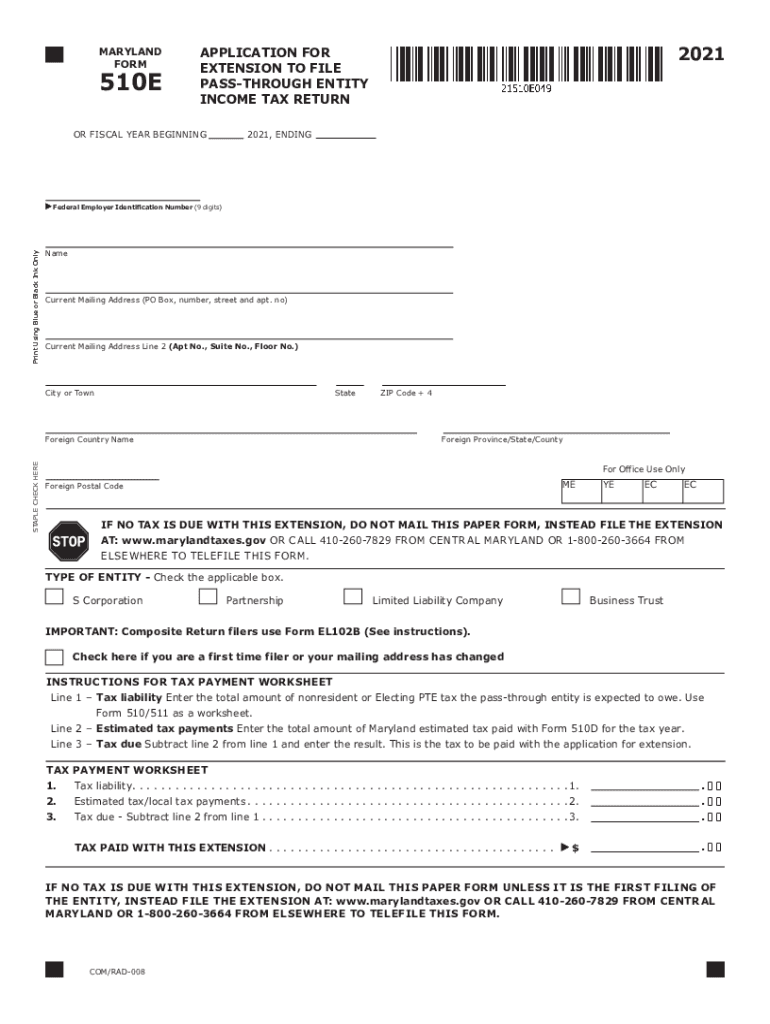

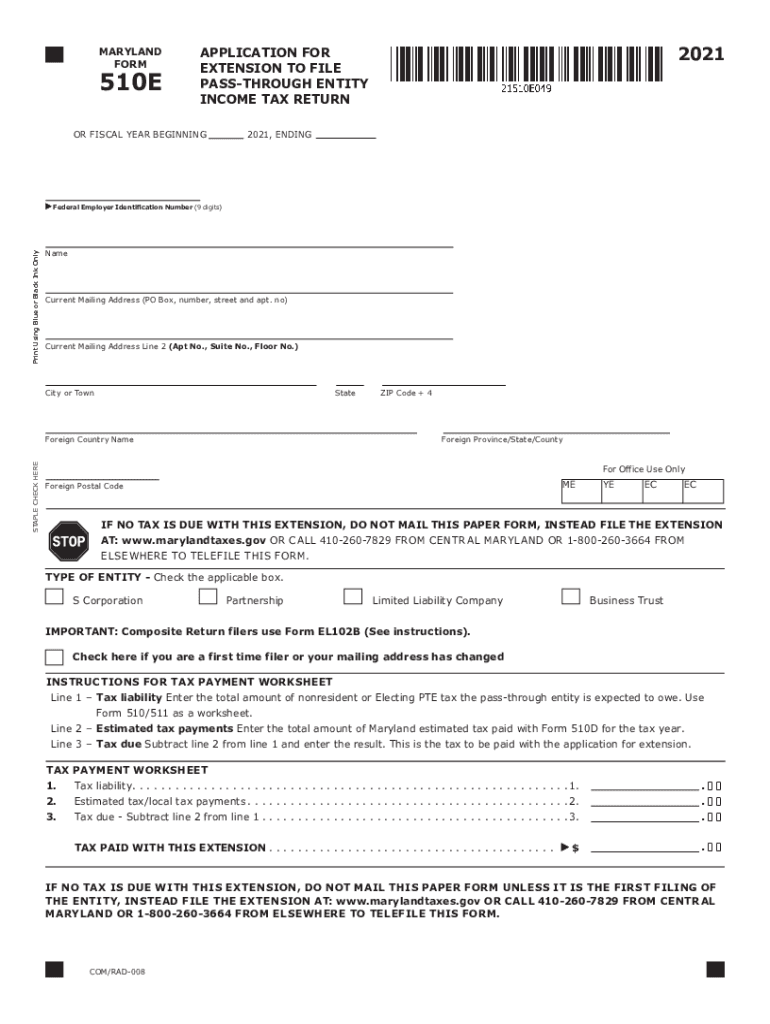

MD Form 510/511E (Formerly 510E) 2021 free printable template

Show details

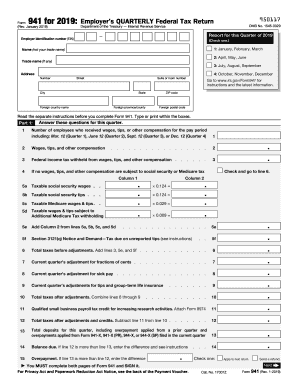

MARYLAND FORM510E2019APPLICATION FOR EXTENSION TO FILE WALKTHROUGH ENTITY INCOME TAX RETURNER FISCAL YEAR BEGINNING19510E0492019, Endangering Using Blue or Black Ink Only Federal Employer Identification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Form 510511E Formerly 510E

Edit your MD Form 510511E Formerly 510E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Form 510511E Formerly 510E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD Form 510511E Formerly 510E online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MD Form 510511E Formerly 510E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Form 510/511E (Formerly 510E) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Form 510511E Formerly 510E

How to fill out MD Form 510/511E (Formerly 510E)

01

Obtain MD Form 510/511E from the designated source.

02

Fill in the personal information section, including your full name, address, and contact information.

03

Provide any required identification numbers, such as Social Security or driver’s license numbers.

04

Complete the health information portion by detailing any relevant medical history.

05

If applicable, fill out the sections for consent and authorization.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the appropriate sections.

08

Submit the completed form to the necessary authority or organization as instructed.

Who needs MD Form 510/511E (Formerly 510E)?

01

Individuals seeking medical services requiring documentation.

02

Patients undergoing examinations or treatment in a facility that requires this form.

03

Healthcare providers needing to gather patient information for record-keeping.

04

Any person involved in a medical claim process that necessitates the use of this form.

Fill

form

: Try Risk Free

People Also Ask about

Can I file a 1041 extension online?

Form 7004 extension for Form 1041 and Form 8868 extension for Form 1041-A and Form 5227 are eligible for electronic filing.

How do I file an extension for 1041?

File IRS Form 7004 with the IRS to obtain an extension for 1041, U.S. Income Tax Return for Trusts and Estates. Once Form 7004 is accepted by the IRS, the Trust or Estate is granted up to 6 additional months to file their 1041 tax return.

Can you file an extension for an estate tax return form 1041?

If you need more time to file Form 1041, apply for an automatic 5-month extension. Submit Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

