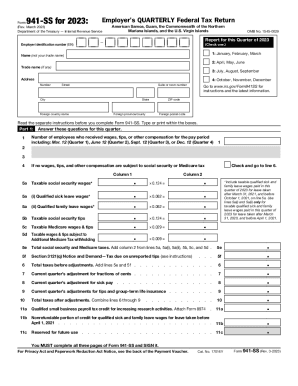

IRS 941-SS 2020 free printable template

Instructions and Help about IRS 941-SS

How to edit IRS 941-SS

How to fill out IRS 941-SS

About IRS 941-SS 2020 previous version

What is IRS 941-SS?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 941-SS

What should I do if I realize there was a mistake on my IRS 941-SS after submission?

If you discover an error on your IRS 941-SS after submission, you should file an amended return using IRS Form 941-X. This allows you to correct any mistakes made on your original filing. Be sure to provide a detailed explanation of the corrections being made and keep a copy of both forms for your records.

How can I verify the status of my IRS 941-SS filing?

To verify the status of your IRS 941-SS filing, you can check the IRS's online tool for tracking your submission status. If you filed electronically, be aware of common rejection codes that may inform you why the form was not accepted. Keeping track of confirmation emails or notices from the IRS can also help you ascertain the processing of your submission.

Are there specific privacy measures I need to be aware of when filing the IRS 941-SS?

When filing the IRS 941-SS form, it’s crucial to ensure that you handle sensitive information securely. Implement data encryption for electronic filings and be cautious about where you store physical copies. Adhering to the IRS's guidelines on record retention can also help protect your data from unauthorized access.

What actions should I take if I receive a notice or letter from the IRS regarding my 941-SS?

If you receive a notice or letter from the IRS concerning your IRS 941-SS, carefully read the document to understand the issue raised. Gather any necessary documentation to support your case and respond to the IRS promptly to address the concerns, thereby preventing further complications.

What are some common errors to avoid when filing the IRS 941-SS electronically?

Common errors in electronic filings of the IRS 941-SS include using incorrect taxpayer identification numbers and submitting without checking for proper electronic signatures. It's also essential to review all entries for accuracy to prevent delays or rejections, ensuring a smooth filing experience.

See what our users say