IRS Publication 4681 2019 free printable template

Get, Create, Make and Sign IRS Publication 4681

How to edit IRS Publication 4681 online

Uncompromising security for your PDF editing and eSignature needs

IRS Publication 4681 Form Versions

How to fill out IRS Publication 4681

How to fill out IRS Publication 4681

Who needs IRS Publication 4681?

Instructions and Help about IRS Publication 4681

Music welcome to the flow paper tutorial styling a publication in this tutorial we will show you how to use flow paper to create a responsive digital addition of your zine by selecting a style template customizing it and saving the style template once you're done start by uploading your PDF to flow paper by clicking the import new PDF button select your PDF and click open flow paper will take you directly to the create publication page where you can choose from multiple customizable styles today we are focusing on the second style option magazine slash easy click on it to see further options with the magazine e-zine category were gonna stick with the first style today 3d accelerated click on this template to select it import options will pop up on the screen were going to leave them on the default settings and click continue now flow paper will import your PDF to take a look at your page flip styling click the arrows to the right or left of your publication I'm really happy with this page training animation, so I'm going to move on to some further customization lets look at how to add a background to your publication go to the styling tab on the right-hand side of the flow paper program the first category under styling is background image to upload a background image select browse find your desired file and click open you will now see the background image appear behind your publication scanning down from background image you will see there are quite a few styling options such as branding image and URL and background colors and gradients we are going to go over a few of these starting with Aero color and size by clicking the arrow color box you can select a color, or you can type in a hex number to get the exact color you're looking for you can see my arrow is now gray let's adjust the size of the arrow by adjusting the arrow size bar that looks good to me now lets take a look at panel color just like with arrow color by clicking the color panel box you can select a color, or you can type in a hex number to get the exact color you want you will see the panel at the top of your page change color this also affects the panels along the side of your publication by going to panel alpha and sliding the bar you will see these side panels slowly appear I want these panels to be completely opaque, so I'm going to slide the bar all the way to the right there that looks perfect now lets look at saving this customized style template by selecting the first icon at the top of flow papers left-hand panel you will see additional style templates pop up we don't want to select any of these because we are happy with the style template we chose, so we are going to go to the bottom of the list and select save current style type in a name for this customized style template then click OK you can now access this customized style template from the style menu and the next time you start a new publication and want to use this template you can find it under saved templates...

People Also Ask about

Is a cancellation of debt bad?

What does it mean when you receive a cancellation of debt?

What are the exceptions to cancellation of debt income?

How much cancelled debt must be reported to IRS?

What is Form 982?

How do I avoid paying taxes on debt settlement?

What is the form for cancellation of debt?

What is the form 982 for cancellation of debt?

What is the IRS code 4681?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Publication 4681 on an iOS device?

How can I fill out IRS Publication 4681 on an iOS device?

How do I edit IRS Publication 4681 on an Android device?

What is IRS Publication 4681?

Who is required to file IRS Publication 4681?

