Get the free home purchase or refinance application checklist - Catalyst ...

Show details

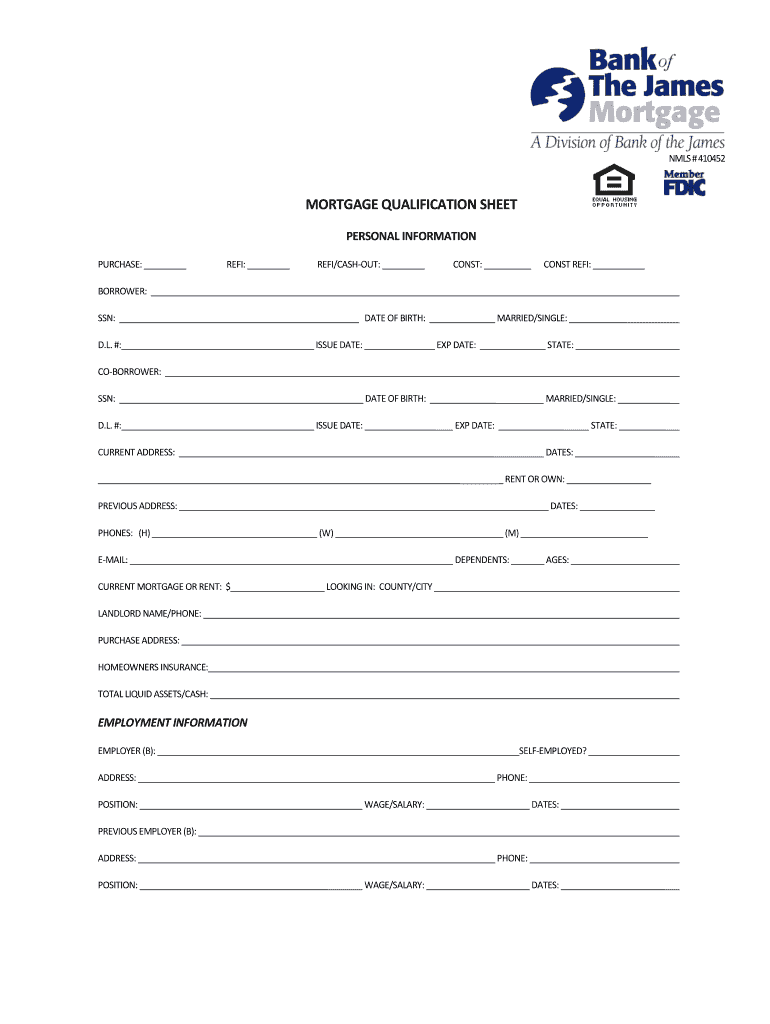

NLS # 410452MORTGAGE QUALIFICATION SHEET PERSONAL INFORMATION PURCHASE: REF: REF/WASHOUT: COAST: COAST REF: BORROWER: SSN: DATE OF BIRTH: MARRIED/SINGLE: D.L. #: ISSUE DATE: EXP DATE: STATE: BORROWER:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home purchase or refinance

Edit your home purchase or refinance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home purchase or refinance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home purchase or refinance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit home purchase or refinance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home purchase or refinance

How to fill out home purchase or refinance

01

To fill out a home purchase or refinance, follow these steps:

02

Gather all necessary documents such as income statements, bank statements, and tax returns.

03

Research and compare mortgage lenders to find the best rates and terms.

04

Apply for a mortgage loan by filling out the application form provided by the lender.

05

Provide all required documentation to the lender for verification.

06

Wait for the lender to review your application and make a decision.

07

If approved, review the loan terms and conditions.

08

Sign the necessary documents, such as the promissory note and mortgage agreement.

09

Arrange for a home appraisal and inspection, as required by the lender.

10

Coordinate with the title company or attorney to handle the closing process.

11

Attend the closing appointment and sign all the final paperwork.

12

Pay any closing costs and fees as specified by the lender.

13

Once the transaction is complete, make arrangements for homeowners insurance and start making mortgage payments.

Who needs home purchase or refinance?

01

Anyone who wants to purchase a home or refinance an existing mortgage may need home purchase or refinance.

02

Here are some common scenarios where home purchase or refinance may be necessary:

03

- First-time homebuyers who want to become homeowners.

04

- Homeowners who want to take advantage of lower interest rates by refinancing their mortgage.

05

- Individuals who want to build equity by purchasing a home instead of renting.

06

- Homeowners who need to access the equity in their home for various purposes, such as home improvements or debt consolidation.

07

- People who want to upgrade to a larger or more desirable home.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in home purchase or refinance without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit home purchase or refinance and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my home purchase or refinance in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your home purchase or refinance and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit home purchase or refinance on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share home purchase or refinance from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your home purchase or refinance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Purchase Or Refinance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.