Get the free Deductible vs. Copay and Coinsurance - Learn the Difference ...

Show details

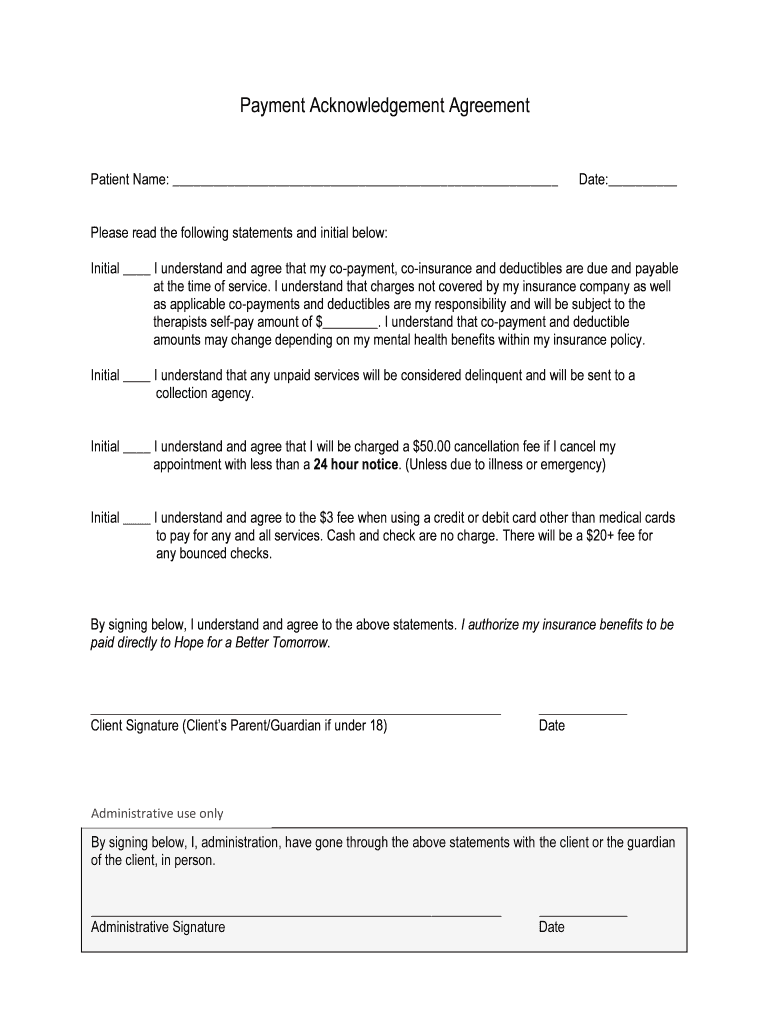

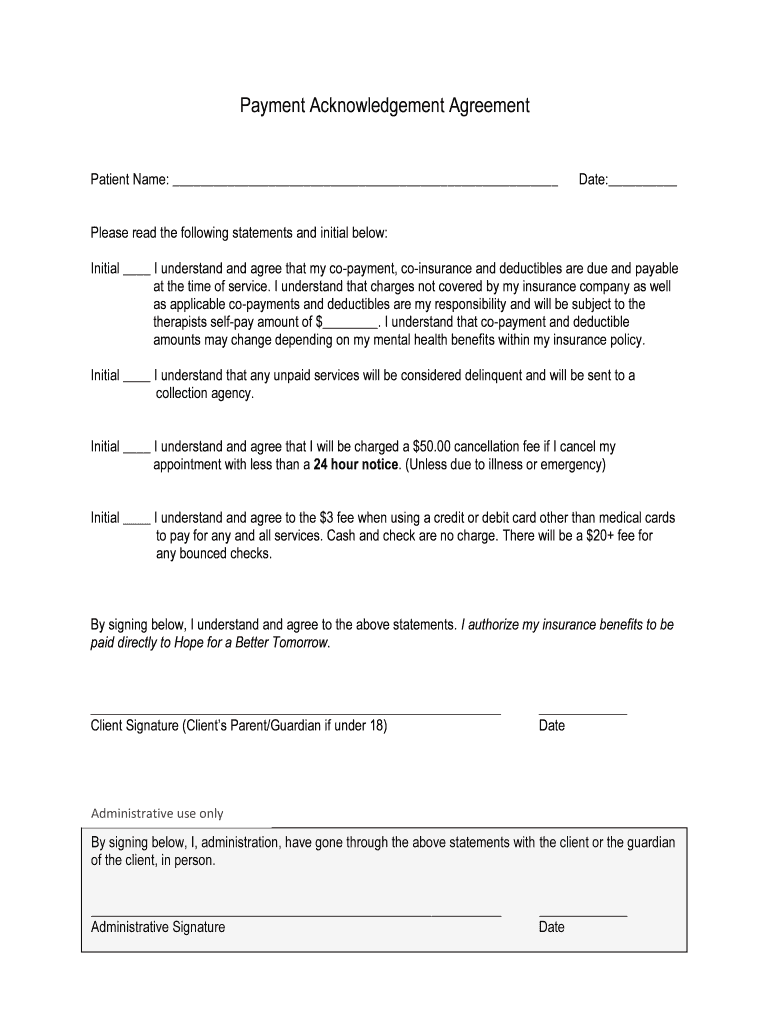

Payment Acknowledgement AgreementPatient Name: Date: Please read the following statements and initial below: Initial I understand and agree that my co-payment, coinsurance and deductibles are due

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deductible vs copay and

Edit your deductible vs copay and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deductible vs copay and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deductible vs copay and online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deductible vs copay and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deductible vs copay and

How to fill out deductible vs copay and

01

To fill out deductible vs copay, follow these steps:

02

Understand the concept: Deductible and copay are two different terms used in insurance policies.

03

Know the deductible: The deductible is the amount you have to pay out of pocket before your insurance company starts paying for covered services.

04

Understand copay: Copay is a fixed amount you pay for a specific service, such as a doctor's visit or a prescription medication.

05

Differentiate between them: Deductible is usually a yearly amount, whereas copay is paid per visit or service.

06

Consider your health needs: Decide whether you need a plan with a higher deductible and lower copayments or vice versa, depending on your frequency of medical visits and expected costs.

07

Review your options: Compare different insurance plans to see how the deductible and copayments vary, and choose the one that best suits your needs and budget.

08

Read the fine print: Before finalizing any insurance policy, carefully read the terms and conditions regarding deductibles and copayments to avoid any surprises later on.

09

Seek assistance if needed: If you are unsure about filling out the deductible vs copay, consult an insurance agent or a knowledgeable professional who can guide you through the process.

Who needs deductible vs copay and?

01

Deductible vs copay is a relevant consideration for anyone looking to purchase or understand health insurance policies.

02

Individuals who want to financially protect themselves from hefty medical expenses may need to know about deductible and copay. It helps them decide the level of coverage they need.

03

Families with dependents, especially children, may also benefit from understanding deductible vs copay. It aids in determining the affordability of medical care for everyone in the family.