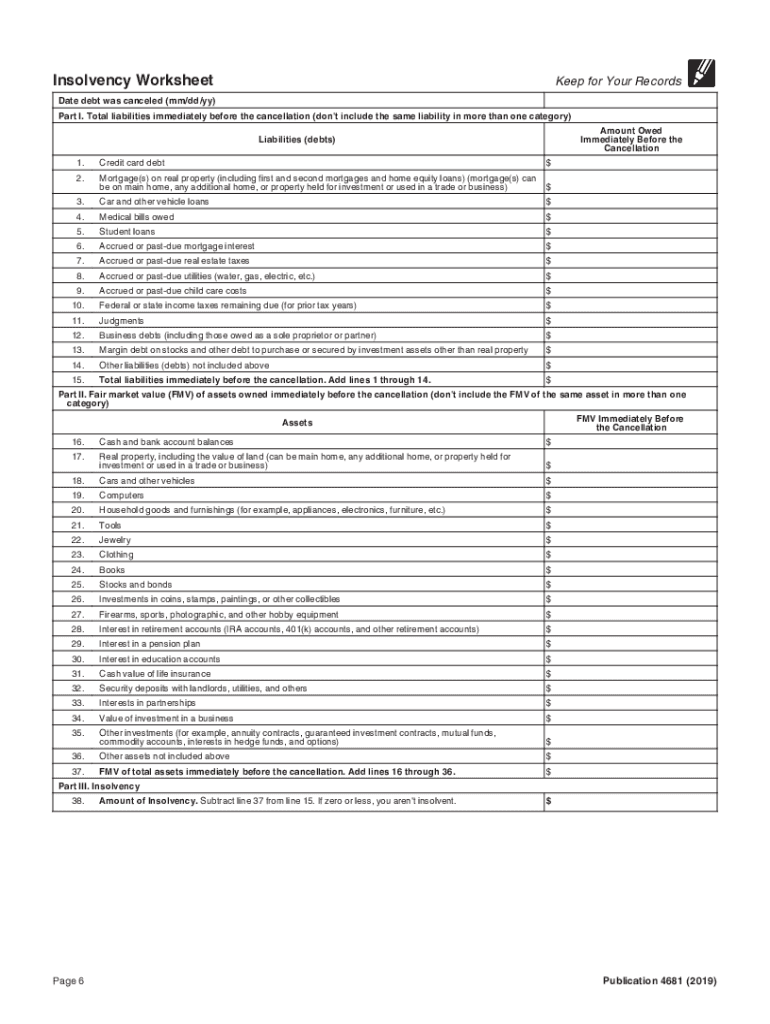

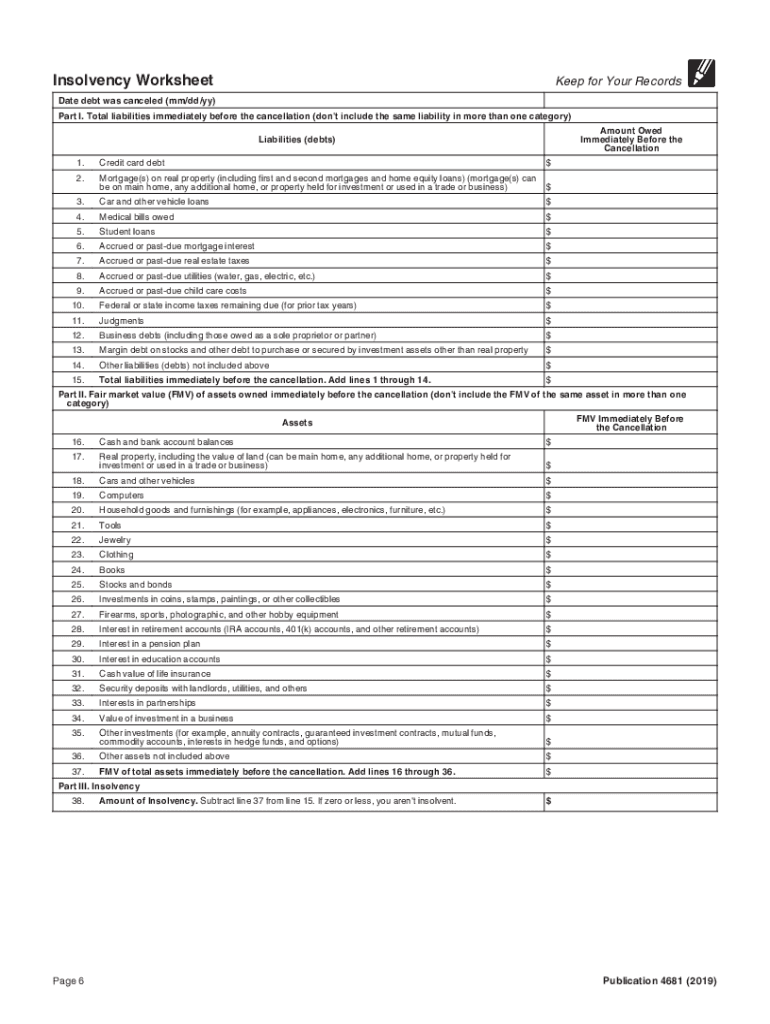

How to fill out IRS Publication 4681?

What is the purpose of IRS Publication 4681?

What information must be reported on IRS Publication 4681?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.