MD MW506R 2020 free printable template

Show details

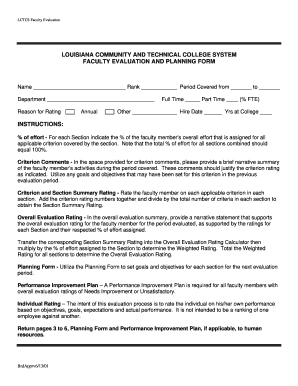

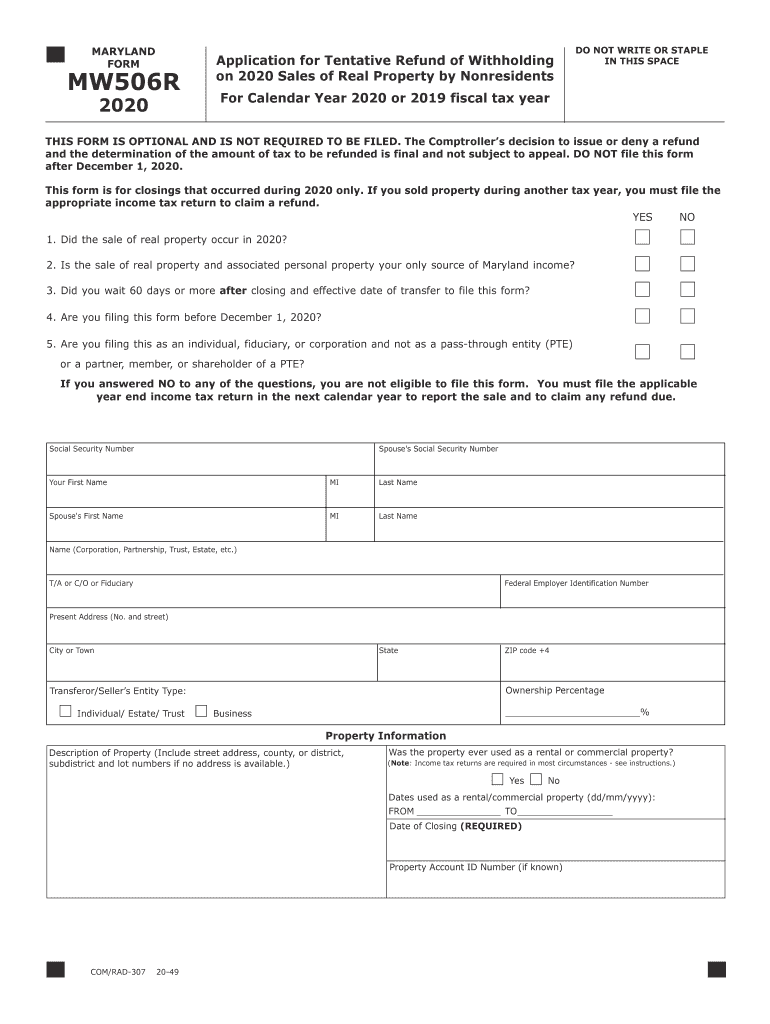

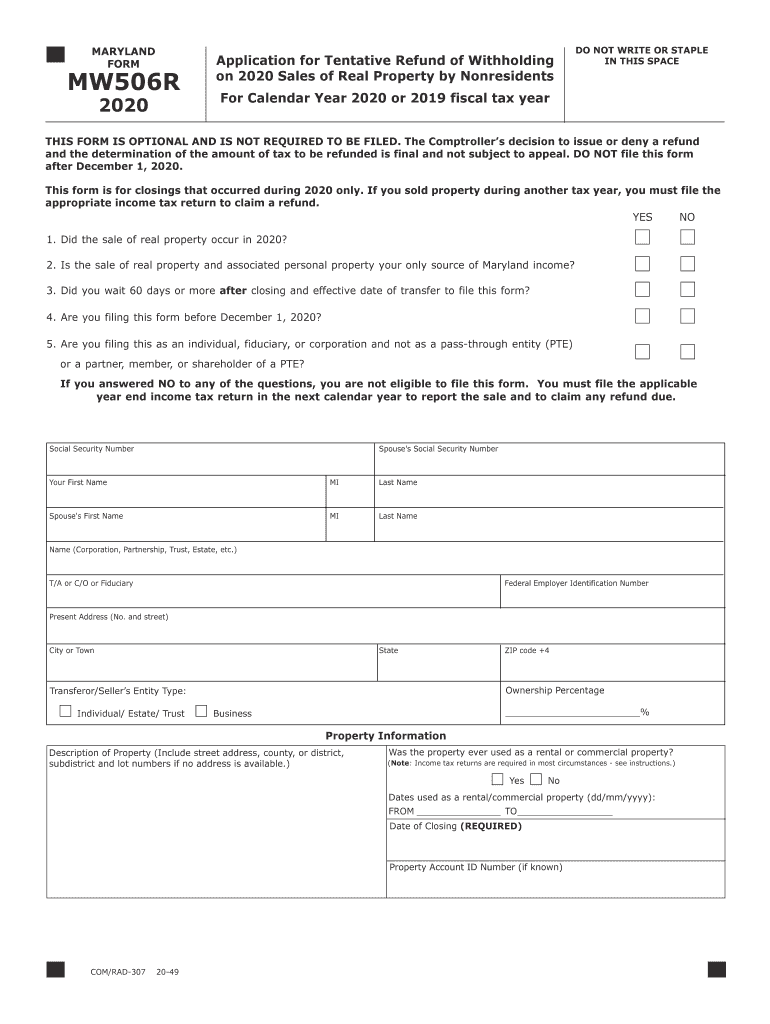

MARYLAND

FORMMW506R

2020Application for Tentative Refund of Withholding

on 2020 Sales of Real Property by Nonresidents DO NOT WRITE OR STAPLE

IN THIS Spaceport Calendar Year 2020 or 2019 fiscal tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD MW506R

Edit your MD MW506R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD MW506R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD MW506R online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD MW506R. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD MW506R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD MW506R

How to fill out MD MW506R

01

Collect all necessary financial documents and information related to your Maryland state income.

