Get the free In-Kind Donations for Nonprofits: Reporting and Accounting ...

Show details

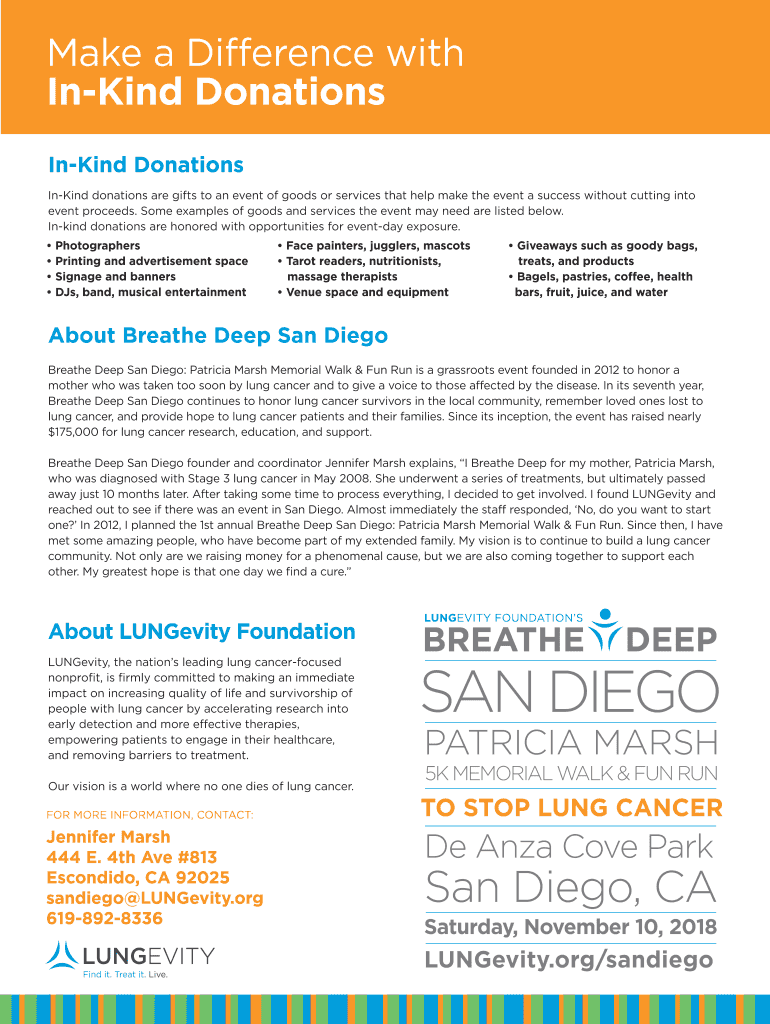

Make a Difference with Inking Donations are gifts to an event of goods or services that help make the event a success without cutting into event proceeds. Some examples of goods and services the event

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind donations for nonprofits

Edit your in-kind donations for nonprofits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind donations for nonprofits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in-kind donations for nonprofits online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit in-kind donations for nonprofits. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind donations for nonprofits

How to fill out in-kind donations for nonprofits

01

Step 1: Start by creating a detailed inventory of the items you wish to donate. Make sure to include a description, quantity, and condition of each item.

02

Step 2: Research and identify nonprofit organizations that accept in-kind donations. Look for organizations that align with your values and mission.

03

Step 3: Contact the nonprofit organizations and inquire about their specific donation guidelines. Some organizations may have restrictions on certain items or require prior approval.

04

Step 4: Pack and organize the donated items for easy transport. Use appropriate containers and labeling to ensure the safe delivery of the items.

05

Step 5: Schedule a time for drop-off or arrange for pick-up with the chosen nonprofit organization. Make sure to communicate any special instructions or requirements.

06

Step 6: Obtain a receipt or acknowledgement from the nonprofit organization for your donated items. This will serve as proof of the donation for tax purposes.

07

Step 7: Follow up with the nonprofit organization to see how your donation has been used and the impact it has made. This helps build a relationship and may lead to future opportunities for collaboration.

Who needs in-kind donations for nonprofits?

01

Nonprofit organizations of various kinds can benefit from in-kind donations. These organizations rely on the support of individuals, businesses, and communities to fulfill their missions.

02

Examples of nonprofits that commonly need in-kind donations include homeless shelters, food banks, educational institutions, animal shelters, healthcare facilities, disaster relief organizations, and social service agencies.

03

In-kind donations can provide essential resources and support to these organizations, helping them meet the needs of their beneficiaries and advance their respective causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit in-kind donations for nonprofits from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your in-kind donations for nonprofits into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in in-kind donations for nonprofits?

The editing procedure is simple with pdfFiller. Open your in-kind donations for nonprofits in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the in-kind donations for nonprofits electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your in-kind donations for nonprofits.

What is in-kind donations for nonprofits?

In-kind donations for nonprofits are non-monetary contributions of goods or services, rather than cash.

Who is required to file in-kind donations for nonprofits?

Nonprofits are required to file in-kind donations with the appropriate tax forms to report the value of the donated goods or services.

How to fill out in-kind donations for nonprofits?

To fill out in-kind donations for nonprofits, organizations should document the value of the donated items or services, and report this information on the necessary tax forms.

What is the purpose of in-kind donations for nonprofits?

The purpose of in-kind donations for nonprofits is to acknowledge and report the value of non-monetary contributions received by the organization.

What information must be reported on in-kind donations for nonprofits?

The information reported on in-kind donations for nonprofits should include a description of the donated items or services, the value of the donation, and the date it was received.

Fill out your in-kind donations for nonprofits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Donations For Nonprofits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.