Direct Deposit Agreement 2020-2026 free printable template

Show details

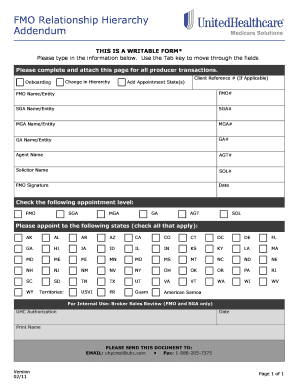

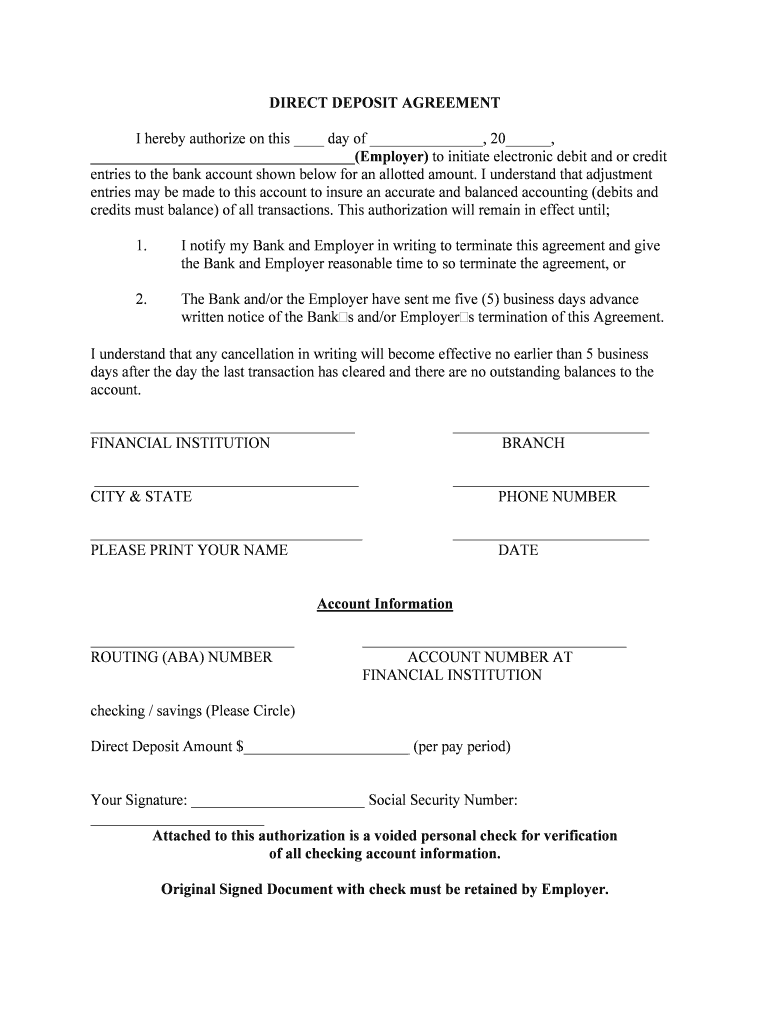

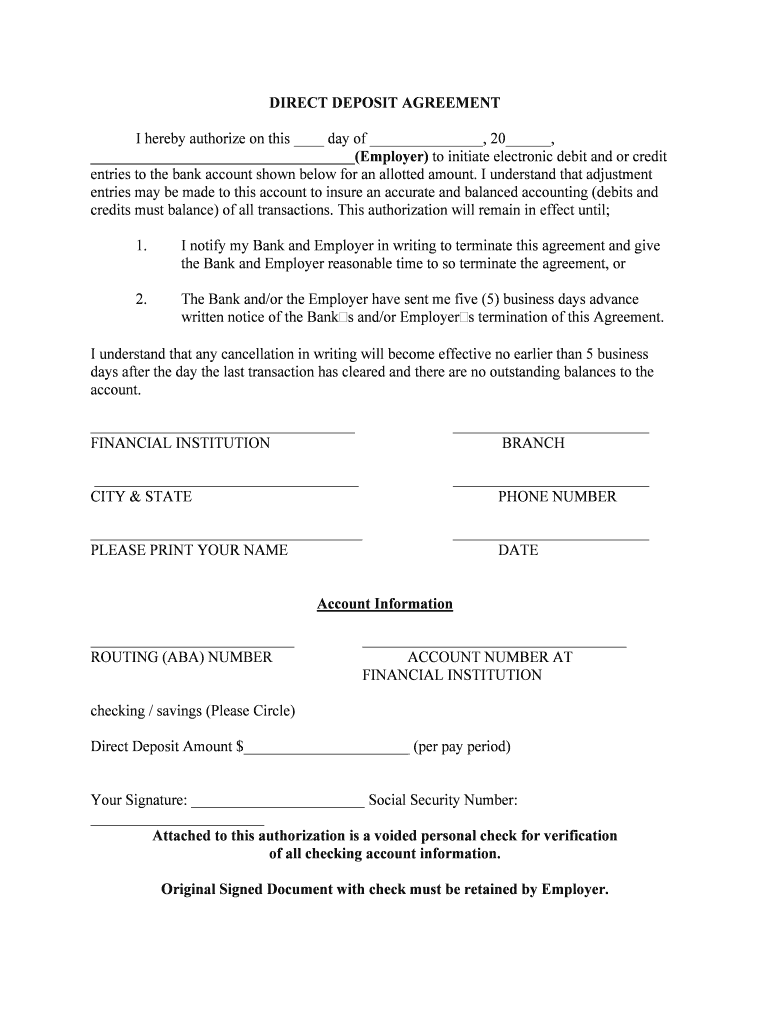

DIRECT DEPOSIT AGREEMENT I hereby authorize on this day of , 20 , (Employer) to initiate electronic debit and or credit entries to the bank account shown below for an allotted amount. I understand

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Direct Deposit Agreement

Edit your Direct Deposit Agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Direct Deposit Agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

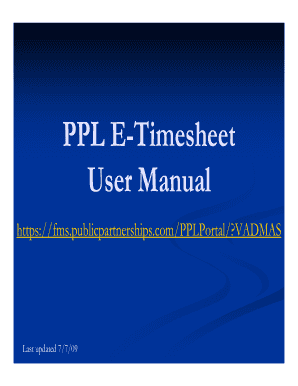

How to edit Direct Deposit Agreement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Direct Deposit Agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Direct Deposit Agreement

How to fill out Direct Deposit Agreement

01

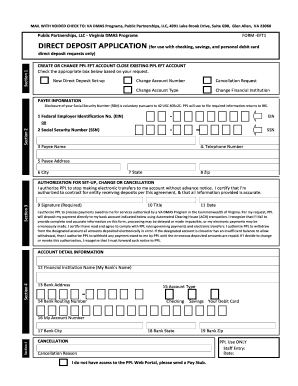

Start by obtaining the Direct Deposit Agreement form from your employer or financial institution.

02

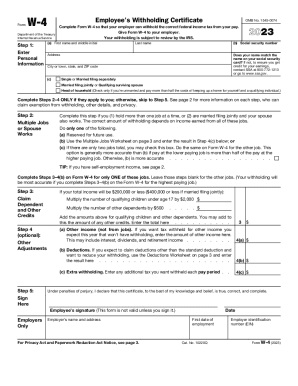

Fill in your personal information, including your name, address, and Social Security number.

03

Provide your bank details, including the bank name, account number, and routing number.

04

Indicate the type of account (checking or savings) you want the funds deposited into.

05

Specify the amount or percentage of your paycheck to be deposited, if applicable.

06

Review the agreement for accuracy and completeness.

07

Sign and date the form to authorize direct deposit.

Who needs Direct Deposit Agreement?

01

Anyone who receives regular payments such as employees, pensioners, or government benefit recipients.

02

Businesses that wish to pay employees or vendors directly into their bank accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out an ACH authorization form?

Suggested clip

TUTORIAL - How to fill out a Direct Deposit ACH Form - YouTubeYouTubeStart of suggested clipEnd of suggested clip

TUTORIAL - How to fill out a Direct Deposit ACH Form - YouTube

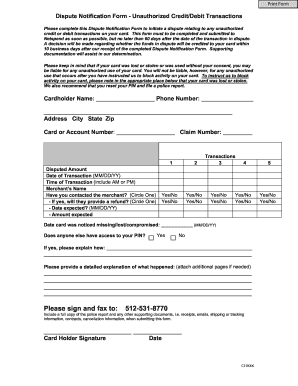

What is an ACH authorization form?

