Get the free Letter to Lienholder to Notify of Trust template

Show details

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to lienholder to

A letter to lienholder is a formal request by a borrower to inform and seek resolution regarding a lien on property or collateral.

pdfFiller scores top ratings on review platforms

Excellent

Very Nice & Good Features in this pdffilter

Very useful and easy to learn

Its been great, we have one though work but this one works much better.

Forms are plentiful and easy to find.

Easy to use thank you!

Who needs letter to lienholder to?

Explore how professionals across industries use pdfFiller.

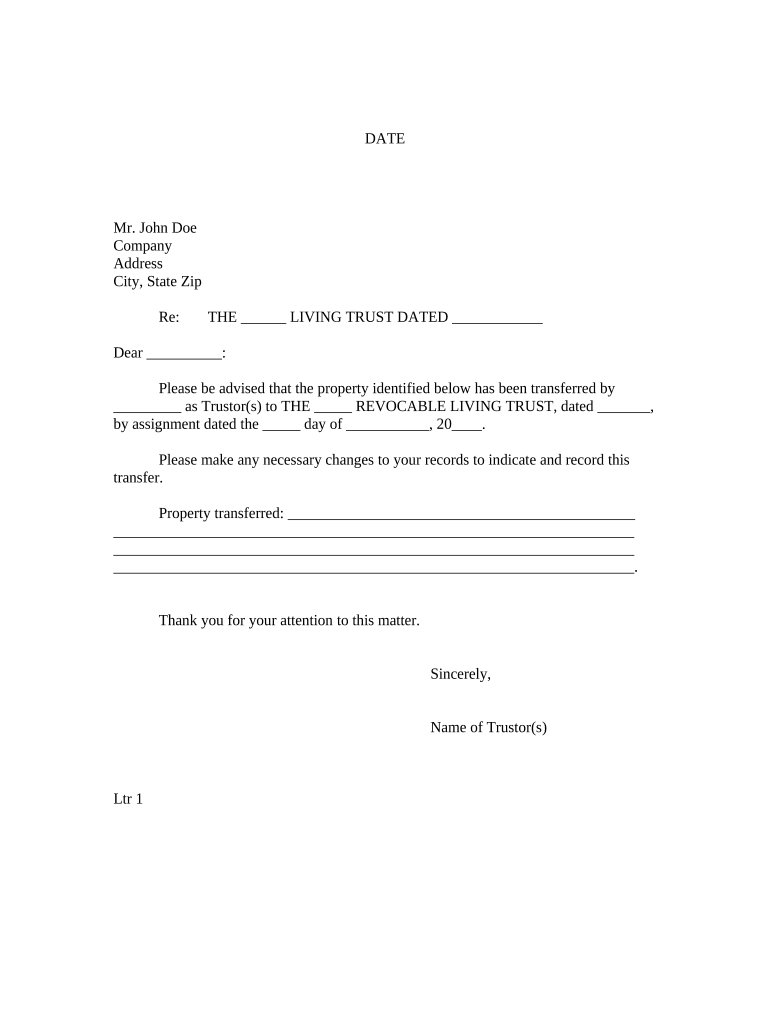

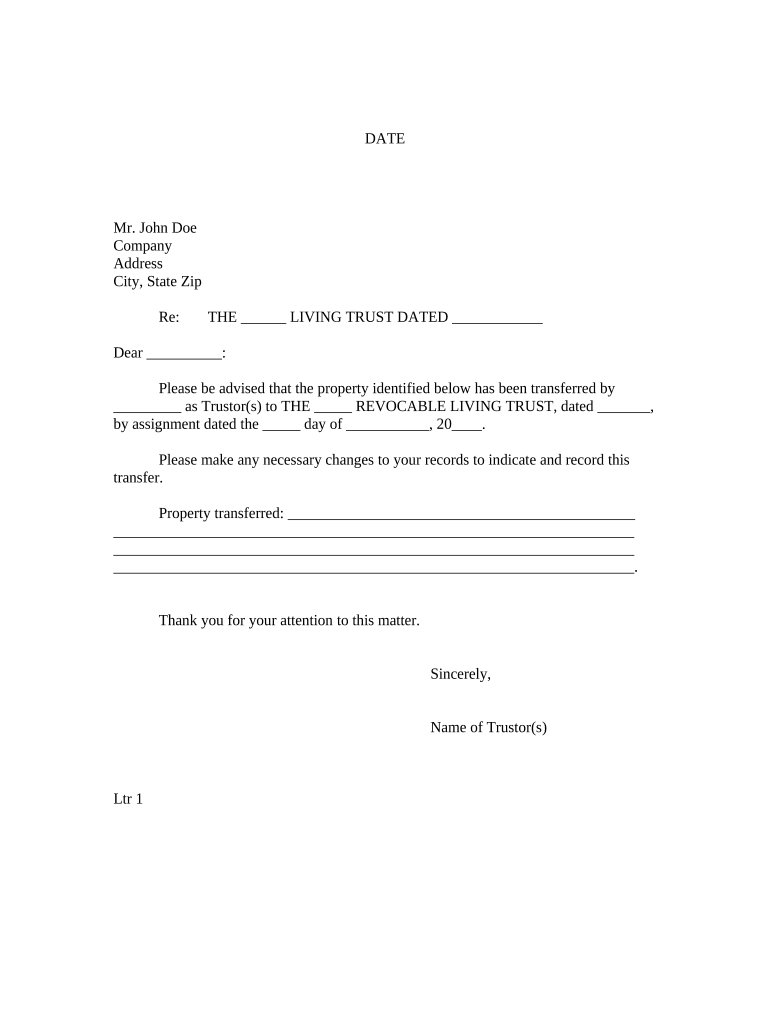

Comprehensive Guide to Creating a Letter to Lienholder

How to effectively fill out a letter to lienholder form?

Filling out a letter to a lienholder involves gathering relevant information about the property and involved parties, ensuring the content is clear and concise, and adhering to legal standards. Utilize user-friendly tools like pdfFiller, allowing easy edits, signing, and document management.

Understanding the role of a lienholder

A lienholder is an individual or entity that has a legal right to possess or take ownership of property until a debt owed by the property owner is satisfied. It’s crucial to notify lienholders promptly, especially during property transfers, to avoid potential legal disputes.

-

Lienholders are typically banks or financial institutions that provide loans secured by the property.

-

They have the right to claim the property if payments are not made as agreed.

-

Proper notification helps in transferring ownership smoothly and legally.

What are the key components of a letter to lienholder?

A well-structured letter ensures clarity and professionalism. Including the correct elements helps facilitate communication effectively.

-

This establishes a timeline for the transaction and communication.

-

Make sure to address the lienholder correctly, using their full name and address.

-

Clearly state your intention for writing, such as notifying about a property transfer.

-

Include specifics about the property, such as its address and identifiers, and any pertinent transfer details.

-

End on a polite note and provide your signature for authenticity.

How can you draft your letter step-by-step?

Start by collecting all necessary information before drafting, including property details and the trustor's information. Clarity is crucial, so be precise in your statements and exhibit professionalism in formatting.

-

Note the address, identifiers, and any relevant previous correspondence.

-

Collect necessary names, addresses, and contact information to include accurately.

-

Directly state the purpose of the transfer to remove any potential ambiguities.

-

Prepare any necessary additional documents to support your letter.

