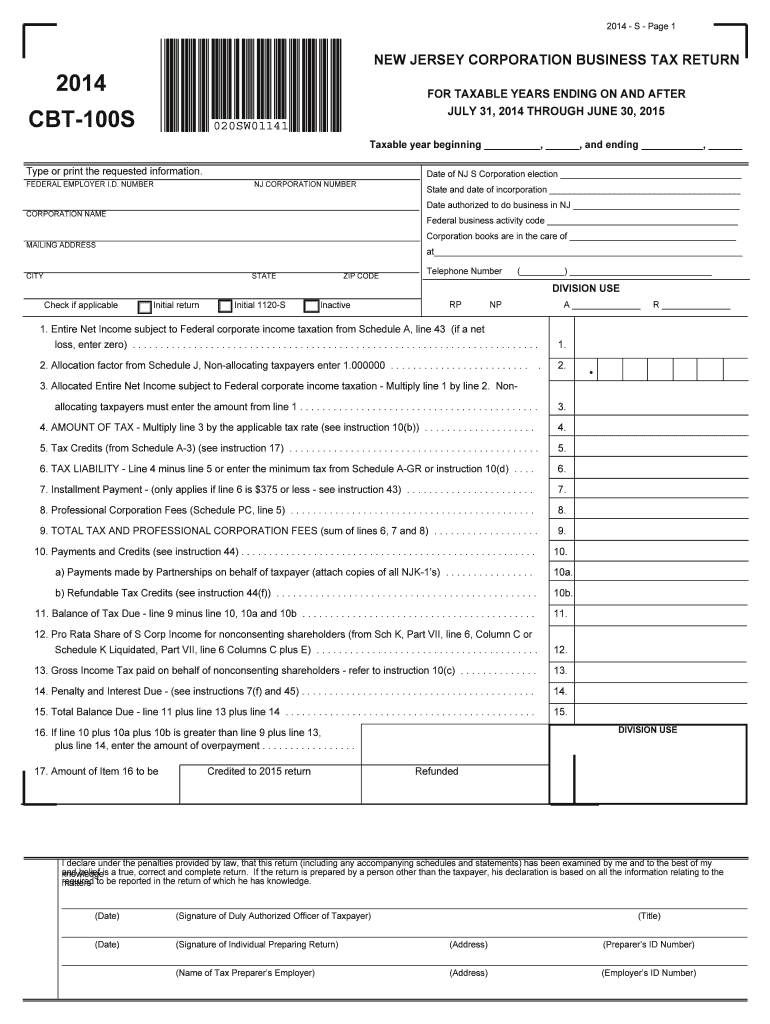

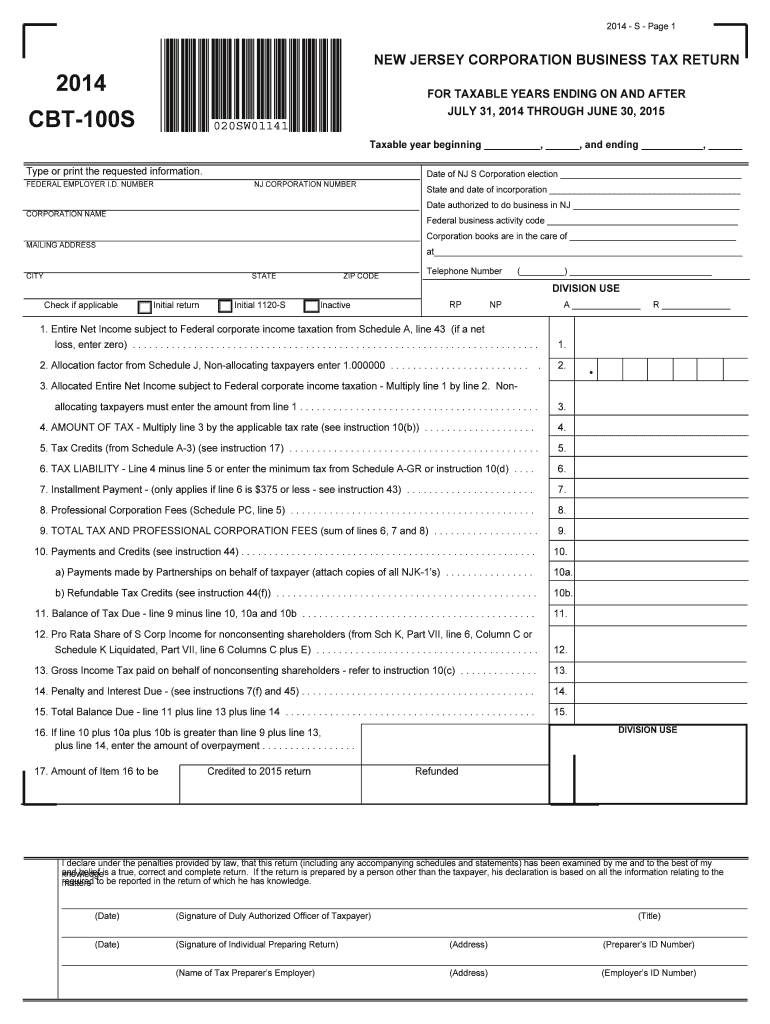

2014 S Page 1NEW JERSEY CORPORATION BUSINESS TAX RETURN2014FOR TAXABLE YEARS ENDING ON AND AFTER JULY 31, 2014, THROUGH JUNE 30, 2015CBT100S020SW01141 Taxable year beginning, and ending, Type or print

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign installment payment - only

Edit your installment payment - only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment payment - only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit installment payment - only online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit installment payment - only. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out installment payment - only

How to fill out installment payment - only

01

To fill out an installment payment, follow these steps:

02

Gather all the necessary information required for the installment payment, such as the amount to be paid, the payment period, and any related invoices or documents.

03

Contact the company or organization offering the installment payment option. This can be done through their website, customer service hotline, or in person.

04

Provide the necessary details and information asked by the company, such as your personal information, financial information, and any supporting documents.

05

Review the terms and conditions of the installment payment carefully. Make sure you understand the interest rates, fees, and any penalties for late or missed payments.

06

If you agree with the terms and conditions, sign the installment payment agreement or contract.

07

Follow the payment schedule provided by the company. Make payments on time and in the specified amounts.

08

Keep track of your payments and ensure that you receive proper receipts or confirmation of each payment made.

09

Once the installment payment has been completed, ensure that all obligations and responsibilities have been fulfilled according to the agreement.

Who needs installment payment - only?

01

Installment payment is beneficial for anyone who may not have the immediate funds to make a full payment upfront. It is commonly used by individuals or businesses who want to purchase expensive items or services but prefer to spread out the payments over an extended period of time.

