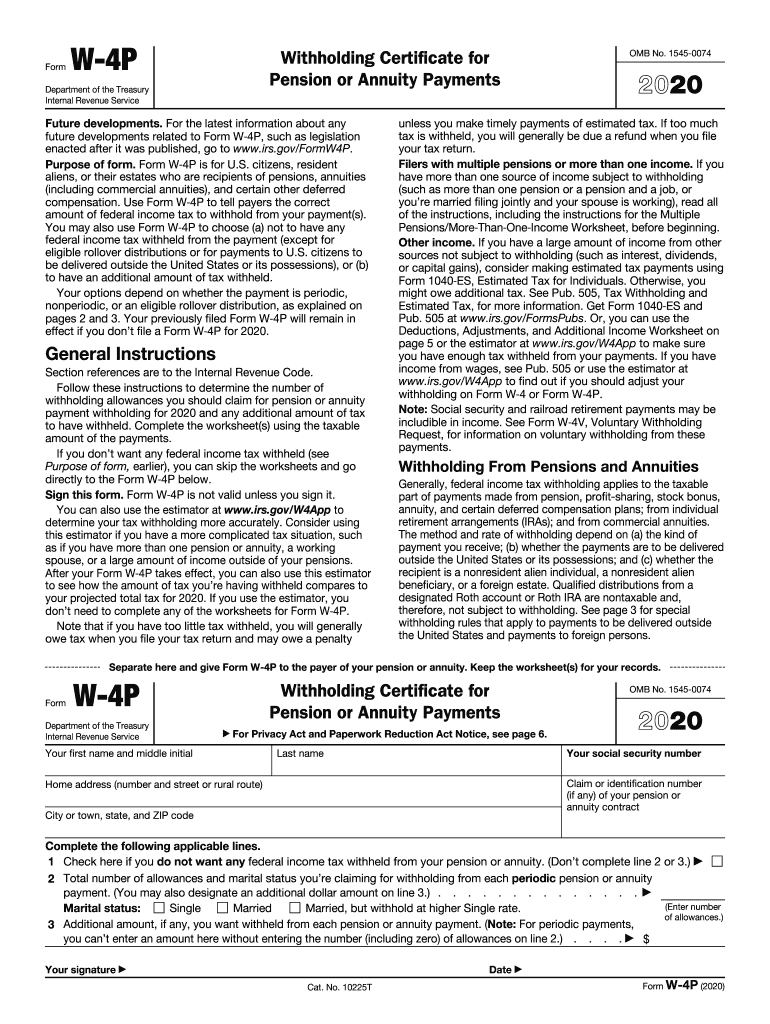

IRS W-4P 2020 free printable template

Instructions and Help about IRS W-4P

How to edit IRS W-4P

How to fill out IRS W-4P

About IRS W-4P 2020 previous version

What is IRS W-4P?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-4P

What should I do if I realize I made a mistake on my IRS W-4P after submission?

If you discover an error on your IRS W-4P after submission, you can submit a corrected form to the IRS. Ensure that you clearly indicate on the new form that it is a correction. This helps the IRS to process your changes accurately and avoid any potential confusion regarding your withholding.

How can I track the status of my IRS W-4P after filing?

To track the status of your IRS W-4P, you can contact the IRS directly or check their online services. They may provide updates regarding the processing of your form. Ensure you have your personal identification details ready for quicker assistance when reaching out.

Can I e-file my IRS W-4P, and are there any fees associated with it?

Yes, you can e-file your IRS W-4P through authorized e-filing services. Fees may vary depending on the provider, and some platforms may even offer free options. It's advisable to compare different providers to find the best deal that suits your needs.

How do privacy and data security apply when filing the IRS W-4P?

When filing your IRS W-4P, it's crucial to ensure that you are using secure methods to protect your personal information. Utilize reputable e-filing services that adhere to privacy regulations. Retaining copies of your submitted forms is also important for future reference while safeguarding your data from unauthorized access.

See what our users say