For formatting, use professional templates available through tools like pdfFiller for a polished presentation, ensuring your information is easily digestible.

How does pdfFiller assist in creating your lienholder letter?

pdfFiller offers features specifically designed for document creation, allowing users to personalize their letters while maintaining legal compliance and organization.

-

These tools facilitate the custom creation of personalized letters, focusing on user needs.

-

They enable teams to draft letters together, enhancing information accuracy and clarity.

-

Quick approval processes through electronic signatures streamline finalizing your documents.

Furthermore, cloud storage enables easy management and retrieval of your letters, ensuring that sensitive documents are always at your fingertips.

What compliance and legal considerations should you remember?

Adhering to state regulations can safeguard your interests when notifying lienholders. Laws concerning property transfers vary by region, so it’s paramount to understand the specific requirements that may apply.

-

Each state has distinct rules regarding how lienholders should be notified.

-

Some forms may require specific documentation or fees to accompany your letter.

-

Failure to notify lienholders properly could result in delays or legal consequences.

What final steps can ensure your letter is effective?

Ensure your letter maintains clarity by proofreading before sending. Consider the method of delivery, as email and physical mail can have different implications for timelines.

-

Check for grammatical errors and confirm that all necessary information is included to avoid delays.

-

Decide whether to send via email for immediacy or physical mail for traceability.

-

After sending, consider following up to confirm receipt or to address any questions the lienholder may have.

How to fill out the letter to lienholder to

-

1.Access pdfFiller and log into your account.

-

2.Search for the template titled 'Letter to Lienholder'.

-

3.Select the template and click to edit.

-

4.Fill in your personal information, including your name, address, and contact details at the top of the document.

-

5.Insert the lienholder's details, including their name and address, below your information.

-

6.Add the date on which you are writing the letter.

-

7.Begin the letter with a formal greeting, addressing the lienholder directly.

-

8.Clearly state the purpose of the letter in the opening paragraph. Specify the lien in question and provide any related reference numbers.

-

9.In the body of the letter, describe your request or the reason you are contacting them, such as requesting a lien release, clarification, or settling an amount owed.

-

10.Conclude the letter with a polite closing statement and your signature above your printed name.

-

11.Review the completed letter for any errors and ensure all information is accurate before saving or printing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.