Get the free Total Loss Claim - scdmv

Show details

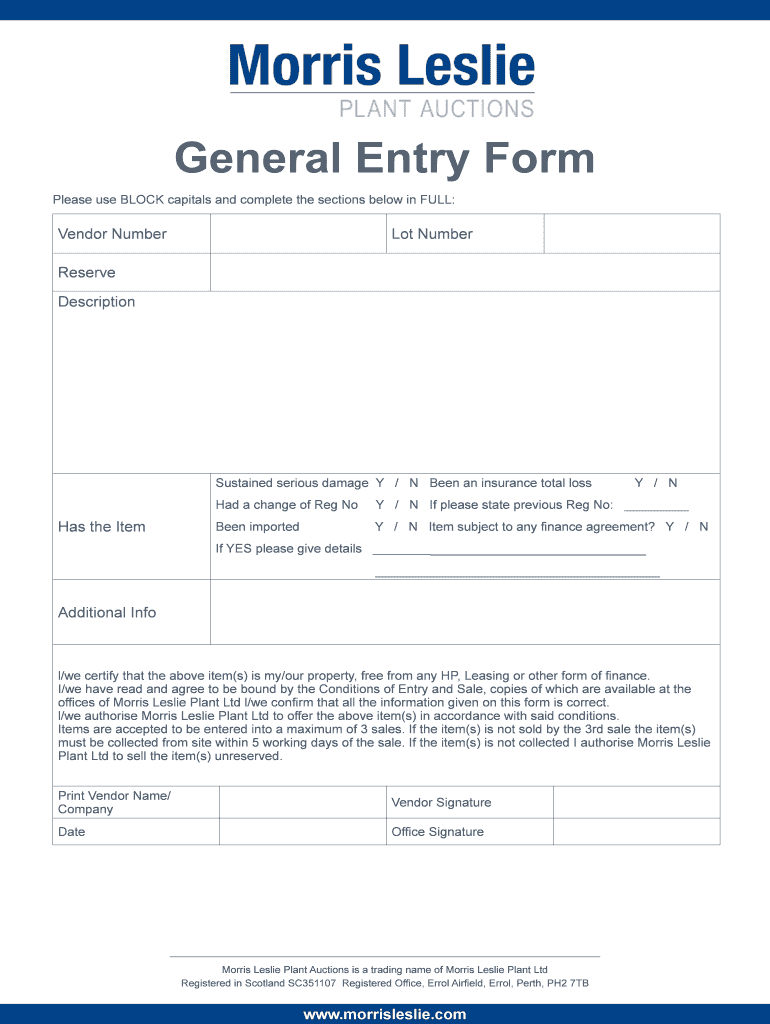

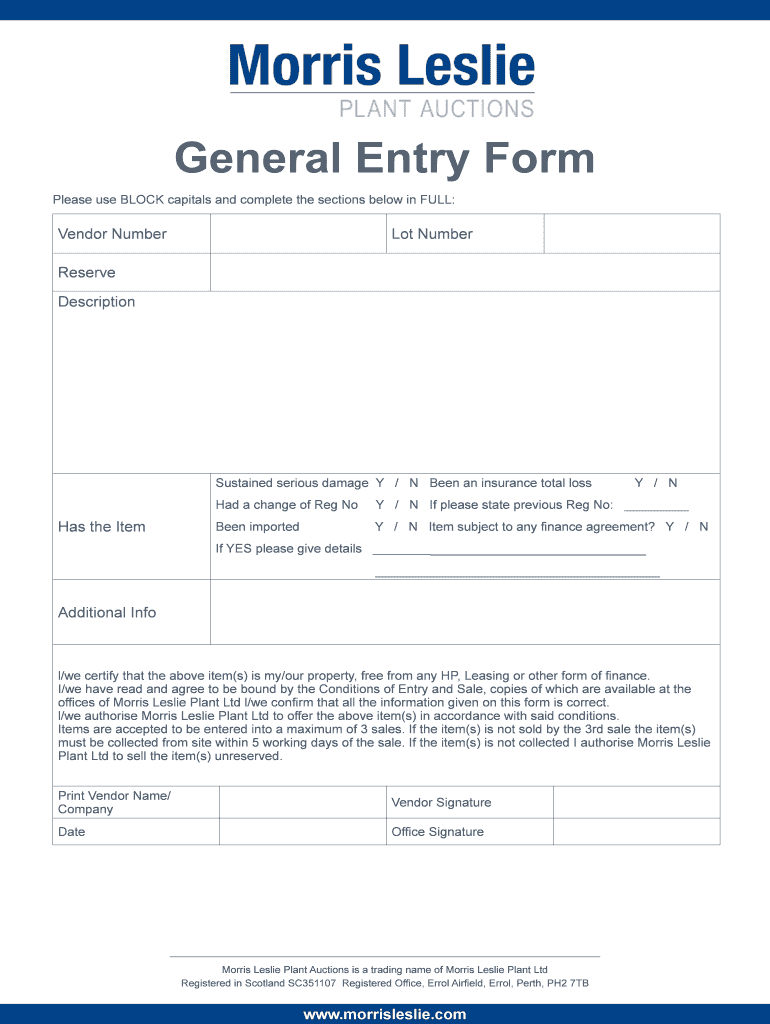

General Entry Form Please use BLOCK capitals and complete the sections below in FULL:Vendor Number Lot NumberReserve DescriptionSustained serious damage Y / N Been an insurance total losses the Items

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign total loss claim

Edit your total loss claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total loss claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing total loss claim online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit total loss claim. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out total loss claim

How to fill out total loss claim

01

Gather all relevant documents such as vehicle registration, insurance policy, and driver's license.

02

Contact your insurance company and inform them about the total loss of your vehicle.

03

Provide the necessary information to your insurance company, including details of the accident and any supporting documents such as photos or witness statements.

04

Schedule an appointment with the insurance company's adjuster to assess the value of the vehicle.

05

Cooperate with the adjuster during the inspection process and provide any additional information or documentation they may require.

06

Review the offer provided by the insurance company for the total loss settlement. If necessary, negotiate with them to ensure a fair value for your vehicle.

07

Once an agreement is reached, sign any required paperwork to finalize the claim and receive the settlement amount.

08

If you have any concerns or issues throughout the process, don't hesitate to contact your insurance company or seek legal advice.

Who needs total loss claim?

01

Anyone who has experienced a significant damage or loss in their insured vehicle may need to file a total loss claim.

02

This may include individuals involved in accidents resulting in severe damage, theft, fire, or other circumstances where repairing the vehicle is impractical or too costly.

03

Moreover, people who have comprehensive or collision insurance coverage on their vehicles are more likely to seek total loss claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify total loss claim without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your total loss claim into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out total loss claim using my mobile device?

Use the pdfFiller mobile app to fill out and sign total loss claim. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out total loss claim on an Android device?

Complete total loss claim and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is total loss claim?

A total loss claim is a request made by an insured party to their insurance company for compensation when their insured asset is deemed completely destroyed or irreparable, typically involving vehicles or property.

Who is required to file total loss claim?

The policyholder or insured party is required to file a total loss claim with their insurance provider after the asset is confirmed as a total loss.

How to fill out total loss claim?

To fill out a total loss claim, the insured must complete a claim form provided by the insurance company, providing details about the incident, the asset, any police reports, and other relevant information.

What is the purpose of total loss claim?

The purpose of a total loss claim is to seek financial compensation for an asset that has been completely lost or damaged beyond repair, allowing the insured to recover their losses.

What information must be reported on total loss claim?

The information typically required includes policy number, details of the loss event, description of the asset, estimated value, and supporting documents like receipts and photos.

Fill out your total loss claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Loss Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.