02

Obtain the MD MW506R form from the Maryland Comptroller's website or your accountant.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your total Maryland income on the form, ensuring all figures are accurate.

05

Complete the sections for any Maryland taxes withheld, including any credits or adjustments.

06

Ensure that you sign and date the form at the bottom.

07

Double-check all entries for accuracy before submitting.

08

Submit the form to the Maryland Comptroller’s Office by the specified deadline.

Who needs MD MW506R?

01

Employers in Maryland who withhold state income tax from employees.

02

Individuals who receive payments subject to Maryland withholding.

03

Businesses that pay certain types of income subject to Maryland taxation.

Fill

form

: Try Risk Free

People Also Ask about

What should I put for exemption from withholding?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

What is Maryland state withholding tax for 2022?

For 2022, we will use eleven brackets: 2.25%, 2.40%, 2.65%, 2.81%, 2.96%, 3.00%, 3.03%, 3.05%, 3.06%, 3.10%, and 3.20%. Refer to the county listing below and use the table that agrees with, or is closest to, without going below the actual local tax rate.

How do I know if I am exempt from Maryland withholding?

If you have an employee who expects to have less than $12,950 in income during 2022, you are not required to withhold Maryland state and local income tax.

What is Maryland withholding Exemption?

Maryland Form MW507 is the state's Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding.

What is NRA withholding tax?

Tax Withholding for Payments to Foreign Nationals or Nonresident Aliens (NRA)

Do non residents get tax deductions?

If you are a nonresident alien, you cannot claim the standard deduction. However, students and business apprentices from India may be eligible to claim the standard deduction under Article 21 of the U.S.A.-India Income Tax Treaty.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is the Maryland nonresident withholding tax?

How is the amount to be withheld determined? rate of 8. 0 percent of the total payment for a nonresident individual and 8.25 percent for a nonresident entity.

What is Maryland state withholding tax rate?

Maryland income tax withholding Maryland's income tax rate ranges from 2% to 5.75%, based on the employee's income and filing status with some exceptions for retirees. Employees who receive Social Security benefits, for instance, are exempt from taxation.

Is Maryland a mandatory withholding state?

You are not required by law to withhold Maryland income taxes from the wages paid to a domestic employee in a private residence. However, you may do so as a courtesy to the employee. If you wish, you can register your withholding account online and use bFile to file your withholding returns electronically for free.

What states have non resident withholding tax?

Six states have wage or income withholding thresholds for nonresident employees. California. Idaho. Minnesota. Oklahoma. South Carolina. Wisconsin.

What states have non resident withholding?

Six states have wage or income withholding thresholds for nonresident employees. California. Idaho. Minnesota. Oklahoma. South Carolina. Wisconsin.

What does non resident tax mean?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

What is the meaning of withholding tax?

Withholding tax is a set amount of income tax that an employer withholds from an employee's paycheck. Employers remit withholding taxes directly to the IRS in the employee's name. The money taken is a credit against the employee's annual income tax bill.

What is Maryland withholding exemption certificate?

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. Your current certificate remains in effect until you change it.

Does Maryland require nonresident withholding?

Yes. The residency of the owners of the property will be determined separately. Withholding is required from each of the nonresident owners based on the percentage of the total payment that represents the ownership percentage of each of the nonresident individuals or nonresident entities.

What is Maryland withholding Exemption?

Maryland Form MW507 is the state's Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages.

What is Maryland withholding tax?

Maryland income tax withholding The rates range from 2.25% to 3.2%.

Does Maryland tax non resident income?

If you are a nonresident who works in Maryland and/or derives other income from a Maryland source, you are subject to Maryland's income tax rates as well as the special nonresident tax rate of 1.75%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MD MW506R online?

With pdfFiller, you may easily complete and sign MD MW506R online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit MD MW506R on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MD MW506R on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out MD MW506R on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your MD MW506R, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is MD MW506R?

MD MW506R is a form used for reporting tax withheld by employers in the state of Maryland.

Who is required to file MD MW506R?

Employers in Maryland who are required to withhold state income tax from employee wages must file MD MW506R.

How to fill out MD MW506R?

To fill out MD MW506R, employers must provide information such as their business details, the total Maryland taxable wages, the amount of state tax withheld, and other relevant details as specified on the form.

What is the purpose of MD MW506R?

The purpose of MD MW506R is to report the amount of Maryland income tax that has been withheld from employee wages and to remit that amount to the state.

What information must be reported on MD MW506R?

MD MW506R must report the employer's identification information, total wages subject to Maryland income tax, total Maryland income tax withheld, and any other required data as per the Maryland State guidelines.

Fill out your MD MW506R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD mw506r is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.