Credit Card (ACH) Authorization Form Credit Card (ACH) Authorization Form. The recurring ACH payment authorization form is a document that will authorize a company or merchant to deduct recurring payments from a client's bank account as agreed upon by the parties.

How do I authorize ACH payments?

To pay with ACH, you'll need to authorize your biller, such as your electric company, to pull funds from your account. This typically happens after you provide your bank account and routing numbers for your checking account, and give your authorization by signing an agreement with your biller.

How do I set up an ACH payment Chase?

Click Pay & transfer at the top of the page.

Click ACH Payment Services.

Click Manage Payees (in the menu bar).

Select the payee.

Click Schedule a repeating payment to continue.

What information is needed to make an ACH payment?

What information do I need to provide for an ACH transaction? You provide your name, indication of personal or business account type, bank routing number, account number, and payment amount.

What is my ACH information?

ACH stands for Automated Clearing House. To find your ACH routing number, first check your checkbook. It may be the nine-digit number to the left of your account number. ACH is an electronic money transfer system that lets individuals receive or send payments via the Federal ACH network of banks in the United States.

How do I start an ACH transfer?

Initiating an ACH Transfer: On the Transfer & Pay > Transfer Funds menu, after you select the transaction type, currency and the transaction method, you enter and save your bank information just as you would for any other deposit or withdrawal method. Note that you do not enter an amount.

What is an ACH transfer?

An ACH transfer is the electronic movement of money between banks through the Automated Clearing House network, one of the biggest U.S. payment systems. The types of transfers include external funds transfers, person-to-person payments, bill payments and direct deposits from employers and government benefit programs.

Can you make an ACH payment with a credit card?

If you're looking to avoid writing paper checks, most credit card banks will allow you to pay with an ACH transfer on the card website. If you're paying with a paper check, you are making an ACH transfer. The bank that receives the check scans it and converts it to an electronic ACH entry.

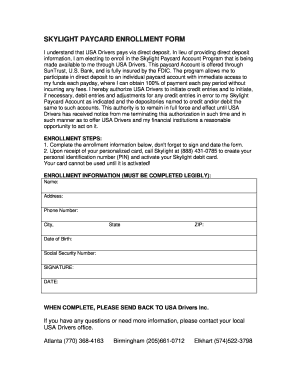

What is a non federal direct deposit enrollment request form?

Download a Bank of America Direct Deposit Form, also known as a Non-Federal Direct Deposit Enrollment Request Form. This is an authorization form, for Bank of America, to allow an employer to pay employees with direct deposits or ACH credits to be placed into a Bank of America customer account.

How do I edit Direct Deposit Agreement in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Direct Deposit Agreement and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the Direct Deposit Agreement electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Direct Deposit Agreement in minutes.

How do I complete Direct Deposit Agreement on an Android device?

Use the pdfFiller Android app to finish your Direct Deposit Agreement and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

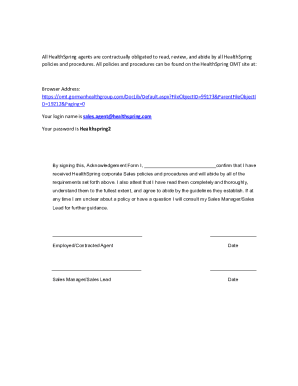

What is Direct Deposit Agreement?

A Direct Deposit Agreement is a contract between an employee and their employer that authorizes the employer to deposit the employee's wages directly into their bank account, rather than issuing a physical paycheck.

Who is required to file Direct Deposit Agreement?

Typically, employees who wish to receive their paychecks via direct deposit are required to file a Direct Deposit Agreement. Some employers may mandate that all employees enroll in direct deposit.

How to fill out Direct Deposit Agreement?

To fill out a Direct Deposit Agreement, an employee must provide their bank account information, including account number and routing number, along with any personal details required by the employer, and then submit the completed form to their HR department.

What is the purpose of Direct Deposit Agreement?

The purpose of a Direct Deposit Agreement is to streamline the payroll process, ensuring that employees receive their wages securely and promptly, while reducing the need for paper checks.

What information must be reported on Direct Deposit Agreement?

The information that must be reported on a Direct Deposit Agreement typically includes the employee's name, address, bank name, bank account number, routing number, and the type of account (checking or savings), along with the employee's signature.

Fill out your Direct Deposit Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Deposit Agreement is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.