Get the free INDUSTRIAL FACILITIES TAX EXEMPTION

Show details

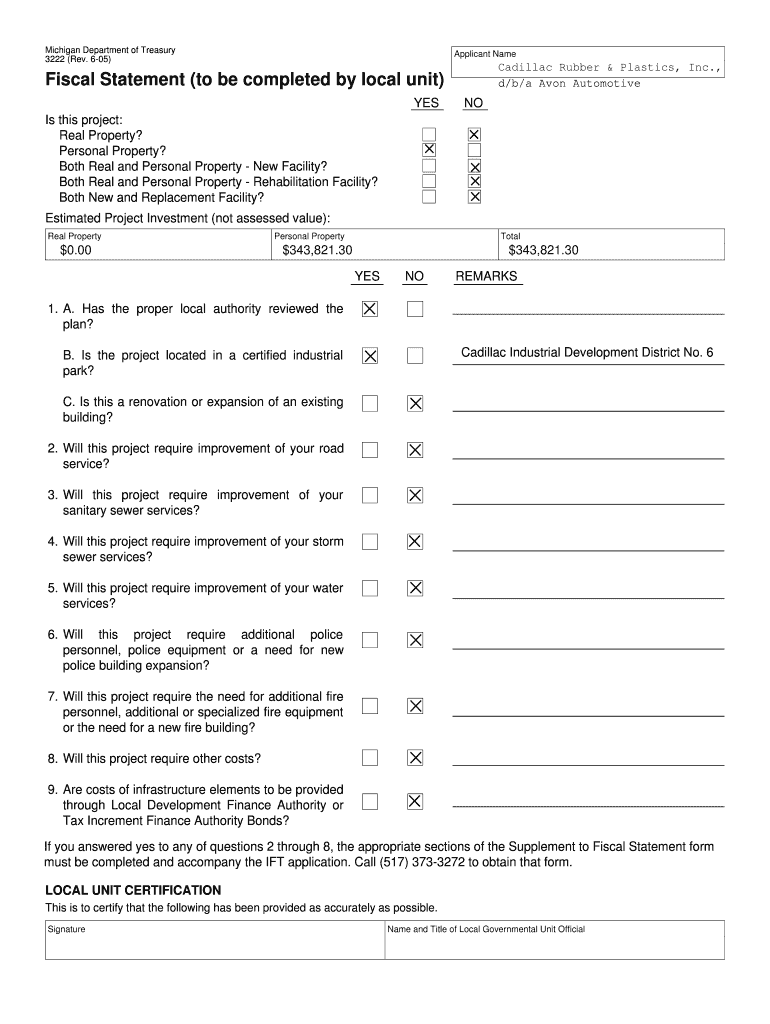

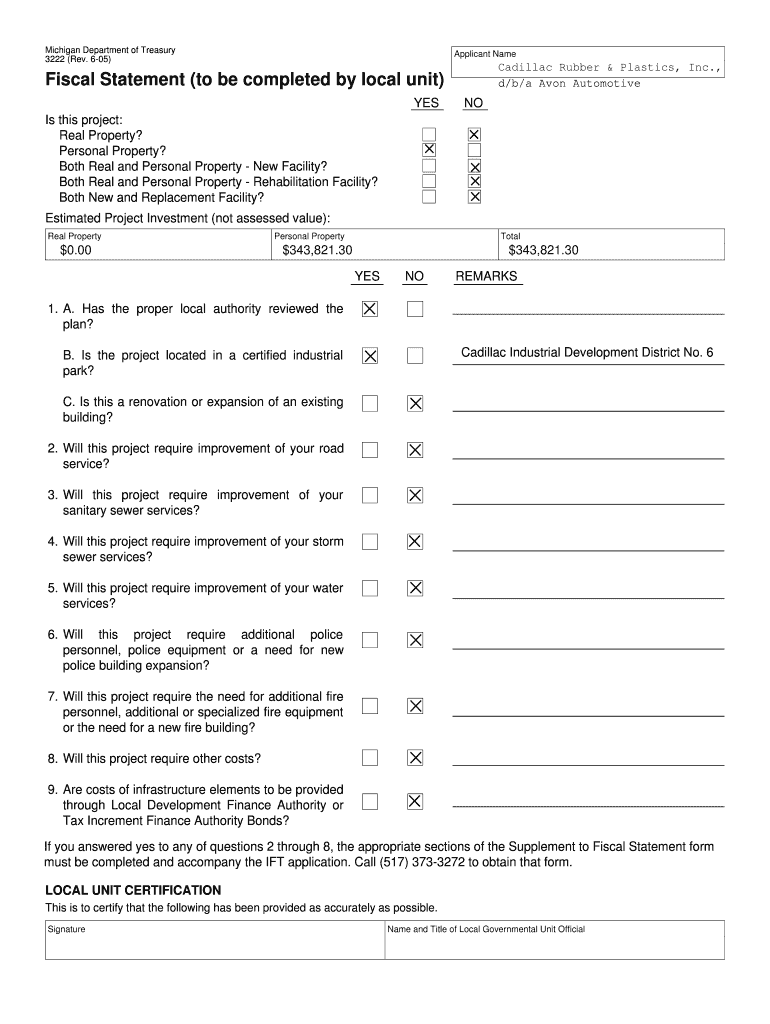

INDUSTRIAL FACILITIES TAX EXEMPTION LETTER OF AGREEMENT City of Cadillac, Michigan, and Avon Automotive This Agreement between the City of Cadillac, Oxford County, Michigan, a Michigan municipal corporation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign industrial facilities tax exemption

Edit your industrial facilities tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your industrial facilities tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing industrial facilities tax exemption online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit industrial facilities tax exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out industrial facilities tax exemption

How to fill out industrial facilities tax exemption

01

Obtain the necessary forms and documents for claiming the industrial facilities tax exemption.

02

Gather information about the industrial facility, such as location, size, and type of operation.

03

Complete the forms accurately and provide all required information.

04

Attach supporting documents, such as property deeds, lease agreements, and business registration certificates.

05

Double-check the completed forms and ensure that all necessary information is provided.

06

Submit the filled-out forms and supporting documents to the appropriate tax authority or government agency.

07

Wait for the review and processing of the application.

08

Respond promptly to any requests for additional information or clarification from the tax authority.

09

Upon approval, follow any instructions provided by the tax authority to claim the tax exemption.

10

Keep records of the exemption and comply with any reporting requirements or renewal procedures.

Who needs industrial facilities tax exemption?

01

Industrial facilities tax exemption is typically needed by businesses or organizations that operate industrial facilities.

02

This can include manufacturing plants, warehouses, power generation facilities, and research and development centers.

03

The tax exemption can provide financial relief or incentives for these entities, encouraging investment and economic growth.

04

However, specific eligibility criteria and requirements may vary depending on the jurisdiction and applicable laws.

05

