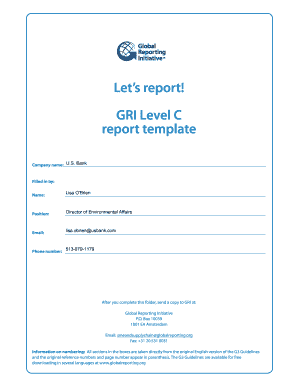

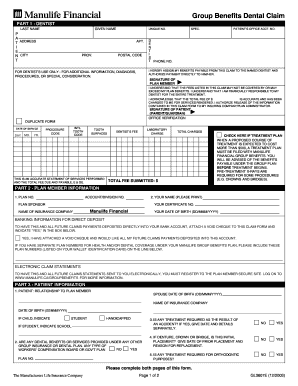

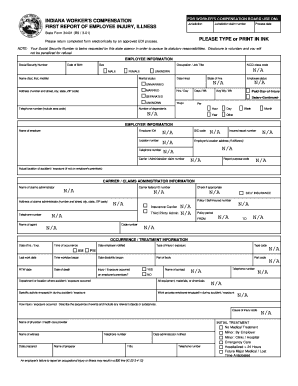

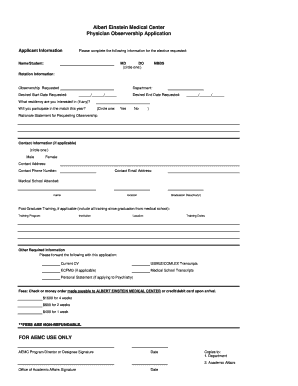

PA UC-1609 2012 free printable template

Show details

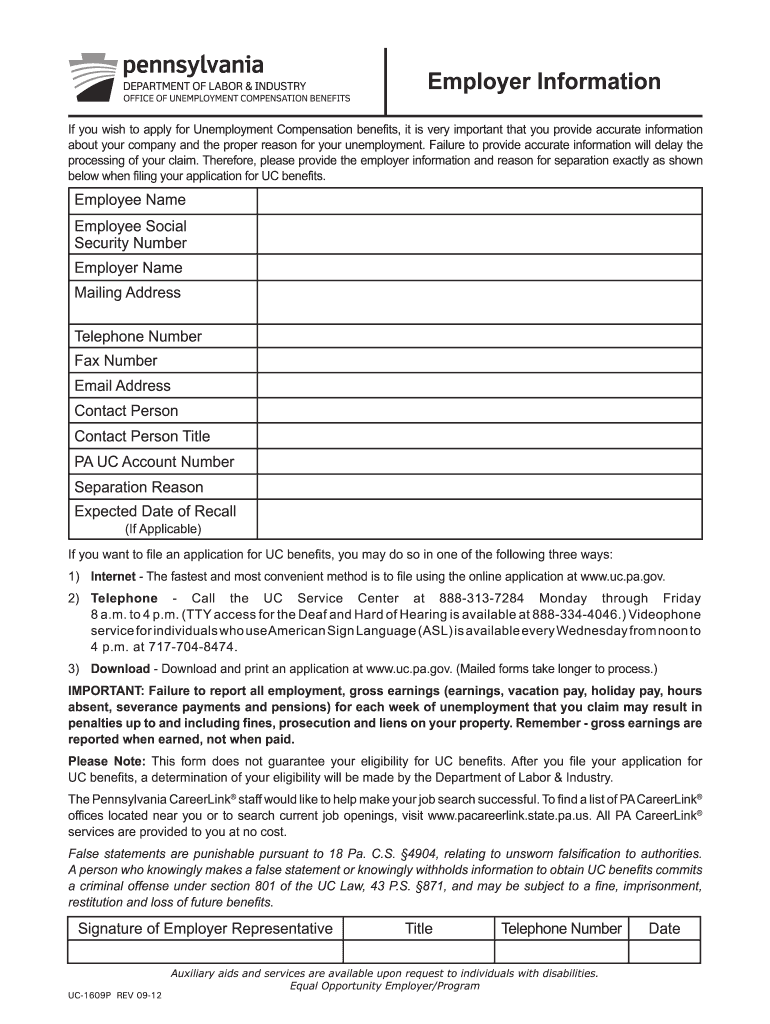

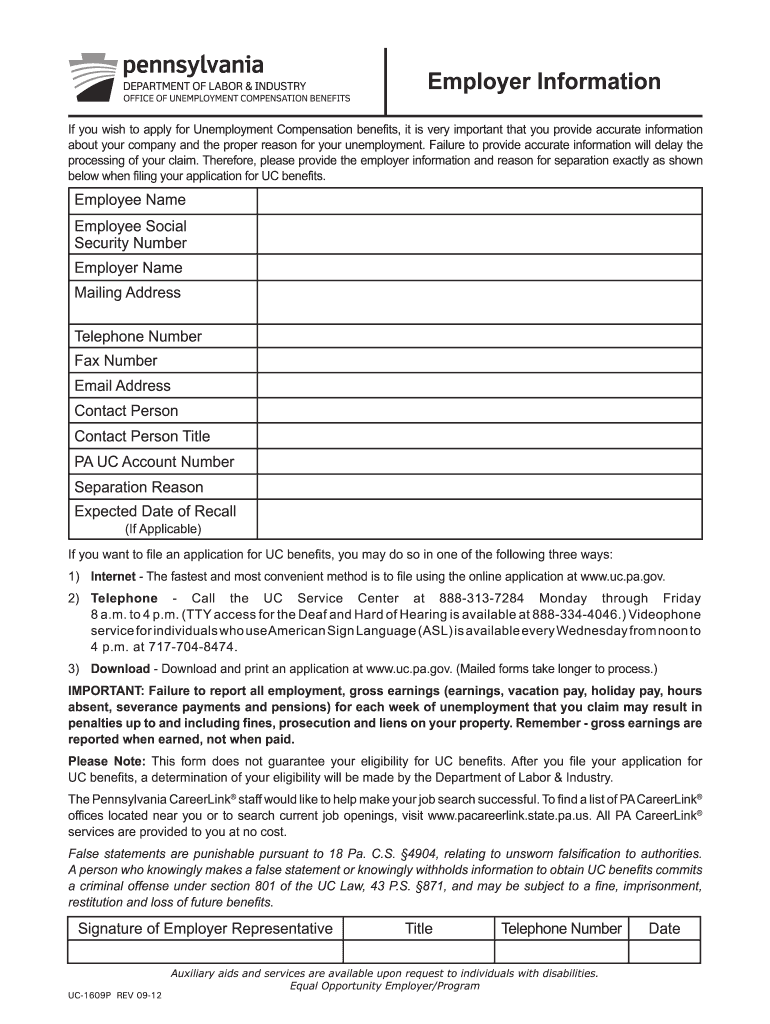

OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS Employer Information If you wish to apply for Unemployment Compensation benefits, it is very important that you provide accurate information about your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA UC-1609

Edit your PA UC-1609 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA UC-1609 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA UC-1609 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA UC-1609. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA UC-1609 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA UC-1609

How to fill out PA UC-1609

01

Gather necessary information: personal identification, employment details, and reason for unemployment.

02

Obtain a copy of the PA UC-1609 form from the Pennsylvania Department of Labor & Industry website or local office.

03

Fill out the form with accurate personal information, including your name, address, Social Security number, and contact details.

04

Provide details about your former employer, including their name, address, and employment dates.

05

Indicate the reason for unemployment clearly, providing any required documentation if necessary.

06

Review the completed form for accuracy, ensuring all sections are filled out and any necessary signatures are included.

07

Submit the form according to the instructions provided, either online or by mailing it to the appropriate office.

Who needs PA UC-1609?

01

Individuals who have recently become unemployed and are seeking unemployment compensation in Pennsylvania.

02

Workers who are eligible for unemployment benefits due to job loss, reduction in hours, or other qualifying reasons.

03

Former employees of companies operating in Pennsylvania who need to provide information regarding their unemployment status.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from PA UC tax?

In addition to "blood relatives", "family" also includes: Stepchildren and their parents. Foster children and their parents.

What is the pa employer UC tax rate?

The new employer rate is 3.8220% for non-construction employers (up from 3.6890% in 2022) and 10.5924% for construction employers (up from 10.2238% in 2022). (Pennsylvania Office of Unemployment Compensation, UC-748, Contribution Rates, Eff. 1/1/2023).

Where do I find my PA UC account number?

Your PA UC Account Number This seven-digit number can be found on the following UC Tax and UC Benefit forms: UC-1408 New Employer Confirmation Letter. UC-851 Notice of PA Unemployment Compensation Responsibilities.

