Get the free IRS Offers Filing and Penalty Relief for 2010 Estates; Basis Form ...

Show details

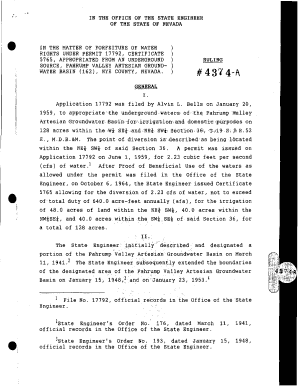

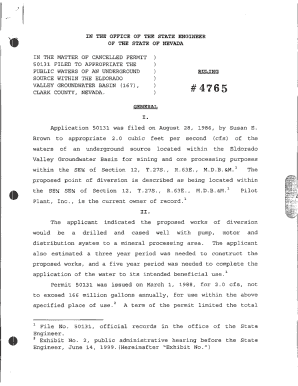

JOHN BENSON BUSINESS BRIEF Website: www.jb-ct.com October 2011 4539 USA FEDERAL TAXATION //// IRS Offers Filing and Penalty Relief for 2010 Estates; Basis Form Now Due Jan. 17; Extension to March

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs offers filing and

Edit your irs offers filing and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs offers filing and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs offers filing and online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs offers filing and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs offers filing and

How to fill out IRS offers filing and:

01

Gather all necessary information: Before starting the filing process, make sure you have all the required documents and information handy. This may include your personal identification details, income statements, receipts, and any other relevant financial records.

02

Determine your eligibility: Familiarize yourself with the eligibility criteria for IRS offers filing and. This program is designed for taxpayers who are unable to pay their tax debts in full. Ensure that you meet the requirements and are eligible to apply for this option.

03

Complete Form 656: The IRS offers filing and requires the submission of Form 656, Offer in Compromise. Fill out this form accurately and provide all the requested information. This form will include details about your financial situation, income, assets, and liabilities.

04

Prepare supporting documentation: Along with Form 656, you will need to submit supporting documentation to substantiate your financial situation. This may include bank statements, tax returns, pay stubs, and other relevant documents. Ensure that you include all necessary paperwork to support your offer.

05

Determine your offer amount: The IRS offers filing and requires taxpayers to propose an offer amount to settle their tax debt. Calculate your offer based on your financial situation and the IRS guidelines. It is advisable to consult with a tax professional or seek guidance from the IRS to determine a reasonable offer amount.

06

Submit your offer: Once you have completed Form 656 and gathered all the supporting documentation, submit your offer to the IRS. Ensure that you follow the specified instructions for submission and include any required fees or payments.

Who needs IRS offers filing and:

01

Taxpayers with significant tax debts: The IRS offers filing and is suitable for individuals or businesses that owe a substantial amount of tax debt that they are unable to pay in full. This program provides an opportunity to settle the debt for a reduced amount.

02

Individuals facing financial hardship: If you are experiencing financial hardship and are unable to meet your tax obligations, IRS offers filing and can be an option for you. It provides a means to resolve your tax debt while considering your financial situation.

03

Taxpayers who meet the eligibility criteria: To utilize IRS offers filing and, individuals must meet certain eligibility criteria set by the IRS. This typically includes criteria related to income, assets, liabilities, and ability to pay. Understanding and meeting these criteria is essential for those seeking this option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs offers filing and to be eSigned by others?

When you're ready to share your irs offers filing and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the irs offers filing and in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your irs offers filing and and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete irs offers filing and on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your irs offers filing and, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is irs offers filing and?

IRS offers filing and is a program where taxpayers can submit an offer to settle their tax debt for less than the full amount owed.

Who is required to file irs offers filing and?

Taxpayers who are unable to pay their full tax debt and meet certain eligibility requirements are required to file IRS offers filing and.

How to fill out irs offers filing and?

To fill out IRS offers filing and, taxpayers must complete and submit Form 656 along with the required documentation and payment.

What is the purpose of irs offers filing and?

The purpose of IRS offers filing and is to provide taxpayers with a way to settle their tax debt and avoid further collection actions.

What information must be reported on irs offers filing and?

Taxpayers must report their financial information, including income, expenses, assets, and liabilities on IRS offers filing and.

Fill out your irs offers filing and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Offers Filing And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.