Get the free Co-Signer bApplicationb

Show details

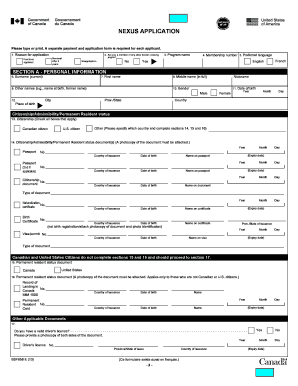

Guarantor Application

The guarantor must complete this application.

PLEASE NOTE:

A guarantor must prove that they have the capacity to be responsible for the rent

payments if the tenant defaults.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign co-signer bapplicationb

Edit your co-signer bapplicationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co-signer bapplicationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing co-signer bapplicationb online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit co-signer bapplicationb. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co-signer bapplicationb

To fill out a co-signer application, follow the steps below:

01

Obtain the co-signer application form: Contact the organization or institution that requires a co-signer and request the application form. You may be able to find this form on their website as well.

02

Read the instructions carefully: Before filling out the application, take the time to thoroughly read the instructions provided. Pay attention to any specific requirements or documents that need to be submitted along with the application.

03

Gather necessary information: Collect all the required information before starting to fill out the application. This may include personal details such as your contact information, social security number, and employment details.

04

Provide personal information: Start by filling out your personal information accurately. This usually includes your full name, date of birth, current address, and any previous addresses you have resided in.

05

Provide financial information: Many co-signer applications will require you to disclose your financial information. This typically includes your income, expenses, assets, and liabilities. Be prepared to provide supporting documentation such as pay stubs, bank statements, or tax returns if requested.

06

Complete additional sections: Some co-signer applications may have additional sections or questions to determine your eligibility or assess your creditworthiness. Carefully answer these sections based on the instructions provided.

07

Review and proofread: Before submitting the application, review all the information you have entered. Make sure it is accurate and complete. Check for any errors or missing information. Additionally, proofread for spelling or grammar mistakes.

08

Sign and submit: Once you are confident that the application is filled out correctly, sign and date it. Follow the instructions regarding submission. It might be necessary to submit the application electronically, by mail, or in person.

Who needs co-signer applications?

01

Students applying for educational loans: Many students, particularly those without a credit history or with limited income, may require a co-signer when applying for educational loans. This provides the lender with additional assurance that the loan will be repaid.

02

Individuals with limited credit history: If someone has not established a strong credit history, they may need a co-signer when applying for certain loans or credit cards. This helps to mitigate the risk for the lender and increases the chances of approval.

03

Individuals with poor credit: People who have a poor credit score or a history of late payments may need a co-signer to secure loans or credit with favorable terms. A co-signer can strengthen the application by providing additional financial backing.

04

New immigrants or international students: Individuals who are new to a country or international students may be required to have a co-signer when applying for various financial products. This is because they may not have a sufficient credit history or meet other requirements.

Remember, the need for a co-signer application varies depending on the specific situation and the requirements of the organization or institution. It is important to carefully review the application instructions to determine whether a co-signer is necessary in your case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my co-signer bapplicationb directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign co-signer bapplicationb and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find co-signer bapplicationb?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the co-signer bapplicationb in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit co-signer bapplicationb on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing co-signer bapplicationb.

What is co-signer application?

Co-signer application is a form filled out by an individual who agrees to assume financial responsibility for a loan if the primary borrower fails to make payments.

Who is required to file co-signer application?

A co-signer is typically required when the primary borrower does not meet the credit or income requirements set by the lender.

How to fill out co-signer application?

To fill out a co-signer application, the individual must provide personal and financial information, including their income, employment history, and credit score.

What is the purpose of co-signer application?

The purpose of a co-signer application is to provide the lender with an additional layer of security in case the primary borrower cannot make payments.

What information must be reported on co-signer application?

The co-signer must report their personal information, employment history, income, and credit score.

Fill out your co-signer bapplicationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co-Signer Bapplicationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.