Get the free Standard Life - Beneficiary Designation 07-2012

Show details

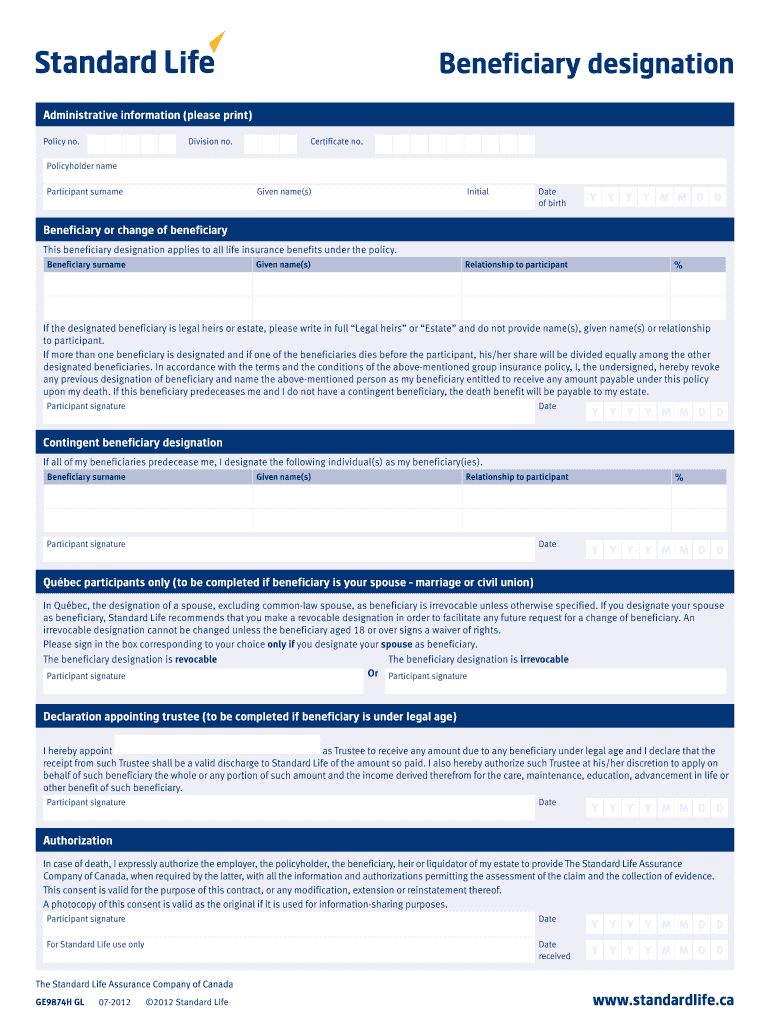

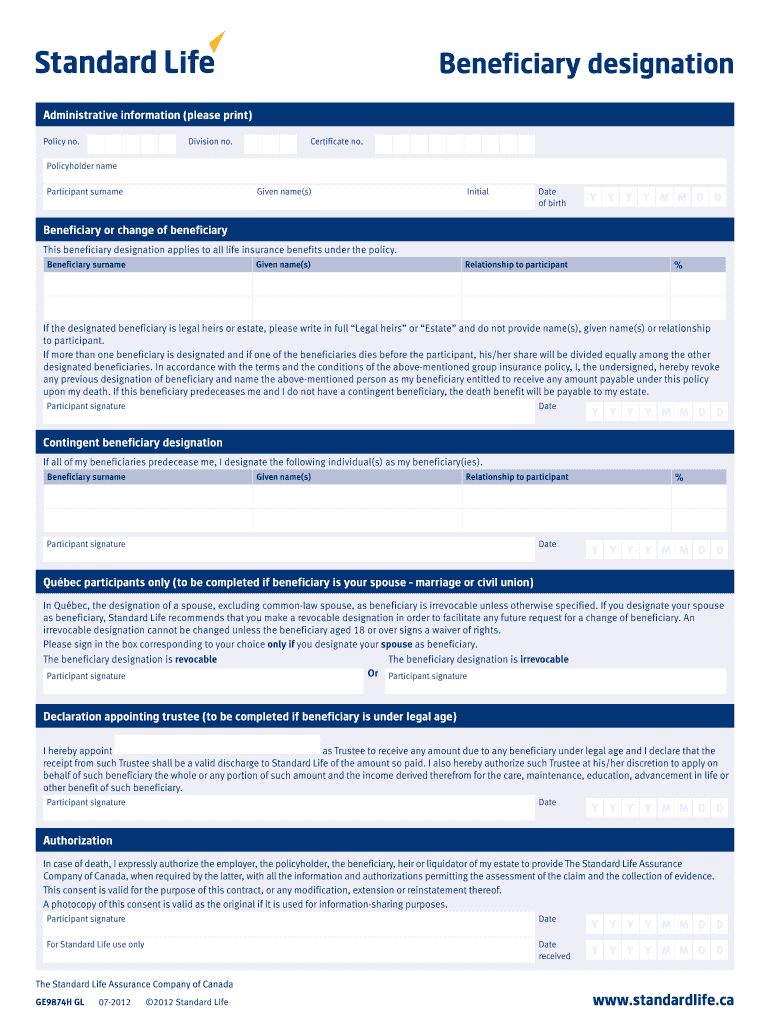

Beneficiary designation Administrative information (please print) Policy no. Division no. Certificate no. Policyholder name Participant surname Given name(s) Initial Date of birth Y Y Y Y M M D Beneficiary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard life - beneficiary

Edit your standard life - beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard life - beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard life - beneficiary online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard life - beneficiary. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard life - beneficiary

How to fill out a standard life - beneficiary form:

01

Start by obtaining a copy of the standard life - beneficiary form from your life insurance provider or employer. This form is typically used to designate who will receive the policy's death benefit in the event of your passing.

02

Read the instructions carefully to ensure that you understand the requirements and options available to you. Some forms may require specific information such as the beneficiary's full name, relationship to the policyholder, and contact details.

03

Begin by providing your personal information, including your full legal name, address, and contact information. This is important for the insurance company to identify the policy and ensure your information matches their records.

04

Identify the primary beneficiary by entering their full name, relationship to you, and any additional information required, such as their date of birth or social security number. The primary beneficiary is the person who will receive the death benefit if they outlive you.

05

Consider naming a contingent beneficiary as well. A contingent beneficiary is someone who would receive the death benefit if the primary beneficiary predeceases you or is unable to claim the benefit for any reason. Provide their full name and any additional information requested.

06

Determine the percentage or allocation of the death benefit that each beneficiary will receive. You may choose to divide the benefit equally among multiple beneficiaries or allocate specific percentages based on your wishes. Ensure the total allocation adds up to 100%.

07

Review the form thoroughly before submitting it. Double-check all the information you have provided to avoid any errors or omissions. Make sure all beneficiary names are spelled correctly and the contact details are accurate.

08

Sign and date the form in the designated area to indicate your consent and authorization for the designated beneficiaries to receive the death benefit. Some forms may require witnesses or notarization, so be sure to follow the instructions provided.

Who needs standard life - beneficiary?

01

Individuals who have a life insurance policy or retirement plan with a death benefit should consider designating a beneficiary. This helps ensure that the policy's proceeds are distributed according to their wishes after they pass away.

02

