Get the free ANNUAL AUDITED REPORT PART llI 12/31/2018 Prime ... - SEC.gov

Show details

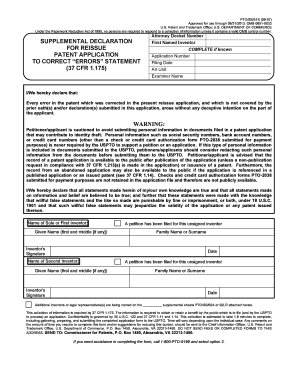

APPROVAL OMB Number: 32350123SEC19005765Expires: August 30, 2020, Estimated average burdenANNUAL AUDITED REPORT FORM X17A5 PART CLI FACINGInformationRequiredSecurities REPORT FOR THE PERIOD of BrokersExchangehoursperresponse......12.00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited report part

Edit your annual audited report part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited report part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual audited report part online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual audited report part. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited report part

How to fill out annual audited report part

01

To fill out the annual audited report part, follow these steps:

02

Gather all relevant financial documents, such as income statements, balance sheets, and cash flow statements.

03

Review the specific requirements and guidelines set by the relevant regulatory authority or standard organization. Ensure you understand what information should be included and how it should be presented.

04

Start by filling out the general information section, which typically includes details about the company, such as name, address, and fiscal year.

05

Proceed to the financial statement section, where you will provide detailed information about the company's financial performance, including revenues, expenses, assets, and liabilities.

06

Make sure to include any necessary supporting documentation, such as bank statements or legal contracts, to validate the financial figures reported.

07

Ensure that all calculations and financial analysis included in the report are accurate and based on reliable data.

08

Review the completed report for any errors or omissions. Double-check all figures and cross-reference them with the original financial documents.

09

If required, have the report reviewed by a qualified auditor or accountant to ensure compliance with auditing standards.

10

Once the report is finalized, sign and date it to indicate its authenticity and completeness.

11

Submit the filled-out and signed annual audited report to the appropriate authority within the specified deadline.

Who needs annual audited report part?

01

Annual audited report parts are typically required by various entities, including:

02

- Publicly traded companies: These companies need to provide annual audited reports to comply with securities regulations and ensure transparency for shareholders and potential investors.

03

- Government agencies: State and federal government bodies often require annual audited reports from organizations receiving public funding or involved in specific industries.

04

- Non-profit organizations: Non-profit entities may need to submit audited reports to maintain their tax-exempt status and demonstrate accountability to donors and stakeholders.

05

- Regulatory authorities: Certain industries, such as banking or insurance, have regulatory bodies that mandate annual audited reports to assess financial stability and compliance.

06

- Lending institutions: Banks and other financing entities may request audited reports to evaluate the creditworthiness and financial health of businesses seeking loans or credit.

07

- Internal management and stakeholders: Even when not legally required, companies may choose to prepare audited reports for internal decision-making, financial evaluation, and communication with shareholders or investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annual audited report part to be eSigned by others?

When you're ready to share your annual audited report part, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit annual audited report part on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share annual audited report part on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out annual audited report part on an Android device?

Use the pdfFiller mobile app and complete your annual audited report part and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is annual audited report part?

The annual audited report part is a section of a company's financial report that has been examined and verified by an independent auditor.

Who is required to file annual audited report part?

Companies that are required to undergo an annual audit are typically required to file an annual audited report part.

How to fill out annual audited report part?

The annual audited report part is typically filled out by the company's accountant or finance team based on the audited financial statements.

What is the purpose of annual audited report part?

The purpose of the annual audited report part is to provide shareholders and stakeholders with a verified and accurate financial overview of the company.

What information must be reported on annual audited report part?

The annual audited report part typically includes financial statements, auditor's opinion, notes to financial statements, and management's discussion and analysis.

Fill out your annual audited report part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Report Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.