Can you file an extension for estate tax return?

An executor may apply for an automatic 6-month extension of time to file Form 706, 706-A, 706-NA, or 706-QDT. Unless you are an executor who is out of the country (see below), the automatic extension of time to file is 6 months from the original due date of the applicable return.

How do I file an extension for my estate tax return?

Use Form 4768 to: Apply for an automatic 6-month extension of time to file Form 706, Form 706-A, Form 706-NA, or Form 706-QDT. Apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768).

Can you file an extension on a 1041?

Trusts and estates that need more time to file their 1041 tax return can apply for an extension using IRS Form 7004 to extend their filing deadline by up to 6 months.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MD Form 510511E Formerly 510E directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign MD Form 510511E Formerly 510E and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the MD Form 510511E Formerly 510E in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MD Form 510511E Formerly 510E.

Can I create an eSignature for the MD Form 510511E Formerly 510E in Gmail?

Create your eSignature using pdfFiller and then eSign your MD Form 510511E Formerly 510E immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is MD Form 510/511E (Formerly 510E)?

MD Form 510/511E is a state tax form used in Maryland for reporting specific tax information. It is an updated version of the previously utilized Form 510E.

Who is required to file MD Form 510/511E (Formerly 510E)?

Individuals and entities that are subject to certain tax regulations and income in Maryland are required to file MD Form 510/511E.

How to fill out MD Form 510/511E (Formerly 510E)?

To fill out MD Form 510/511E, taxpayers should provide accurate information such as personal details, income sources, deductions, and any relevant tax credits, following the instructions outlined in the form.

What is the purpose of MD Form 510/511E (Formerly 510E)?

The purpose of MD Form 510/511E is to collect information regarding income and tax liability from individuals or entities subject to taxation in Maryland, facilitating appropriate tax assessment.

What information must be reported on MD Form 510/511E (Formerly 510E)?

MD Form 510/511E requires reporting of personal identification details, income figures, deductions, credits claimed, and any other relevant financial data necessary for tax computation.

Fill out your MD Form 510511E Formerly 510E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Form 510511e Formerly 510e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.