02

Specific groups of people who may need installment payment options include:

03

- Consumers who want to buy high-ticket items like electronics, furniture, or appliances.

04

- Students or individuals seeking education or training courses.

05

- Small businesses looking to finance equipment or machinery.

06

- Medical patients who require expensive treatments or procedures.

07

- Individuals with limited cash flow or irregular income.

08

- Anyone looking to build credit history or improve credit scores through responsible payment behavior.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send installment payment - only for eSignature?

When you're ready to share your installment payment - only, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit installment payment - only straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing installment payment - only.

How do I edit installment payment - only on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign installment payment - only right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is installment payment - only?

Installment payment-only is a form of payment plan where an individual or business can pay off a debt or purchase in multiple fixed amounts over time.

Who is required to file installment payment - only?

Individuals or businesses who have agreed to an installment payment-only plan with a creditor or seller.

How to fill out installment payment - only?

To fill out an installment payment-only plan, one must agree to the terms of the plan and make payments according to the agreed schedule.

What is the purpose of installment payment - only?

The purpose of installment payment-only is to allow individuals or businesses to manage their cash flow by spreading out payments over a period of time.

What information must be reported on installment payment - only?

The information required on an installment payment-only plan typically includes the total amount owed, the payment schedule, and any fees or interest charges.

Fill out your installment payment - only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Installment Payment - Only is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.