TN SS-4431 2019-2025 free printable template

Show details

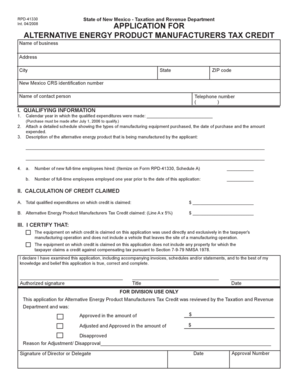

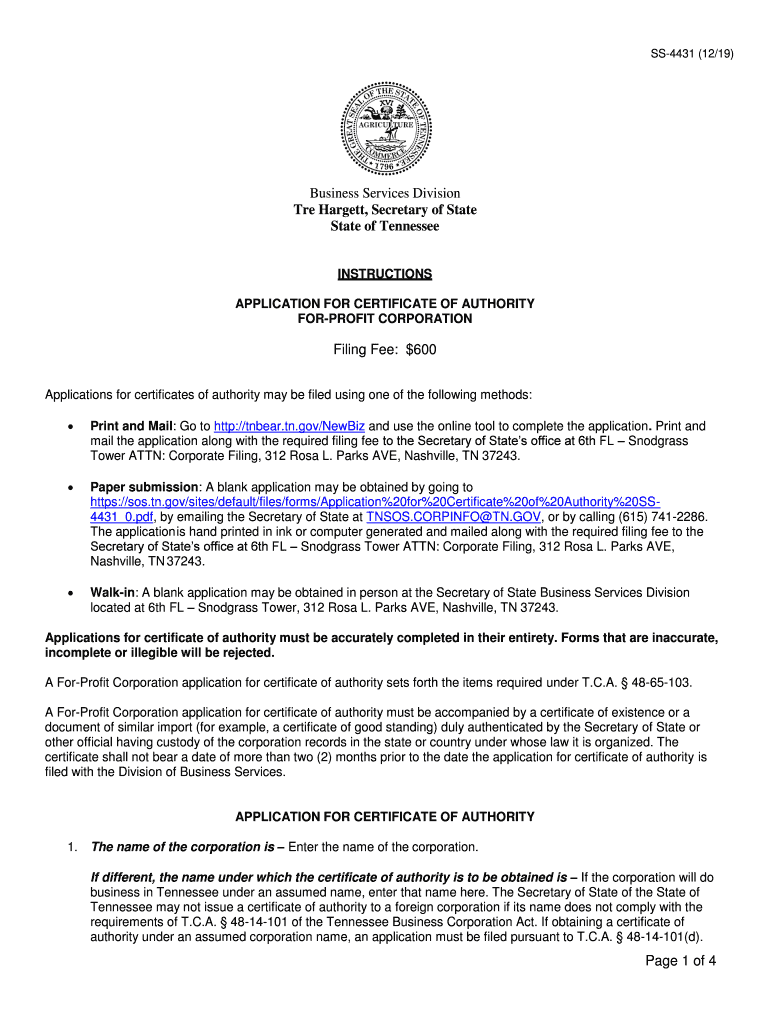

Paper submission A blank application may be obtained by going to http //www. tn.gov/sos/forms/ss-4431. SS-4431 07/14 Business Services Division Tre Hargett Secretary of State State of Tennessee INSTRUCTIONS APPLICATION FOR CERTIFICATE OF AUTHORITY FOR-PROFIT CORPORATION Filing Fee 600 Applications for certificates of authority may be filed using one of the following methods Print and Mail Go to http //tnbear. C. A. 10-7-503 all information on thi...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ss-4431 1219

Edit your ss-4431 1219 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ss-4431 1219 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ss-4431 1219 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ss-4431 1219. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN SS-4431 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ss-4431 1219

How to fill out TN SS-4431

01

Obtain the TN SS-4431 form from the appropriate state department or website.

02

Fill in the applicant's personal information, including name, address, and contact details.

03

Provide relevant identification details as required, such as Social Security number or driver's license number.

04

Indicate the purpose for filling out the form, following any specific instructions provided.

05

Attach any necessary supporting documents that are required by the form's instructions.

06

Review the completed form for accuracy and completeness.

07

Submit the form according to the specified submission guidelines, whether by mail or online.

Who needs TN SS-4431?

01

Individuals who are applying for benefits or services that require the TN SS-4431 form.

02

Residents of Tennessee who need to provide documentation for specific requests related to state services.

03

Anyone required to verify identity or eligibility for programs that utilize the TN SS-4431 in their application processes.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax clearance letter Tennessee?

The Department of Revenue issues this letter upon taxpayer request. A Certificate of Tax Clearance declares that all tax returns administered by the Department of Revenue have been filed and all liabilities have been paid. Certificates of Tax Clearance are issued to both terminating and ongoing businesses.

How do I get a certificate of tax clearance in Tennessee?

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

How much does it cost to form an LLC in Tennessee?

The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000. The franchise tax is due the 15th day of the fourth month following the close of your fiscal year. It is calculated based on the LLC's net worth or real and tangible property in Tennessee. The minimum tax is $100.

How do I get a tax clearance certificate in TN?

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

How do I dissolve a single member LLC in Tennessee?

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ss-4431 1219?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ss-4431 1219 and other forms. Find the template you need and change it using powerful tools.

How do I make changes in ss-4431 1219?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ss-4431 1219 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete ss-4431 1219 on an Android device?

On Android, use the pdfFiller mobile app to finish your ss-4431 1219. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is TN SS-4431?

TN SS-4431 is a tax form used by some taxpayers in Tennessee to report certain types of income and pay the appropriate taxes.

Who is required to file TN SS-4431?

Individuals or entities that have specific types of income subject to taxation in Tennessee, such as self-employment income, may be required to file TN SS-4431.

How to fill out TN SS-4431?

To fill out TN SS-4431, taxpayers need to provide their personal information, report income details, calculate the tax owed based on that income, and sign the form before submitting it to the appropriate tax authority.

What is the purpose of TN SS-4431?

The purpose of TN SS-4431 is to ensure that individuals and entities accurately report their taxable income and pay the corresponding state taxes in Tennessee.

What information must be reported on TN SS-4431?

Information that must be reported on TN SS-4431 includes taxpayer identification details, types of income earned, amounts of income, applicable deductions, and the calculated tax liability.

Fill out your ss-4431 1219 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ss-4431 1219 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.