How do I find my UC employer account number in PA?

How do I know what my Employer UC account number is? A Notice of Pennsylvania Unemployment Compensation Responsibilities (Form UC-851) is mailed to an employer when the registration information has been processed. It provides the UC account number assigned, as well as other important UC tax information.

What is employer UC tax in PA?

A 0.07 percent (. 0007) tax on employee gross wages, or 70 cents on each $1,000 paid. Employee withholding contributions are submitted with each quarterly report.

What information do I need to file for unemployment in Pennsylvania?

What you need before you get started SSN. Home address and mailing address (if different) Telephone number. Valid email. UC System username and password, if already established. Direct deposit bank information (optional) - bank name, address, account and routing number.

What is a UC employer number?

You may call the UC Service Center's employer toll-free number at 833-728-2367, weekdays from 8 a.m. to 4 p.m.

What disqualifies you from unemployment in PA?

Section 402(e) provides that an individual who is discharged from employment for reasons that are considered to be willful misconduct connected with his/her work, is not eligible to receive benefits. The employer must show that the employee's actions rose to the level of willful misconduct.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PA UC-1609 online?

With pdfFiller, you may easily complete and sign PA UC-1609 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit PA UC-1609 on an iOS device?

Create, modify, and share PA UC-1609 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out PA UC-1609 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your PA UC-1609, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is PA UC-1609?

PA UC-1609 is a Pennsylvania form used for filing unemployment compensation tax reports.

Who is required to file PA UC-1609?

Employers in Pennsylvania who have employees subject to unemployment compensation tax are required to file PA UC-1609.

How to fill out PA UC-1609?

To fill out PA UC-1609, employers need to provide information such as their account number, the period for which they are reporting, wages paid, and any other information required by the form.

What is the purpose of PA UC-1609?

The purpose of PA UC-1609 is to report wages, calculate unemployment compensation contributions, and ensure compliance with state unemployment tax laws.

What information must be reported on PA UC-1609?

PA UC-1609 requires reporting of the employer's account number, wage information for each employee, and details regarding contributions for the unemployment compensation program.

Fill out your PA UC-1609 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA UC-1609 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.