04

Employers and human resources departments need to be knowledgeable about deductible and copay while selecting healthcare plans for their employees.

05

Healthcare professionals, such as doctors and hospital administrators, should have a good understanding of deductible and copay to explain and assist patients in understanding their financial responsibilities.

06

In summary, anyone who wants to make informed decisions about their health insurance coverage or has a responsibility in providing healthcare services can benefit from understanding deductible vs copay.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my deductible vs copay and in Gmail?

deductible vs copay and and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit deductible vs copay and from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your deductible vs copay and into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in deductible vs copay and?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your deductible vs copay and to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is deductible vs copay and?

A deductible is the amount you pay for healthcare services before your insurance plan starts to pay. A copay (or copayment) is a fixed amount you pay for a specific service or prescription at the time of receiving the service.

Who is required to file deductible vs copay and?

Individuals who have health insurance that includes a deductible and copay provisions are required to track and file these amounts, especially when submitting claims for reimbursements.

How to fill out deductible vs copay and?

To fill out the forms, you need to provide personal information, details of the healthcare service received, the amount paid towards the deductible, the copay amount, and attach any relevant invoices or receipts.

What is the purpose of deductible vs copay and?

The purpose of a deductible is to ensure that insured individuals share in the cost of their healthcare by paying a certain amount out of pocket before insurance coverage kicks in. A copay simplifies the payment process for services by providing a fixed payment that is made at the time of service.

What information must be reported on deductible vs copay and?

The information that must be reported typically includes the total deductible amount paid, the copay amounts for specific services, dates of service, and identifying information related to the insurance policy.

Fill out your deductible vs copay and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deductible Vs Copay And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.