Those who want to have control over who will receive the death benefit can benefit from designating a beneficiary. Without a designated beneficiary, the death benefit could be subject to probate and distributed according to state laws, which may not align with the insured's intentions.

03

Individuals who want to provide financial security for their loved ones or charitable organizations should consider naming a beneficiary. This allows the funds to be efficiently transferred to the designated individuals or organizations, avoiding any potential delays or complications.

04

Policyholders who experience significant life changes such as marriage, divorce, the birth of a child, or the death of a previous beneficiary should review and update their beneficiary designations accordingly. Keeping beneficiary information up to date is crucial to ensure the intended individuals receive the death benefit.

05

People who want to protect their estate from potential creditors or legal claims can benefit from designating a beneficiary. When a death benefit is paid directly to a named beneficiary, it generally bypasses the probate process and may be protected from certain claims filed against the policyholder's estate.

Remember, it is always recommended to consult with a financial advisor or an attorney to ensure that your beneficiary designations align with your overall estate planning goals and are in accordance with any applicable laws or regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send standard life - beneficiary to be eSigned by others?

When you're ready to share your standard life - beneficiary, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete standard life - beneficiary on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your standard life - beneficiary, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit standard life - beneficiary on an Android device?

You can make any changes to PDF files, such as standard life - beneficiary, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is standard life - beneficiary?

Standard life - beneficiary refers to the individual or entity designated to receive the benefits of a life insurance policy or retirement account upon the death of the policyholder.

Who is required to file standard life - beneficiary?

The policyholder or account holder is typically required to file standard life - beneficiary forms to designate who will receive the benefits.

How to fill out standard life - beneficiary?

Standard life - beneficiary forms can usually be filled out by providing the necessary information such as the name, relationship, and contact details of the beneficiary.

What is the purpose of standard life - beneficiary?

The purpose of standard life - beneficiary is to ensure that the benefits of a life insurance policy or retirement account are distributed according to the wishes of the policyholder after their passing.

What information must be reported on standard life - beneficiary?

Standard life - beneficiary forms typically require information such as the full name, date of birth, social security number, and contact information of the beneficiary.

Fill out your standard life - beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Life - Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.