IRS CP09 2018-2026 free printable template

Show details

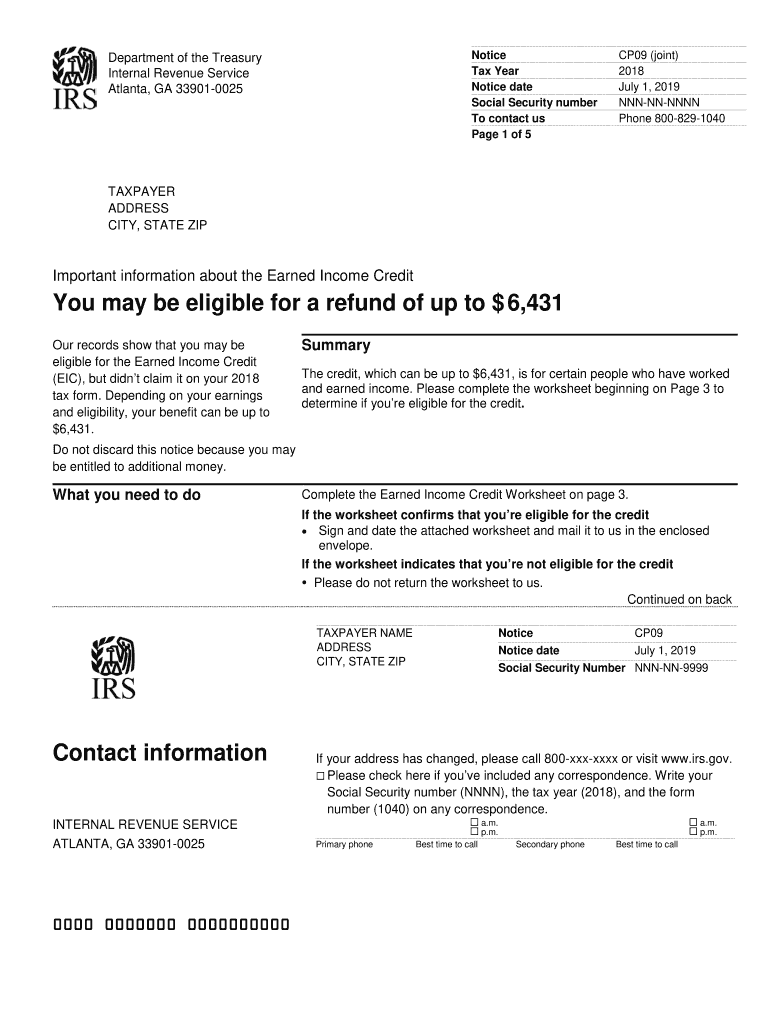

Additional information Visit www.irs.gov/cp09. You can also find the following online - Form 1040 - Earned Income Credit Publication 596 For tax forms instructions and publication visit www.irs.gov or call 800TAX-FORM 800-829-3676. Please do not return the worksheet to us. Continued on back TAXPAYER NAME Contact information INTERNAL REVENUE SERVICE ATLANTA GA 33901-0025 0000 0000000 0000000000 CP09 If your address has changed please call 800-xxx-xxxx or visit www.irs.gov. Please check here...

pdfFiller is not affiliated with IRS

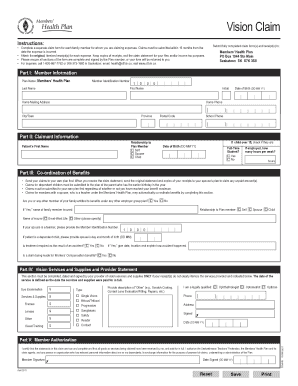

Get, Create, Make and Sign irs gov cp09 form

Edit your irs cp09 notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cp09 notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cp09 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS CP09. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IRS CP09

How to fill out IRS CP09

01

Read the notice carefully to understand why you received IRS CP09.

02

Gather any required documents related to your tax return (e.g., W-2s, 1099s).

03

Follow the instructions provided in the notice regarding any information you need to submit.

04

Complete any forms that are necessary based on the guidance in CP09.

05

Double-check your information for accuracy before sending it.

06

Send your response to the address indicated on the notice, ensuring it is postmarked by the specified deadline.

Who needs IRS CP09?

01

Taxpayers who received IRS CP09 notice indicating they need to verify their identity or tax information.

02

Individuals who have filed a return that requires further review by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Is form 15111 legit?

Form 15111 is a US Treasury Form that is a questionnaire of the dependents on your return to see if they qualify for EIC. This is an IRS Internal Form. They will expect you to complete and return the form.

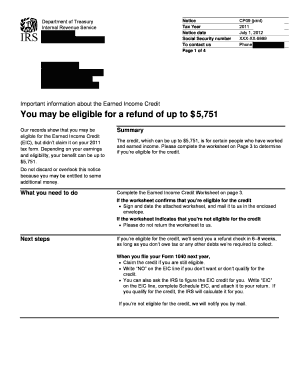

What is a CP 09 notice from IRS?

What this notice is about. You may be eligible for the Earned Income Credit but didn't claim it on your tax return.

What does form 15111 mean?

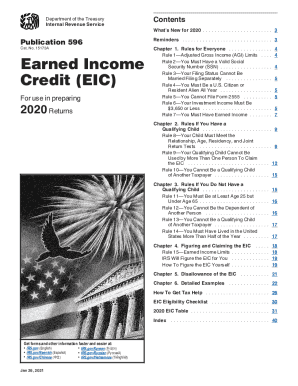

Within the CP09 notice, the IRS includes an Earned Income Credit Worksheet (Form 15111) on pages 3 through 5 of your notice. This worksheet will guide you through three steps to help determine if you are eligible for the credit.

Why did the IRS send me a 15111 form?

Form 15111 is a US Treasury Form that is a questionnaire of the dependents on your return to see if they qualify for EIC. This is an IRS Internal Form. They will expect you to complete and return the form.

What is IRS code CP09?

Why Did I Receive IRS Notice CP09? You received notice CP09 because the IRS determined that you could be eligible for the Earned Income Tax Credit (EITC) but did not claim it on your tax return. If you are eligible, it could result in a tax refund. The amount of the anticipated refund is also included in the notice.

Why did I receive a CP09 notice?

Why you received IRS Notice CP09: You filed an original return with the IRS listing dependent children but did not claim the earned income tax credit (EITC). The IRS determined that you may qualify for the EITC and may be due a refund because of the credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS CP09?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IRS CP09 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the IRS CP09 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS CP09 in seconds.

Can I edit IRS CP09 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IRS CP09 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IRS CP09?

IRS CP09 is a notice sent by the Internal Revenue Service informing taxpayers that they may be eligible for the Earned Income Tax Credit (EITC) based on their tax return information.

Who is required to file IRS CP09?

Taxpayers who receive the IRS CP09 notice and wish to claim the Earned Income Tax Credit must respond with the required information.

How to fill out IRS CP09?

To fill out IRS CP09, taxpayers need to carefully read the notice, provide the requested information, and follow the instructions for submission outlined in the notice.

What is the purpose of IRS CP09?

The purpose of IRS CP09 is to notify taxpayers of their potential eligibility for the Earned Income Tax Credit and to encourage them to provide necessary information to receive it.

What information must be reported on IRS CP09?

Taxpayers must report details such as their qualifying children, income information, and any other relevant tax information necessary for determining eligibility for the Earned Income Tax Credit.

Fill out your IRS CP09 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS cp09 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.