It is advisable to consult with the relevant tax authority or seek professional advice to determine if your industrial facility qualifies for the tax exemption.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send industrial facilities tax exemption to be eSigned by others?

Once your industrial facilities tax exemption is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the industrial facilities tax exemption in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your industrial facilities tax exemption right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit industrial facilities tax exemption on an Android device?

You can edit, sign, and distribute industrial facilities tax exemption on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is industrial facilities tax exemption?

Industrial facilities tax exemption is a form of tax relief that allows certain industrial facilities to be exempt from specific property taxes for a designated period. This incentive aims to encourage investment in industrial development and create jobs.

Who is required to file industrial facilities tax exemption?

Businesses or companies that are operating or planning to establish a new industrial facility and wish to benefit from the tax exemption are required to file for industrial facilities tax exemption.

How to fill out industrial facilities tax exemption?

To fill out the industrial facilities tax exemption application, applicants must provide detailed information about the facility, including its location, type of business, investment amount, and expected job creation. The application form can usually be found on the state or local government's website.

What is the purpose of industrial facilities tax exemption?

The purpose of the industrial facilities tax exemption is to stimulate economic growth by encouraging companies to invest in new facilities, thus fostering job creation and increasing local tax revenue in the long term.

What information must be reported on industrial facilities tax exemption?

Applicants must report information such as the business name, facility location, nature of the business, estimated project cost, number of jobs created or retained, and other relevant details about the facility's operation.

Fill out your industrial facilities tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Industrial Facilities Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.